Cattle numbers remain tight as new season lamb boosts output: Beef & lamb market update

Friday, 22 August 2025

Key points

- UK beef production in July was steady month-on-month but fell 8% year-on-year, leaving year-to-date (Jan-Jul) volumes 5% lower than 2024.

- Prime cattle numbers remained flat while carcase weights lifted slightly, likely reflecting supportive feed and finished prices.

- Sheep meat production fell 10% on the month but rose 10% year-on-year, keeping year-to-date output 4% higher than the equivalent period in 2024.

- Cull ewe slaughter declined both month-on-month and year-on-year, continuing to be influenced by the smaller UK flock.

Beef

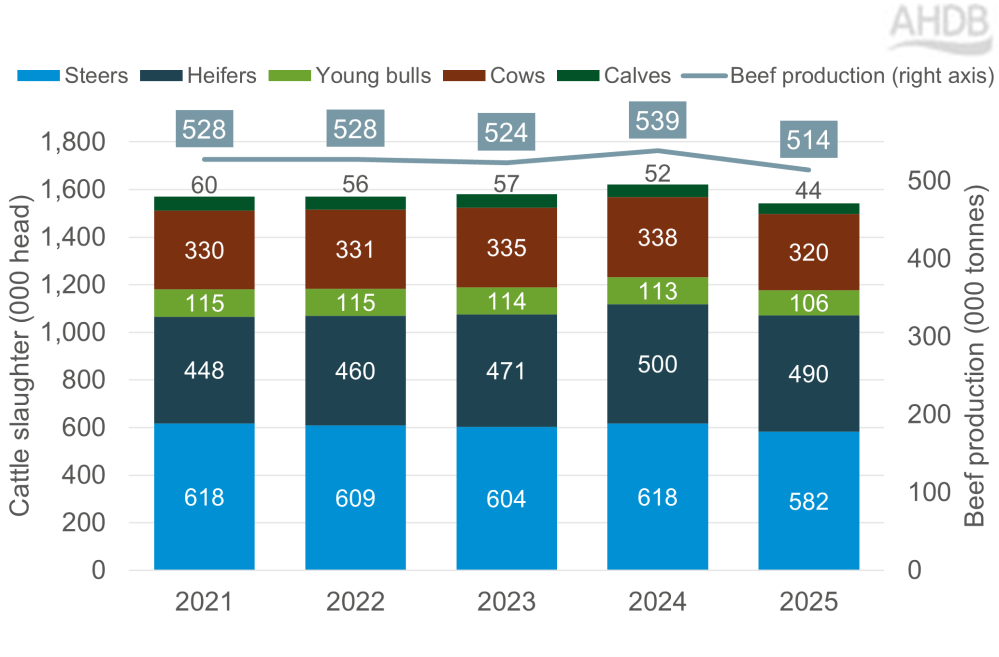

The latest production data published by Defra for July 2025 recorded UK beef production at 70,800 tonnes, broadly steady on the month (+400 tonnes, +1%) but down 6,200 tonnes (-8%) compared with July 2024. Cumulative beef production for the first seven months of the year now totals 514,000 tonnes, a reduction of 25,000 tonnes (-5%) from the same period in 2024.

Prime cattle slaughter in July stood at 161,900 head, almost unchanged compared to June (-1,500 head, -1%), but down 14,000 head (-8%) year-on-year. This brings the January–July prime kill to 1.18 million head, around 53,000 head (-4%) lower than the same point last year. This reflects the continuation of tighter cattle availability, which has characterised much of 2025 and helping keep prices firm compared with a year ago, despite recent softening in consumer demand.

Average prime cattle carcase weights rose slightly in July to 348.1kg, up 3.4kg versus June and 1.7kg higher than July 2024. This uplift may reflect producers holding cattle slightly longer following recent price stability coupled with comparatively affordable feed prices.

Cull cow slaughter was recorded at 43,600 head, up 5% (1,900 head) from June but down 8% (4,000 head) compared to July 2024. The year-to-date kill (Jan-Jul) now stands at 320,000 head, a fall of 18,000 (-5%) from the previous year. Throughput continues to be limited by retention within the dairy herd, encouraged by relatively supportive milk prices, and challenges around sourcing replacement heifers.

