- Home

- News

- Irish milk production shows significant year-on-year declines for the fourth consecutive month

Irish milk production shows significant year-on-year declines for the fourth consecutive month

Thursday, 18 April 2024

Irish milk production has recorded significant year on year declines for the past few months. We discuss some of the drivers behind these declines and what it means for the global dairy market.

Production declines

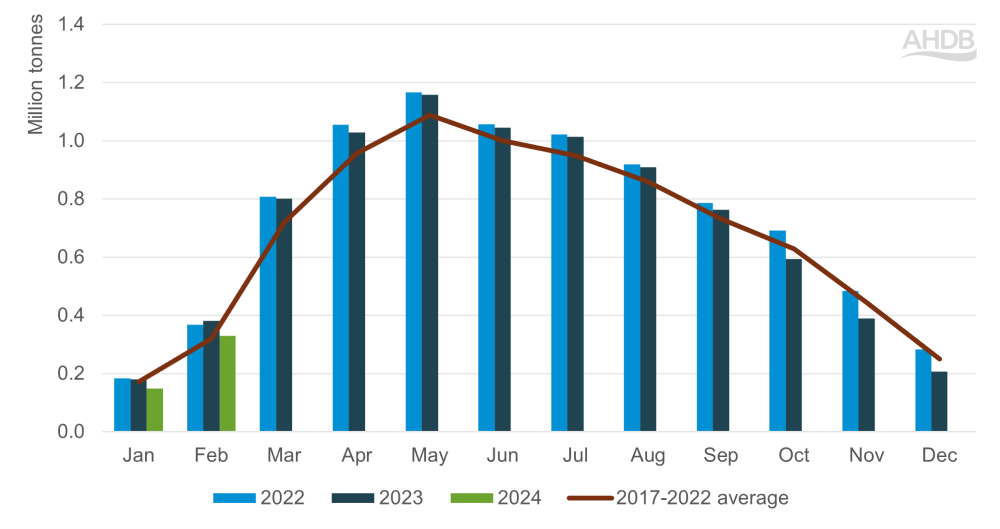

Milk production in Ireland was down 29% year on year in the fourth quarter of 2023 and has continued to record significant year on year declines in the first couple of months of 2024. January and February production were down 18% and 13% year on year, respectively, with the challenging conditions for Irish dairy farmers widely reported in the local farming press.

Milk production in Ireland

Source: Eurostat

Wet weather

Ireland has seen a wet winter, much like GB, with six named storms and above average rainfall across the country . This particularly impacts the Irish dairy industry as the vast majority of cows are on grass-based systems. Poor autumn weather meant cows were moved inside earlier and then the wet spring has delayed turn out, meaning grass intake has been significantly reduced which will have a knock on effect on lower milk yields per cow.

Costs of production

Wet weather also presents challenges with increased costs for feed and bedding, meaning farmers are more likely to pull back on production and cow numbers. Industry stakeholders are reporting that milk price has fallen below the cost of production, with calls for increased support, through milk prices, to help farmers to deal with increased costs of feed and fodder.

Late calving

Milk production in Ireland is highly seasonal, with production peaking in the spring following calving. The calving season normally runs from January through to mid April, with reports suggesting that calving was later in 2024 . As the season comes to a close, calf registrations are up year on year , however later calving will have contributed to the reduced milk deliveries at the beginning of the year, with cows reaching peak lactation later in the season.

Environmental regulation

Increasing environmental regulation is another key concern for Irish dairy producers, often cited in market reports as a driver for reduced production. An example of this is the European Nitrates Directive, delivered in Ireland via the Nitrates Action Programme, which sets out regulations for slurry storage, spreading and management on dairy farms. Concerns have been raised by farmers on the effect of these restrictions on stocking rates, and the knock-on effect of reduced cow numbers on milk production. Reports suggest that farmers may have reduced cow numbers in anticipation of these regulations coming into effect.

Reduced EU milk production

Ireland produced 6% of the EU’s total milk supply in the last year, so whilst not one of the largest producers on the continent, its production has a significant effect on the supply picture. The significant reductions of the last few months have been key drivers for overall year on year declines in EU milk volumes.

Lower product volumes

Alongside lower milk production, we have also seen butter production decrease over the past few months. Between November 2023 and February 2024, total monthly production volumes of butter were down on average 24% year on year. Lower butter production has limited volumes available for Ireland to export, with total butter export volumes down 18% year on year for 2024 so far (Jan-Feb). This might create opportunities for other butter exporters, such as GB, in markets such as the US and the Netherlands, the two biggest export markets for Irish butter.

Trade between the UK and Ireland

Irish exports of butter to the UK in the six months to February 2024 totalled 2,500 tonnes, down 17% on the same period of the previous year. Historically, a significant amount of Irish product has been placed on the UK marketplace which has bolstered supply, creating a drag on prices. The reduction of Irish products, particularly butter, is likely to have provided some support for UK milk prices, particularly for fats.

Conclusions

Due to its grass based production system, the Irish dairy sector is particularly vulnerable to weather challenges which has been reflected in the production declines of the past few months. Whether production recovers as they move into the peak of their milk season and environmental policy progresses, will be an important watchpoint, for its effects on trade, EU milk supply and also across the global dairy commodity markets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.