China and African Swine Fever - its effect on global beef and lamb prices

Thursday, 24 October 2019

By Rebecca Wright

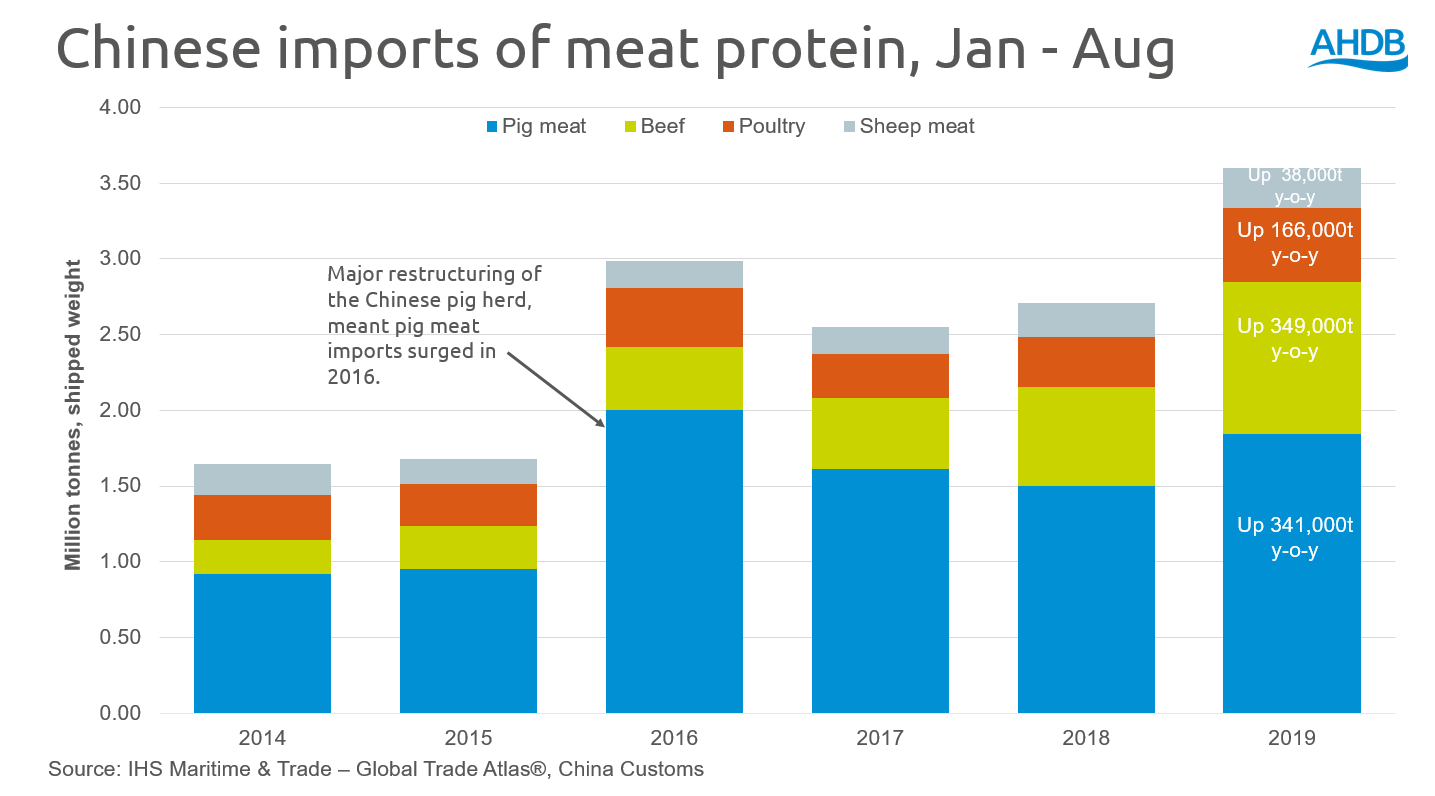

China has upped its protein imports since an outbreak of African Swine Fever (ASF) last year, but what effect has this had on farmgate prices around the world?

