Rising natural gas prices: Grain market daily

Wednesday, 3 August 2022

Market commentary

- Little changed for UK feed wheat futures (Nov-22), closing at £265.75/t, up £0.20/t from Monday’s price. Over the same period, the May-23 contract closed at £271.25/t, up £0.95/t.

- Global feed wheat contracts have varied, with Chicago wheat futures (Dec-22) down by $9.18/t to close at $291.72/t yesterday, whilst Paris milling wheat futures (Dec-22) closed at €326.50/t, up by €1.00/t.

- There was slight pressure in Chicago wheat futures yesterday, from a strengthening dollar and as the first Ukrainian grain shipment was received in Turkey. It is reported that 27 ships in three Ukrainian ports are awaiting export under the agreement. This is weakening some global availability concerns.

- Paris rapeseed futures (Nov-22) rose yesterday to close at €656.75/t, up by €5.50/t. This contrasted the Winnipeg Canola futures (Nov-22) closing price of CAD$848.40/t, which was a decrease of CAD$44.40/t. The Paris rapeseed contract is up on the back of slightly stronger crude oil prices. However, other oilseeds saw pressure yesterday from slightly improved US soyabean conditions in the latest USDA crop condition report released on Monday.

Rising natural gas prices

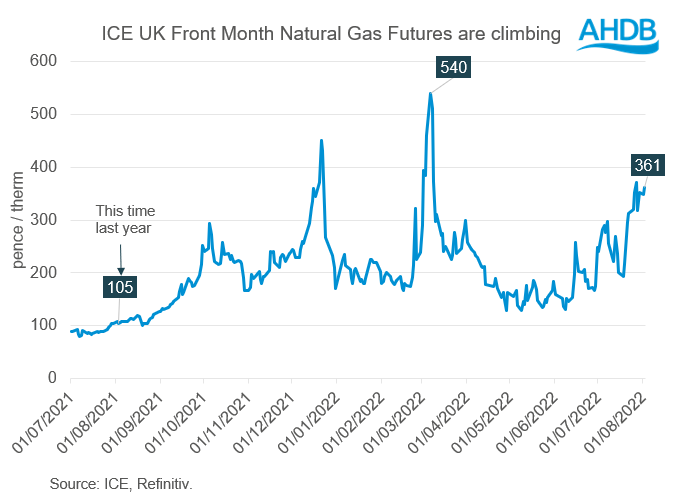

In recent weeks, UK natural gas prices have been rising to levels not seen since March.

Why? Rising natural gas prices have been fuelled by the squeeze in Russian gas supplies and increased EU demand.

Last week, Russian gas supplier Gazprom announced that the flow of gas running through the Nord stream pipeline was to reduce to around 20% of normal capacity (beginning on 27 July). The pipeline that runs Russia to Germany will see a flow of 33 million cubic meters per day, citing the availability of turbines as the reason for reduced flow.

EU countries seeing gas deliveries reduced are struggling to fill storage facilities for winter, which is causing rationing concerns for industry. Demand on the continent is looking to procure replacement for the lack of supplies from the Nord Stream by sourcing alternatives, such as liquefied natural gas (LNG).

Reportedly, the channel linking Britain to the EU has been working at full capacity.

Why is this important?

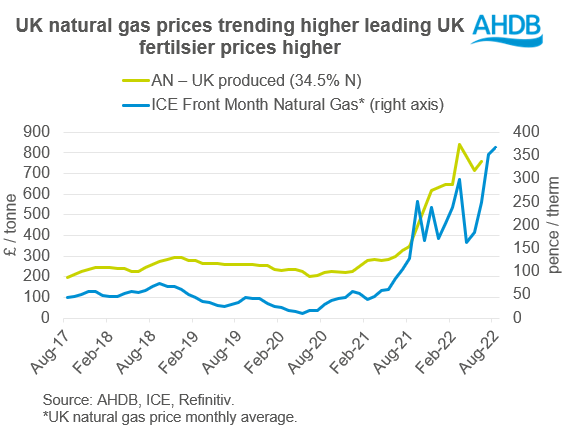

Demand is not the only factor driving ammonia nitrate (AN) fertiliser prices, so too does supply. Natural gas prices are the main feedstock for fertiliser production. As such, with natural gas prices rising considerably over the past year, this has increased AN fertiliser cost of production too.

Earlier this year, we saw production halted at two of the UK’s main fertiliser production sites. Since then, CF Industries have announced the Ince production site to be permanently shut. Though Billingham is to remain open.

As natural gas prices climb, we have also been seeing rising fertiliser prices.

In recent weeks, we have been seeing climbing natural gas prices again. As such, looking ahead, the outlook for fertiliser prices does not currently look to be easing.

Decisions on fertiliser applications can be difficult. There are many resources to help including a nitrogen fertiliser adjustment calculator, as well as previous analysis considering strategies for nitrogen fertiliser applications.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.