UK beef production - YTD (Jan-Jul)

Source: Defra

Lamb

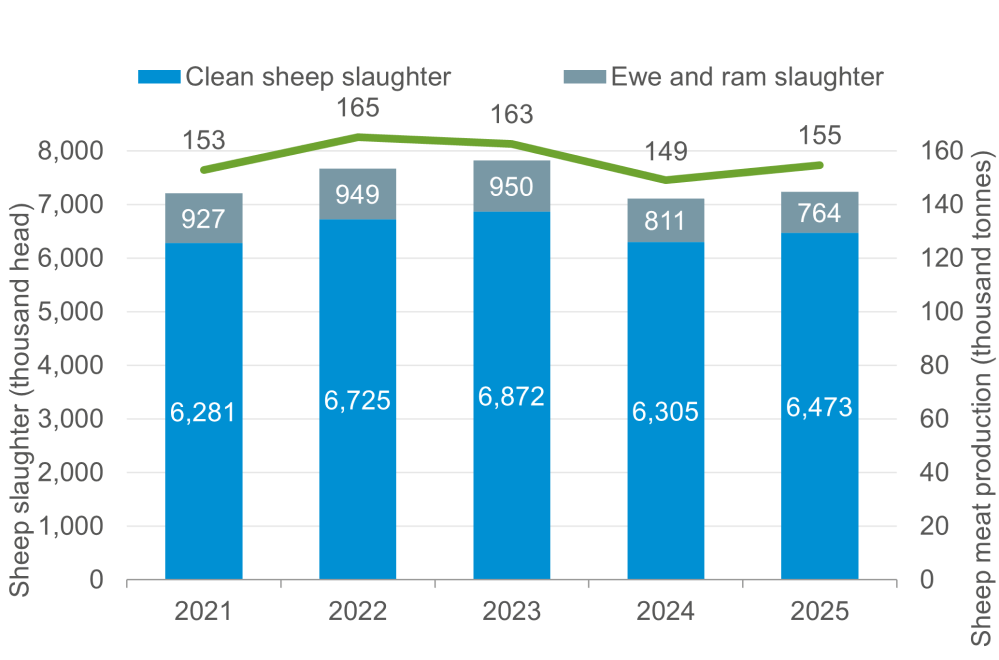

UK sheep meat production for July 2025 totalled 20,700 tonnes, falling 10% (2,300 tonnes) from June but still up 10% (1,900 tonnes) year-on-year. This takes year-to-date production (Jan–Jul) to 154,700 tonnes, around 5,600 tonnes (+4%) ahead of the same period in 2024. The year-on-year uplift is consistent with the larger carryover of hoggs from last season, while the seasonal dip from June reflects the transition to new season lambs, which are now beginning to dominate throughput.

Clean sheep slaughter reached 892,000 head, down 6% (-62,000 head) from June and marginally below last year (-8,000 head, -1%). Cumulative throughput for 2025 so far totals 6.47 million head, a rise of 168,000 head (+3%) year-on-year. Although numbers tightened in July compared to June, lambs have been coming forward earlier than normal in some areas due to patchy grazing conditions. This has balanced against the delayed marketing seen earlier in the season, leaving total kill volumes for the year slightly ahead of 2024.

Carcase weights averaged 19.8kg in July, 0.7kg lighter than June (-3%) as new season lambs came to dominate the kill.

Cull ewe slaughter fell to 110,000 head in July, down 12% (-15,000 head) from June and 7% (-8,000 head) below last year. Year-to-date ewe and ram throughput now totals 764,000 head, a decline of 47,000 head (-6%) versus the same period in 2024. The lower ewe kill may raise the question of whether this reflects stronger retention within flocks, or simply the ongoing contraction of the national breeding flock. Defra’s census from 1 December 2024 showed fewer ewes available, so throughput could naturally be smaller year-on-year even if farmers are not consciously keeping more animals back.

UK sheep meat production - YTD (Jan-Jul)

Source: Defra

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.