Beef

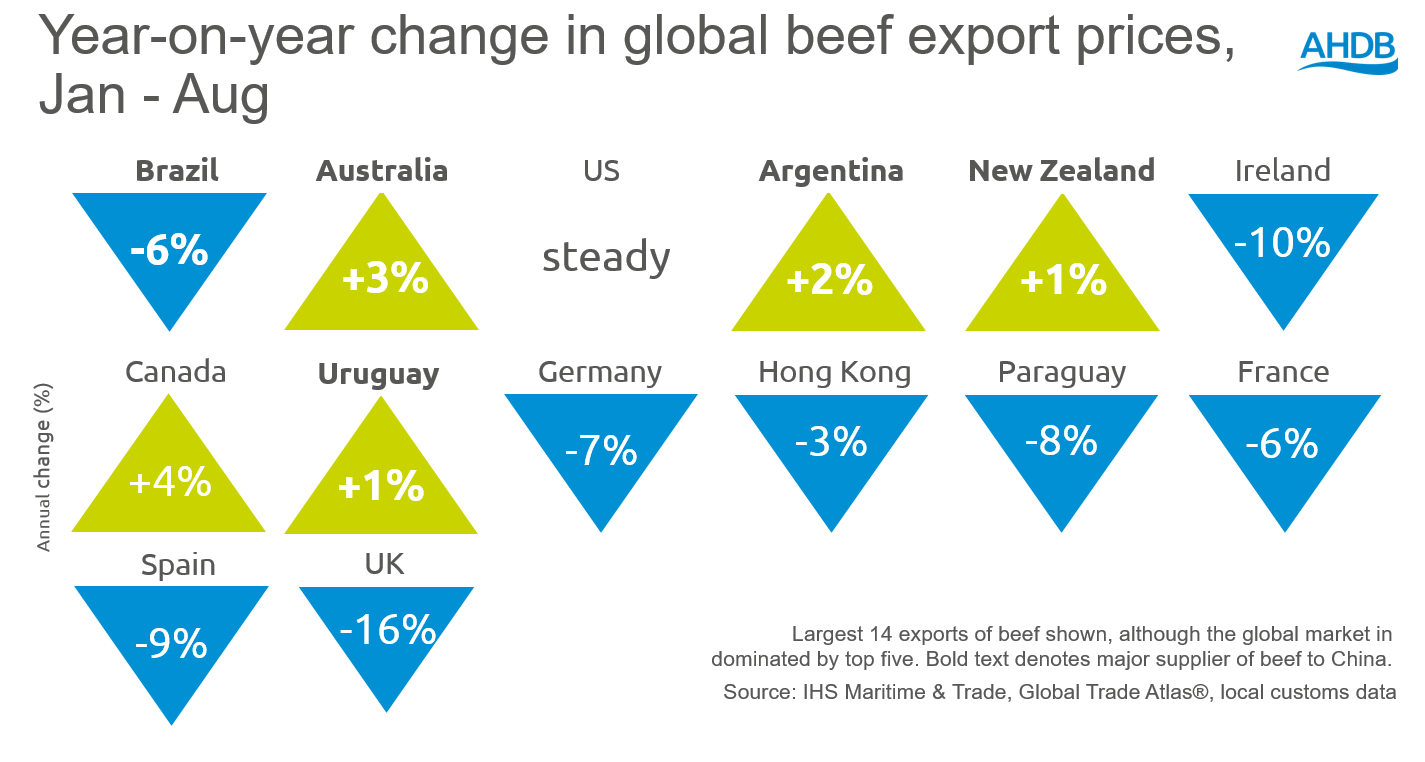

Beef has benefited most in volume terms from the increase in protein demand from China, although prices around the world have not risen as much as anticipated. In part this is due to global beef supply increasing. The average Chinese import price, in US$, for beef is up just 2% year-on-year.

Argentina, Uruguay, Brazil, Australia, and New Zealand are the five largest suppliers of beef to China. Growth of imports from Brazil have been limited this year due to Brazil regaining access to the Russian market, and re-directing exports in that direction. However the other 4 countries have all had at least double digit growth in percentage terms, with imports from Argentina growing 122%.

