Free trade with Australia: four weeks in

Tuesday, 4 July 2023

With the Free Trade Agreement (FTA) with Australia in force from 31 May 2023, we examine the volumes of beef shipped to the UK under the tariff-free quotas (TRQ) and the current state of Australia’s beef production capacity.

What has happened so far?

The TRQs allow Australian beef to enter the UK without paying for tariffs that would usually increase the cost of importing. Under the new FTA, the current limit of beef imports (product weight) is 20,616 tonnes per calendar year (1 Jan – 31 Dec). This is split equally between First Come First Served (FCFS), and Allocated quotas. Allocated quotas are for large exporters with an allocated tonnage they can import and are based on the size of the company. FCFS quotas are non-allocated and fill up as and when. The total TRQ will continue to grow from 2023 to 2033, up to 110,000 tonnes.

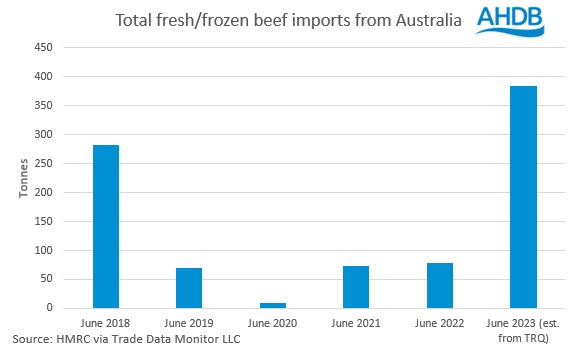

Recorded shipments of Australian beef have totalled 384 tonnes in June under the new TRQ. Under the allocated TRQ, 343 tonnes of Australian beef have been shipped to the UK in the four weeks ending 26 June 2023. This is 3% of the allocated quota, with 9,984 tonnes available to enter until 31 December 2023. Under the FCFS quota just under 41 tonnes have been shipped, with 10,267 tonnes available to enter until the end of the year. Looking at previous years, June imports of beef from Australia have averaged 103 tonnes from 2018 -22, making up 0.4% of the UK’s beef imports in June. For comparison, we have imported an average of 15,400 tonnes from Ireland in the same period, 68% of our total imports in June 2022.

Australia’s production capacity

Meat and Livestock Australia (MLA) have updated their beef projections for the remainder of 2023 and beyond.

For the remainder of 2023, Australia’s cattle population is set to increase to 28.7m head, up 4% from 2022. Stocking rates are above long-term averages, as there is retention of females for rebuilding and restocking herds. There will be a higher number of young cattle in 2024, as improved genetics allows for greater fertility in the breeding herd. A younger and more productive herd is set to drive production capabilities, as production is predicted to hit 2.2m tonnes in 2023 (carcase weight equivalent).

Slaughtering’s are set to reach 6.95m head, as slaughter levels sit consistently above weekly averages. Processing capacity is improving within the country, as it recovers from flooding and Covid 19 restrictions in previous years. Significantly higher cull cow throughputs have been recorded, as increased breeding stock on farm necessitates culling of older stock in 2023.

MLA predicts that slaughtering’s will increase by 43% from 2022 – 25, as production increases 37% during the same period.

That being said, labour and processing ability continue to weigh on capacity for production and outputs. The Department of Agriculture, Fisheries and Forestry (DAFF) notes that whilst there isn’t a direct shortage of labour in beef processing plants, processors are more likely to produce greater volumes of less processed products, as higher throughputs come in and labour remains tight. We may see this come into play in UK imports as Australian products ramps up over the coming years.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.