Bread wheat and malting barley premiums still elevated: Grain market daily

Tuesday, 10 October 2023

Market commentary

- Nov-23 UK feed wheat futures gained £1.30/t yesterday to close at £186.55/t, while the Nov-24 contract rose £1.50/t to £201.05/t.

- Global wheat prices edged higher on concerns about the conflict in Gaza and dry weather in the Southern Hemisphere. Also, there are signs that the strong pace of Russian wheat exports, which has weighed on markets for weeks, may be easing.

- A first forecast from SovEcon suggests that October exports could be in the region of 3.9–4 Mt, down from September’s 5.0 Mt. While supplies remain high, the Russian government is said to be trying to limit exports below a certain price.

- Nov-23 Paris rapeseed futures closed unchanged yesterday at €426.25/t, while the Nov-24 contract edged lower, down €0.75/t to €450.00/t. Despite further rises in crude oil futures due to fears the renewed conflict in the Middle East could curb oil production, rapeseed prices followed soyabean prices lower. Nearby Brent crude oil futures gained $3.57/barrel yesterday to close at $88.15/barrel.

- Chicago soyabean (and maize) futures edged lower as the market focused on the US harvest progress. The weekly US crop progress report is due tonight, delayed due to the US holiday, Indigenous Peoples' Day, yesterday.

Bread wheat and malting barley premiums still elevated

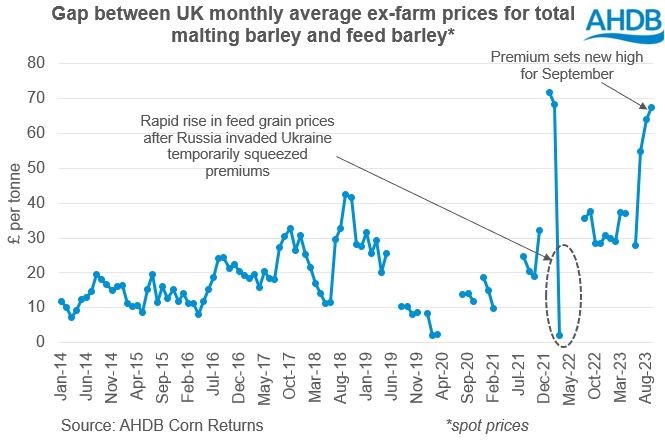

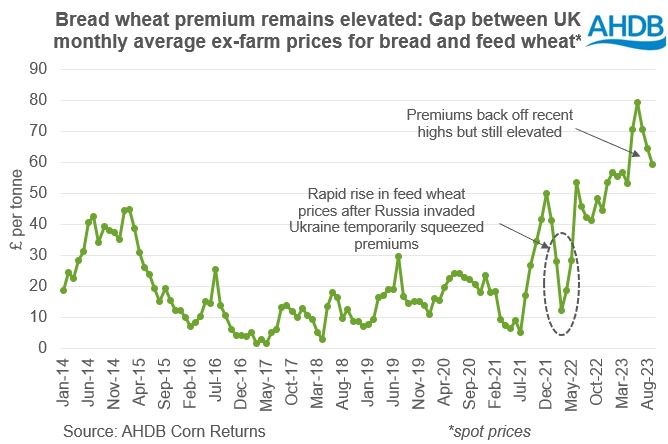

UK average spot ex-farm prices show the premium for bread milling wheat over feed wheat, and the premium for premium malting barley over feed barley are still historically high.

Malting premium sets new record for September

In September 2023, the gap between the UK average spot ex-farm prices for total malting barley and feed barley was £67.50/t. This is the largest gap (malting premium) in September on electronic records (back to 1976). It is also the third-highest monthly gap recorded over that time frame. September 2023 is only beaten by the premiums in January 2022 (£71.80/t) and February 2022 (£68.10/t).

The gap between spot premium malting barley (included in total malting barley price) and feed barley prices averaged £71.30/t across the UK in the week ending 5 October.

The wide gap reflects the challenging weather during harvest, both in the UK and across Europe. With global barley supplies tight and European quality down, UK prices need to be elevated to prevent excess exports. Meanwhile, demand from brewers, maltsters and distillers in the UK got off to a strong start this season.

Bread premium remains high

The gap between spot ex-farm bread milling wheat and feed wheat prices also remains large. The average UK ex-farm price in September 2023 also set a record for the month of September. But the levels are down from earlier this year.

Last week (week ending 5 October), the UK average spot price for bread milling wheat was £243.90/t. This equated to a £56.70/t premium over the feed wheat price.

Note added: The average ex-farm prices are an average of all trades during that period, weighted by the tonnage traded. The UK averages for each category of grain can contain different proportions of trade from different parts of the week, and different regions of the UK. Prices vary across the UK and the UK averages offer an indication of price trends, rather than specifics. More details about the Corn Returns can be found here. Alternatively, AHDB’s delivered price survey is a once-a week snapshot of prices, giving insight into the costs of each specification of grain delivered to set localities on that day. As this survey includes how November and May delivered bread wheat prices compare to the corresponding UK feed wheat futures price for the same day, it gives greater transparency of cash markets.

Like barley, the challenging growing year and harvest impacted wheat quality, including specific weights. Germany and Canada, plus to a lesser extent France, are historically the main sources for imported milling wheat to supplement the UK crop. But in 2023, the quality of the German crop was hit by a wet harvest meaning that prices are elevated this year.

The higher relative costs for importing milling wheat and questions about the UK quality are supporting bread wheat premiums. The premium for bread wheat over feed wheat is likely to stay elevated compared to previous years as long as imports remain expensive.

Tools to help

A lot of malting barley will have already been sold and/or moved to central or trade stores. But for any malting barley or milling wheat that remains, understanding what’s in the shed, preserving the quality and regular communication with your merchant(s) can help maximise the value on any unsold loads. AHDB’s Harvest Toolkit has information on grain sampling, grain storage and tips around grain contracts that might be useful.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.