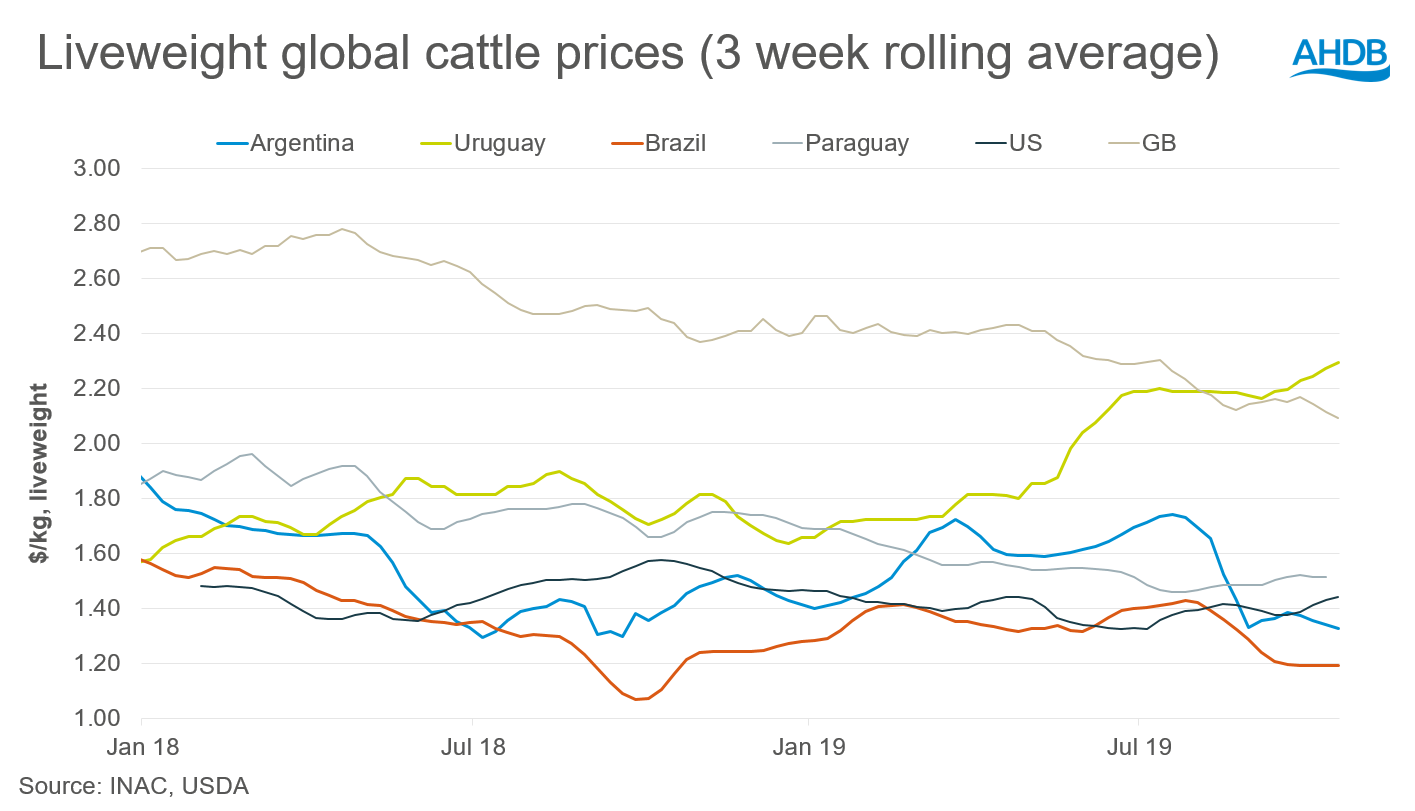

New Zealand and Uruguay have seen increases in cattle prices in recent months. Uruguay in particular has seen a sharp increase in farm gate prices. Increased demand from China, coupled with a long term decline in the beef herd has tightened supply in the country. A devaluing of the peso has likely improved the competitiveness of Uruguayan beef in the global marketplace as well.

For the other countries, farmgate prices have been trending below the long-term average throughout 2019. In Brazil and Argentina, prices in US$ have declined since the start of August, in part due to weakening domestic currency.

Average export prices are down globally, although the main suppliers to China have avoided much of the pressure. Even then Brazil has seen a 6% average price decline.

Prices in the EU have been under pressure from increasing supply and cooling demand. The EU is not a major supplier of beef to China, and is slightly insulated from the global market. Free trade agreements allow some beef access to the EU market, however the majority of beef traded occurs within the bloc.

