Australian sheep forecast update

Friday, 14 October 2022

Production

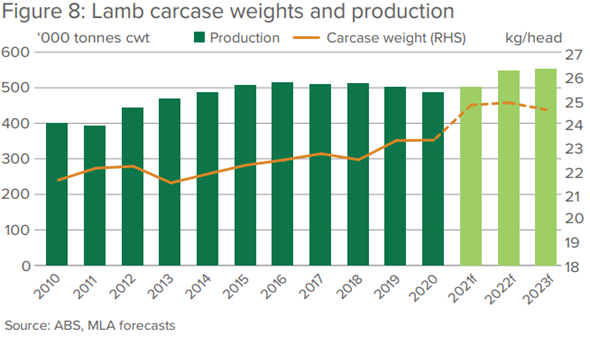

Meat and Livestock Australia (MLA) have revised their 2022 sheep industry projections upwards. Underpinned by historically high carcase weights, increased slaughter volumes and favourable weather, lamb production is now forecast to reach 549,000 tonnes for the full year. This is an additional 9,000 tonnes compared to earlier forecasts and a year-on-year increase of 8%. National flock numbers have also been revised higher, by 2%, to reach 76 million head by the end of 2022, a year-on-year increase of 7%. Further growth is expected in 2023 with the flock size forecast to reach 78.8 million head and lamb production increasing to 557,000 tonnes.

Trade

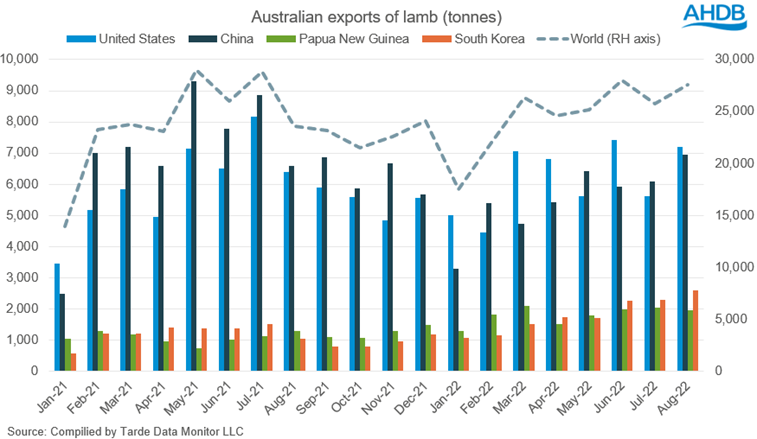

There still remains major challenges within the export industry. Increased freight costs make long haul routes less attractive and the disturbance to shipping channels caused by lockdowns at Chinese ports and the war in Ukraine has left some goods stranded or requiring large detours. Despite this, Australian sheep meat exports have been strong so far in 2022 due to increased domestic supply paired with strong global demand. Total lamb export volumes for the year to date (Jan-Aug) have reached 197,100 tonnes, up 3% compared to the same period in 2021.

There has been a shift in the key destinations of Australian lamb over the last 12 months. Chinese import volumes are down 21% year on year, standing at 44,200 tonnes for the year so far (Jan-Aug). Hong Kong specifically has seen the largest year on year decline in volumes, dropping from 5,400 tonnes in 2021 (Jan-Aug) to only 500 tonnes in 2022. The US has increased imports by 3% to total 49,200 tonnes so far in 2022, now overtaking China as Australia’s largest market for lamb.

Shifting consumer eating habits, economic growth and foodservice recovery post-COVID has seen demand for sheep meat grow in many countries in the Southeast Asia region. Papua New Guinea has seen the largest volume growth, up 68% (5,900 tonnes) to reach 14,500 tonnes in 2022 so far, closely followed by South Korea where volumes from Australia have increased 48% (4,600 tonnes) year on year to total 14,300 tonnes.

Between January and May, Australian live sheep exports were 25% lower than in 2021. On the back of this, MLA has revised down its projected live sheep exports for 2022 by 20% from 600,000 head to 500,000 head.

Prices

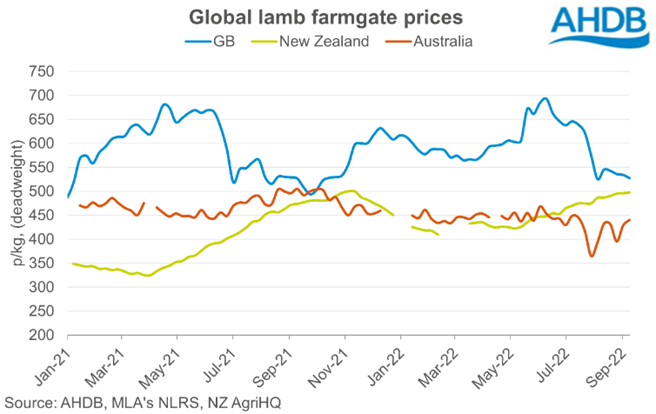

Australian sheep and lamb prices this year have been tracking lower than 2021 prices due to increased supply. However, heavy lambs have been the best performing category, driven by strengthened demand from international markets. With another large lamb cohort expected in 2022, prices may not reach their traditional 'winter peak' as supplies remain high.

The Australian dollar has depreciated against the US dollar over the past 12 months. Most of Australia’s sheep meat exports are traded in US dollar, meaning the weakness of the Australian dollar has made Australian sheep meat more price competitive on the global market.

Impact on UK market

As lamb supplies have improved and prices eased in Australia, exports to the UK have increased 11% year on year so far in 2022. It is worth noting that as this data only runs till August, the UK-Australia free trade agreement is not yet in force and so growth is down to market dynamics rather than policy changes. At time of writing, it is uncertain when this agreement will come into effect. Read our Horizon report, which models the potential impact of the agreement on UK agriculture, including the lamb sector.

Total UK lamb import volumes have risen strongly year-on-year so far in 2022, partly because of recovery from COVID and Brexit, and also increased foodservice activity as restrictions have lifted. UK exports have also shown strong growth year-on-year, and farmgate lamb prices have remained in a relatively strong position. Imports are not forecast to maintain the rate of growth seen in the first half of 2022 for the rest of the year, but are forecast to end 2022 above 2021 levels overall.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.