Analyst Insight: Have you thought about marketing grain for harvest 23?

Thursday, 1 September 2022

Market commentary

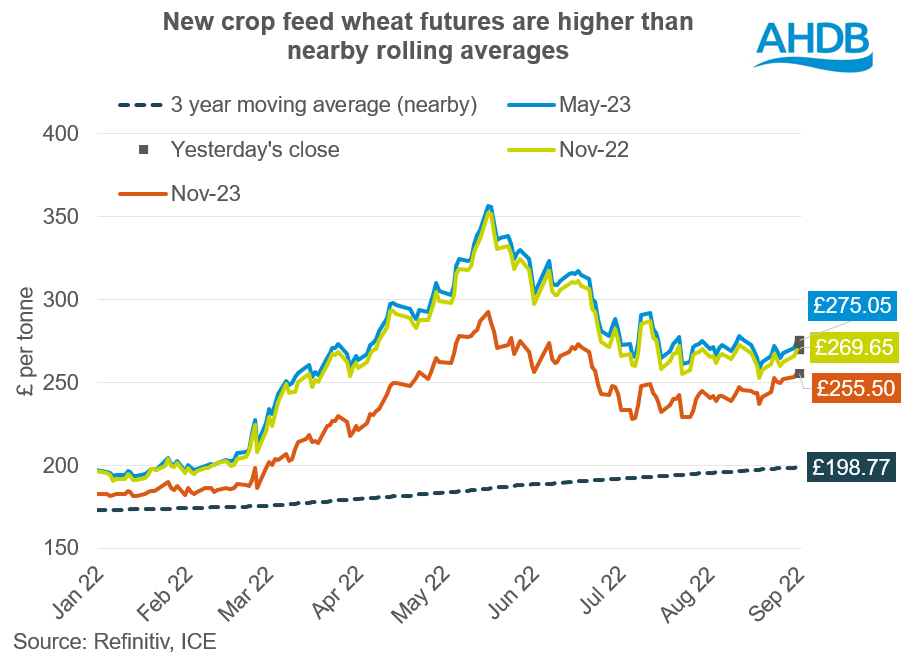

- UK feed wheat futures (Nov-22) closed yesterday at £269.65/t, gaining £3.65/t on Tuesday’s close. The May-23 contract gained £4.05/t over the same period to close at £275.05/t.

- For new crop, the Nov-23 contract closed at £255.50/t, gaining £2.30/t on Tuesday’s close.

- The UK market followed the Paris and Chicago market up as wheat markets rose on technical buying and further worries about shipments from Ukraine, as grain silos in Mykolaiv were hit by Russian shelling on Tuesday.

- DEFRA released their estimates of English cereal and oilseed rape areas yesterday. The English wheat area in 2022 is estimated at 1.67Mha. This is an 0.8% increase compared with 2021. Winter sown oilseed rape (98% of the total oilseed area) is estimated to increase by 21% to 317Kha. Further statistics and information are linked here.

- The first monthly insight into UK human and industrial cereal usage and GB animal feed production for the 2022/23 marketing year has been released today with July’s usage data now published.

Have you thought about marketing grain for harvest 23?

Global grain markets have been supported but at the same time subject to a large degree of volatility since the war between Ukraine and Russia began.

This has led to rising commodity values, such as fuel and fertiliser, which have stimulated rapid inflation and increased interest rates. The knock-on effect of all of these impacts will affect every farm business across the country.

Analysis from AHDB concluded that the general support in commodity markets and impact on cereal and oilseed prices has kept ahead of input cost rises for producing crops. However, holding onto 2022 margins will prove difficult with continuing rapidly-rising costs for harvest 2023. News such as CF industries temporarily halting production of ammonia at their Billingham site will likely further add to these rising costs.

For the 2022/23 marketing year, prices are expected to remain volatile, with UK prices reactive to global news and weather. Monitoring forward market movement and locking in forward prices for harvest-23 (and beyond) delivery could be the difference between a positive and negative net-margin for 2023.

Forward selling grain

Although some growers may be reluctant to sell grain forward due to the risks involved, it’s critical to take advantage of high prices where that allows acceptable margins to be made. Yesterday, November-23 UK feed wheat futures closed at £255.50/t. Although not a contract high, prices still remain relatively supported compared to historic averages.

Whether it’s selling 10% or 50% of your budgeted tonnage for harvest-23, can you make this price work and still profit? Domestic grain prices conventionally follow the sentiment of global markets. The current high forward prices we are experiencing now may not be as well supported when we get to harvest-23, for instance if we experience a recession. Equally, strong support could continue until then under a different scenario – e.g. continued issues within the Black Sea.

So why not spread the risk and consider splitting your grain sales into three parts: forward selling, selling at harvest-23 and out of store (Sep-23 to Jun-24)?

By doing this you are manging the risk and locking in prices when the market is supported. You are also avoiding selling all of your crop post-harvest when prices could be lower.

Hedging your forward sales with options

It is important to control your exposure to the market if selling forward. Selling a proportion of your budgeted tonnage per hectare for forward delivery could provide a starting point for sales, whilst leaving plenty of scope for changes, such as reacting to market movements.

Options contracts can bring a monetary return for farm businesses, but they require a view on potential future market direction. Furthermore, they can be utilised even if you are not forward selling. For example, they can be used to remain invested in a market, even if you sell everything at harvest or they can be used as a method of ‘insuring’ unsold grain to protect against markets moving downwards.

Trading “Call” or “Put” options can be a way of benefitting from a market moving either up or down. A “Call” option market position would benefit from a rising market and a “Put” option market position will benefit from a falling market.

On the AHDB Price Risk Management webpage there is a plethora of analysis such as an introduction to options and looking at different marketing strategies when using options.

Conclusion

Unfortunately, there is not a crystal ball as to where markets could go next but they are expected to remain volatile. We know that for harvest-23 prices could possible remain historically high given the lack of winter wheat plantings in Ukraine for next season. However, there are other factors that could potentially pressure the market such as recessional fears and/or strong southern hemisphere crop development at the end of 2022. It is this uncertainty which makes it important to consider taking advantage of these high prices as they may not remain forever. If profits can be secured now, what is to stop you taking advantage?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.