Lamb

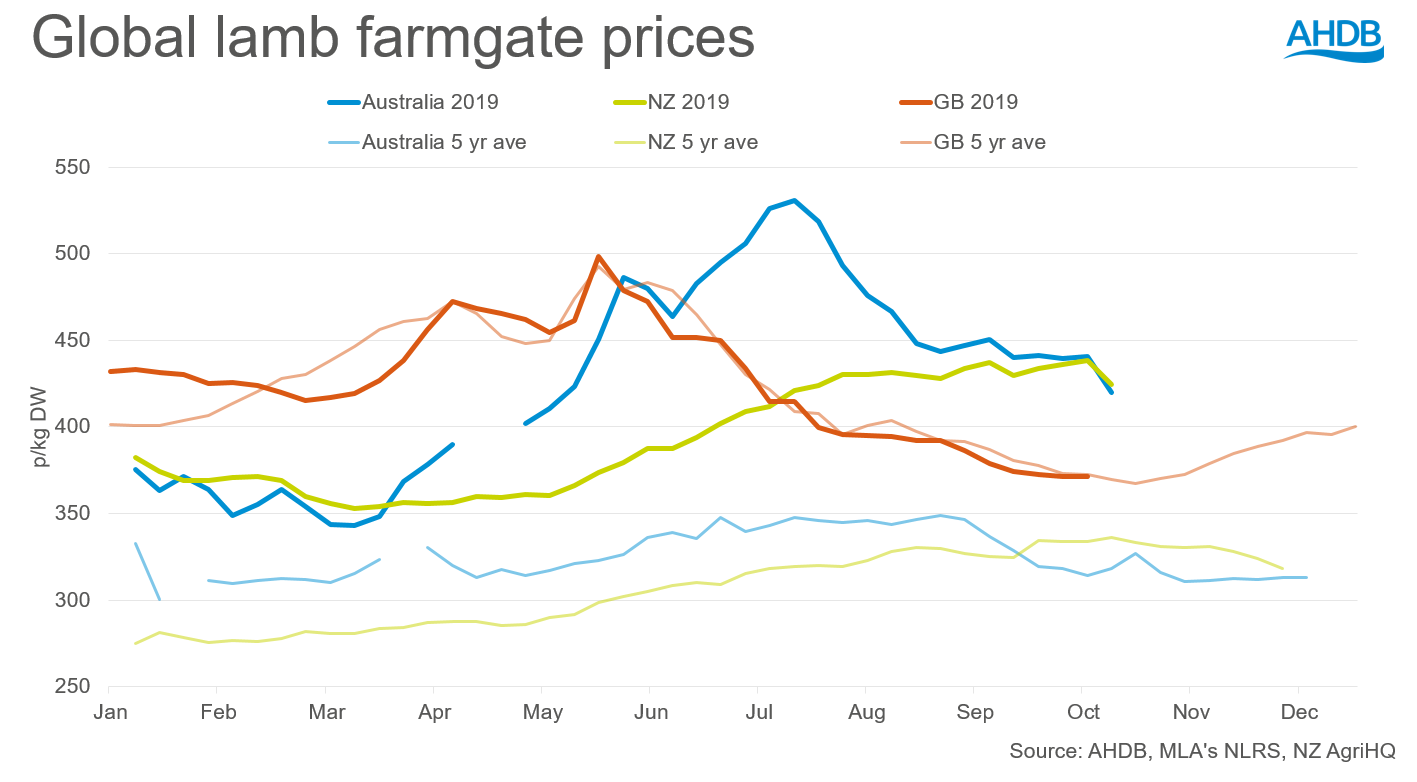

In 2017 Australian farmgate prices increased sharply, with further large increases during 2018 and holding their ground during 2019. Prices surpassed the record highs of 2011, which was the last time global sheep meat prices rallied. New Zealand prices rose shortly after the Australian prices. What has been more unusual this time is that the GB farmgate prices has largely been un-effected, bar spring 2018. Why is this? Historically just over half of New Zealand’s sheep meat exports were destined for the EU, however over the past decade this has declined to around a quarter.

China is clearly having a large impact on the global sheep meat market. For example, lamb flap which used to sell for around NZ $2/kg (or around £1), is now being sold for circa $13/kg. Around a quarter of all NZ agricultural exports in value terms are now destined for China. Such is New Zealand’s reliance on China that the NZ treasury has issued a warning about relying upon one market too much.

While it is clear the outbreak of ASF is having some impact on the global sheep meat market, some of the rises can also be attributed to long term growth in sheep meat demand in China. Tightening global supply, is also supporting prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: