Strong start to Russian exports: Grain market daily

Thursday, 5 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £185.90/t, down £1.10/t from Tuesday's close. New crop futures (Nov-24) closed at £199.15/t, down £1.10/t also over the same period.

- Domestic futures followed pressure on both Chicago and Paris wheat futures yesterday, weighed on by optimism surrounding Ukrainian exports through the sea corridor, and competitive Black Sea supply coming into focus. More on this below.

- In a hope to speed up exports, Ukraine, Poland and Lithuania have agreed that Ukrainian grain will be inspected at the Port of Klaipeda in Lithuania along the Baltic Sea as opposed to the Ukraine–Poland border.

- Paris rapeseed futures (Nov-23) closed yesterday at €439.00/t, down €8.25/t from Tuesday's close. Nov-24 futures closed at €460.00/t, down €2.50/t over the same period. Yesterday saw wider pressure on Winnipeg canola and vegetable oil prices, as well as the wider oil complex.

- Nearby Brent crude oil futures fell by 6% on Wednesday to close at $85.81/barrel. This is due to forecasts of weaker oil demand with recent price rises and after reports Russia might soon lift its ban on diesel exports.

Strong start to Russian exports

The competitiveness of Black Sea supply in global tenders continues to hang over wheat markets. This is despite the tightening of global wheat supply and demand this season, and the war ongoing in Ukraine. Along with the plentiful maize supplies forecast for this season, these factors continue to bring a more bearish sentiment into markets. We can see this reflected in speculative traders holding large net-short positions in Chicago wheat and maize futures.

Last year, we saw an aggressive Russian wheat export campaign continue to push prices down into the new year. So, what can we expect from this season?

The USDA currently forecasts wheat exports from Ukraine and Russia this season to total 11.0 million tonnes (Mt) and 49.0 Mt respectively. For Ukraine, this is 6.1 Mt lower than last season (2022/23), but for Russia this forecast is 3.0 Mt higher than last season’s strong pace. Russia is forecast to be the world’s largest wheat exporter yet again this season.

How much is really leaving Russia and Ukraine?

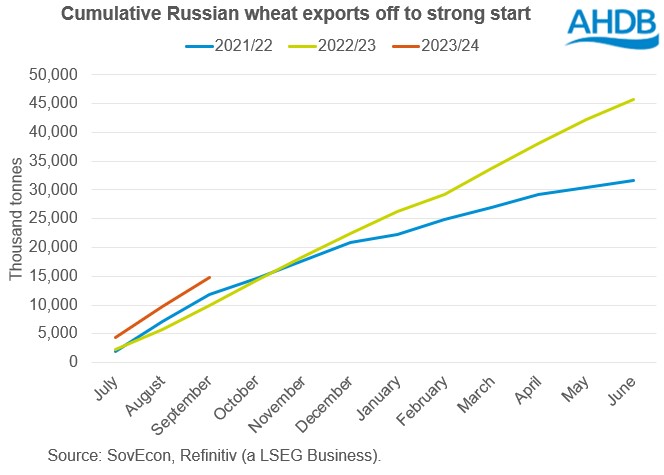

Russia’s wheat export pace started the season strongly, according to Russian consultancy SovEcon. Cumulative season-to-date exports (July–September) are up 49% from the same point last season and 26% higher than 2021/22.

Talk of unofficial minimum price restrictions are ongoing limiting buying of Russian wheat in recent market tenders. But away from the official offers for global tenders, Russian prices are reportedly still competitive.

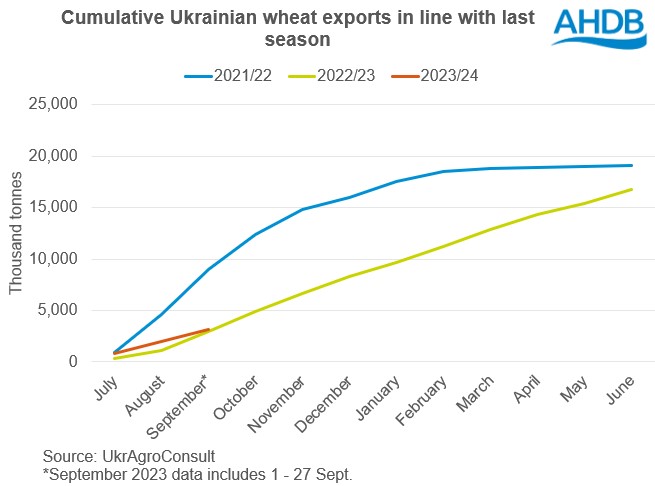

Ukrainian wheat exports have slowed since the end of the Black Sea Initiative. However, the Danube is still a key export route for grains despite Russian bombing, and ships have also started to leave through a humanitarian corridor. In the first three days of October, reportedly 153 Kt of grain were exported, down from 297 Kt in the same period last year (Refinitiv - LSEG).

Despite restrictions and disputes, Ukrainian grain continues to flow through Poland, Hungary, Romania, Bulgaria and Slovakia. A verification procedure for exporting wheat, maize, sunseed and rapeseed into these five EU countries has been put in place. It requires the Ukrainian government to issue a licence within 30 days of receiving an export application from a Ukrainian exporter. The application is negotiated with the EU and government of the importing country during these 30 days.

Where next?

Russian wheat exports have started this season strong, with 30% of this season’s USDA export forecast estimated to have been shipped in the first three months of this season (July–September). Looking ahead, should this pace continue to stay strong, we could see continued pressure on global wheat markets as we progress through 2023. Though, how competitive Russian wheat stays for global tenders will be something to watch, considering the current competitiveness of other Black Sea origins.

Looking at this season to date for Ukraine, 29% of this season’s USDA wheat export forecast has been met. This leaves a pace of 870 Kt a month needed for the rest of the season to meet the USDA forecast.

Yesterday, Ukraine’s navy said another 12 cargo vessels were ready to enter the Black Sea shipping corridor, following at least seven ships entering Ukrainian water to be loaded in recent days.

If we continue to see Ukrainian grain move, considering Danube export routes are becoming more efficient and the use of Black Sea shipping corridor too, this could also contribute to a more bearish sentiment on the market despite the war ongoing.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.