April 2024 dairy market review

Thursday, 9 May 2024

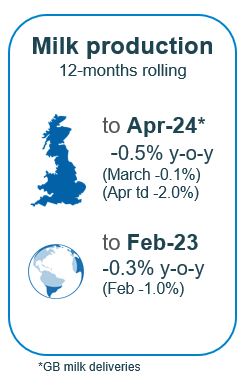

Milk production

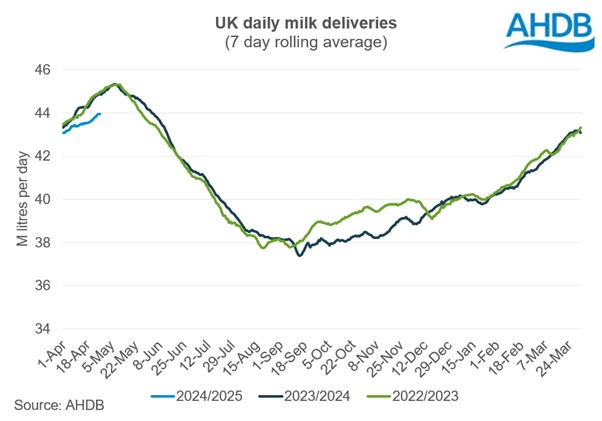

GB milk deliveries are estimated to have totalled 1,073 million litres in April 2024 with an average of 35.8 million litres per day. This would mean a decline of 2.0% year on year.

Exceptionally wet conditions throughout the Autumn, winter, and spring, teamed with a cooler than average second half of April have held back production with all expectations pointing to a spring flush that is well below average. Until the end of March grass growth according to AHDB’s Forage for Knowledge tool was in line with the 5 year average. However, since then ongoing above average rainfall and cool conditions have seen grass growth well below the seasonal average with the grass growth rate in kg of DM per hectare sitting at 40.3 compared to the 5-year average of 57.7. Grass utilisation will have been a problem for many with the wet precluding much turnout for most, barring those on the lightest of soils. This could cause difficulties right through the season with farmers unable to get on to conduct usual groundwork activities until later in the growing season causing future issues for silage making.

You can read more about expectations and drivers for the milk year ahead in the Dairy market outlook.

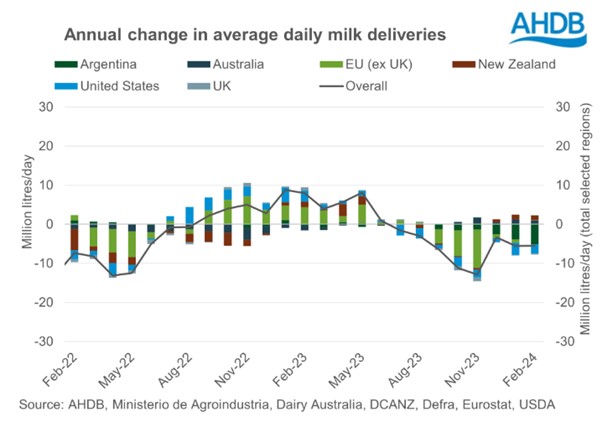

Global milk deliveries in the latest period (February) averaged 813.0 million litres per day in February, a decline of 5.5 million litres per day, or -0.4%), across the selected regions, compared to the same period last year. Australia and New Zealand recorded year on year volume increases, EU was stable, and Argentina, UK and the US declined. Stability in the EU belied quite a lot of variance by market with significant declines year on year for Ireland, down 50.6 million litres or 13.3%. Growth in Germany (3.3%), France (4.0%) and Poland (7.4%) year-on-year compensated for these losses.

Rabobank, in their latest outlook, predict lower year-on-year output for H1 2024, before being a little more positive in the back half of the year. Looking ahead, Rabobank expect global prices to improve at farm-gate to some extent, and project easing of feed costs.

Available supplies and trade

Estimates of available supplies are mixed but don’t point towards an over-supply of dairy products currently. In the fourth quarter of 2023 milk powders registered a small growth in supplies year-on-year while cheese and butter saw a drop. EU dairy product availability continued a downward trajectory in Q4 2023 compared to the same period in 2022. Declines in production and improved exports tightened supplies.

There are key opportunities for mozzarella in exports. In 2023, 43,415 tonnes of mozzarella were exported, an increase of 6.8% compared to 2022. Whilst European markets made up the bulk of these exports at 88%, the growth is coming from elsewhere. Asian markets saw the biggest boost with exports increasing by 163% to 2,114 tonnes. Over half of that demand came from China at 1,082 tonnes and a further 354 tonnes to Hong Kong with both markets seeing substantial year-on-year growth (335% and 122% respectively).

The EU-NZ Free Trade Agreement will enter into force on 1 May 2024. Trade of goods between the two was worth almost 9.1 billion euros in 2022. The agreement provides improved access into the EU market for New Zealand products. While there is some potential for displacement of UK dairy produce, analysts expect the UK to keep their market share although with more risk for butter.

Wholesale markets

Overall price movements on UK wholesale markets continues the theme of lack of market direction. Nervousness over milk production has been playing on the minds of industry during April following a continuation of the unseasonably wet and cool weather. Despite this, changes in product pricing were minimal, generally easing month on month, with the exception of butter. Buyers and sellers continue to hold out, waiting to see where milk production peaks. Cream lost £7/t or 0%; SMP lost £40/t or -2%; mild cheddar dropped a scant £20/t. Butter was the only commodity that gained seeing an uplift of £60/t.

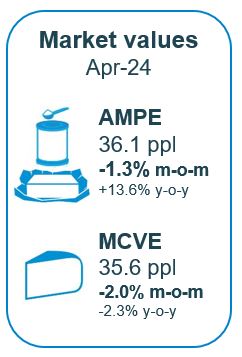

As of April, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) dropped slightly to 35.7ppl. AMPE dropped by 1.3%, MCVE lost 2.0%. AMPE is now ahead of a year ago by 13.6%, with MCVE still lagging slightly behind. Some of this loss was driven by an uplift in manufacturing costs.

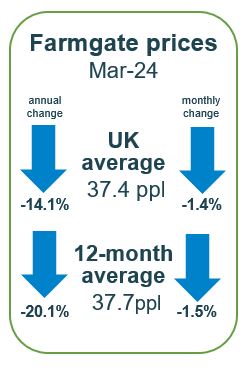

Farmgate milk prices

The latest published farmgate price was for March with a UK average of 37.4ppl. Latest announced farmgate prices for May were relatively positive, continue the upward trajectory with processors becoming nervous about limited spring milk supplies.

Mixed moves on the retail aligned contracts; Tesco dropped their price by 0.60ppl. Conversely, Co-op increased their prices by 0.12ppl while Sainsbury and M&S held on to their prices. On non-aligned contracts, all members of the AHDB League Table held their prices.

Cheese contracts mostly held steady or edged upwards as cheese processors are nervous about milk flows. Barbers increased their price by 0.50ppl for the second consecutive month. First Milk made an announcement of price increase of 0.75ppl. This is the fourth consecutive month of price increase in a row. South Caernarfon Creameries increased their prices for four consecutive months and prices increased by 1.00ppl in May. Meanwhile Belton, Leprino Foods, Lactalis and Wyke Farms held on to their prices and Saputo has been holding steady for the last three months.

Manufacturing contracts remained steady for the most part, barring UK Arla Farmers which gained 0.43ppl.

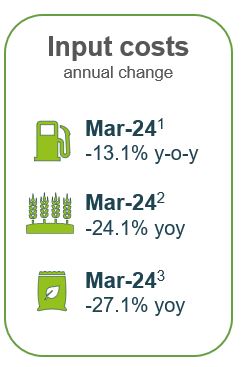

Input costs

The Agricultural Price Index has seen minor movements for the past few months, providing some stability to key input costs. However, output price inflation is still smaller than input costs inflation which squeezes margins. Fertiliser costs have reduced by £200/t over the past 12 months; energy and fuel has fallen 14.6% year-on-year; compound feed has only risen by 0.5% compared to the end of 2023.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.