Beef market update: Brazil's production grows as prices support trade

Thursday, 28 September 2023

Key points:

- Brazil beef production up 7% in the first half of 2023

- China remains the most important market for Brazil exports

- Prices are around $3 lower than the US, remaining internationally competitive

What does beef production in Brazil look like?

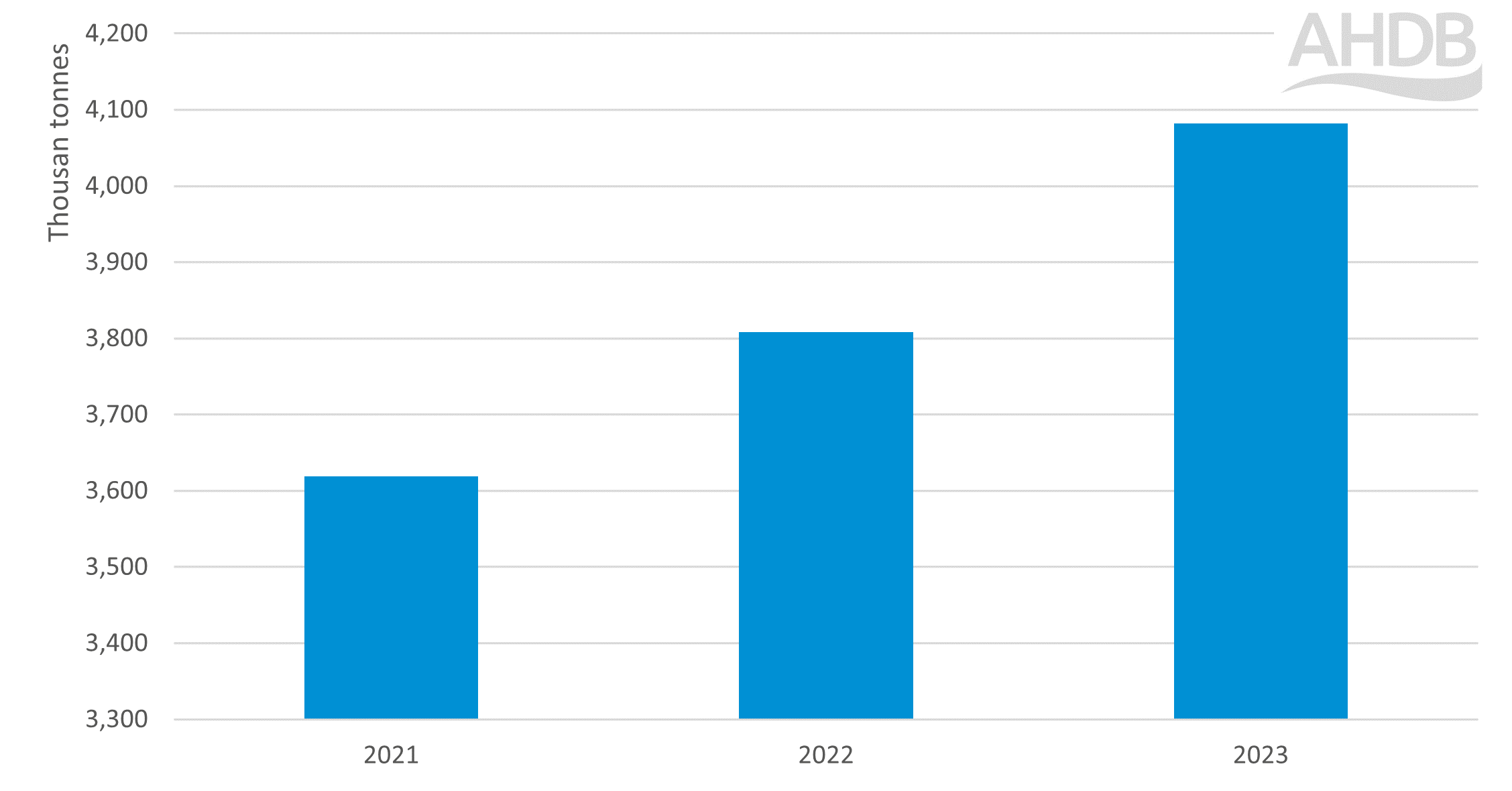

Beef production in Brazil has grown by 7% year on year for the first half of 2023, to a total of 4.1 million tonnes. This can be attributed to increased availability of cattle for slaughter, with 15.7 million head slaughtered in the first half of 2023 (+1.4million from 2022). Higher feed availability has lowered feed costs, contributing to better margins for the cattle industry. The USDA predict production levels will finish 2023 8% higher than 2022, with an additional 2% growth in 2024. This allows increased opportunities for export, particularly into China. USDA have predicted that Brazil’s main competitors - US, EU and Argentina - will be slowing their production, further enhancing the opportunity for Brazil to grow its beef production. However, this may be contingent on the growth of Australian exports, as their production is expected to grow through to 2024, and the markets they may export to could compete with Brazilian exports.

Brazil's H1 beef production 2021 - 2023

Source: IGBE Brazil

Lower domestic prices and improved economic conditions, combined with increased availability have led to higher domestic consumption. However, this trend may come under pressure if the economic situation changes in Brazil, with consumers opting to trade down to more affordable proteins such as poultry and pork.

How do Brazil’s prices compare?

Deadweight steer prices in Brazil have slowly fallen throughout 2023 so far, as domestic production has grown. The latest data available (22 September) shows a slight resurgence in prices, up to $3/kg, from a low of $2.70. During this time period, US prices have grown up to $6.4/kg as the country struggles with lower available supplies.

Brazil’s trade situation

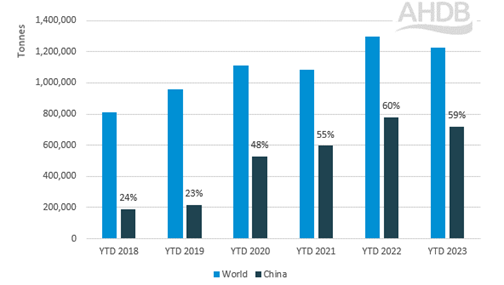

Brazil’s beef exports remain amongst the most competitive (volume wise) in the world, as exports to date (Jan – Aug) totalled 1.23m tonnes. This is a fall of 5% from the same period in 2022, as volumes to China fell by 8%, down to 719,000 tonnes for 2023. China remains the most important trading partner for Brazil, at 59% of its total export volume. The market share of exports to China has grown significantly since 2019, up from 23% to a peak of 60% in 2022. This is despite multiple challenges facing export into the Chinese market, such as waning consumer demand and trade interruptions from BSE cases in Brazil.

Brazil’s beef exports, to China and the globe YTD (Jan – Aug)

Source: Brazil Ministry of Development, Industry and Trade, via Trade Data Monitor LLC

Whilst Brazil’s exports are dependent on Chinese demand, industry sources remark that Brazil are looking to diversify the base of their exports, into countries such as Indonesia, Thailand, and Singapore.

Brazil’s beef imports are limited given the size of the domestic market and industry, totalling 29,000 tonnes for the year to date, with the majority of the trade being intra-regional (from Paraguay, Argentina, and Uruguay).

What does this mean for the UK?

Growth in Brazil’s production is not likely to directly impact the UK. The UK has imported 13,700 tonnes from Brazil (Jan – July) the majority being corned beef, this is compared to our largest trading partner of Ireland at 109,000 tonnes. Any interruption to trading dynamics for Brazil, such as further BSE cases, could shift the international beef markets. If denied or limited access to China, domestic stocks within Brazil could grow and require a new home on the international market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.