Nitrogen fertiliser application strategies explored: Grain Market Daily

Friday, 6 May 2022

Market commentary

- Nearby UK feed wheat futures moved up £10.75/t yesterday, closing at £340.25/t, a contract high. The new crop (Nov-22) contract also up £12.60/t on the day before, closing the session at £315.30/t. Both contracts mirrored Paris milling wheat futures.

- The above contracts gained support on news that French winter cereal crop conditions are easing slightly, due to the hot and dry April weather. This morning, France AgriMer have estimated 89% of the French soft wheat crop in good/excellent condition, down from 91% the week earlier.

- The Ukrainian grain trader’s union (UGA) have reported this morning that 6.1Mha of spring grains has been planted in Ukraine as at 5 May. Maize and sunflower is dominating this area. The union has pegged this year’s spring cropping area at 11.45Mha, 3.5-4Mha less than a year earlier due to the war.

- Natural gas prices continue to show a strong carry in futures markets. Q4 ICE natural gas futures are trading at 242p/therm, compared to July prices at 184p/therm. We know from historical relationships that natural gas prices are very strongly correlated to fertiliser prices, and so a strong forward market for gas may point to increased costs of production for ammonium nitrate this autumn.

Nitrogen fertiliser application strategies explored

It's been a challenging time for growers wondering what to do around their fertiliser buying and application strategies off the back of higher prices over the last few months. However, using one of AHDB’s virtual farm models, analysis of the most common approaches shows that you won’t go far wrong with any of them.

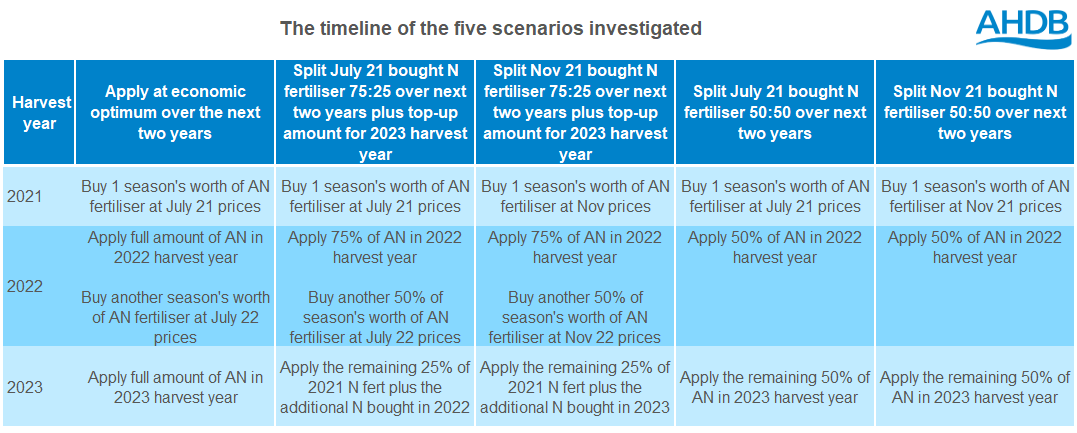

Five scenarios were explored based on three main approaches:

- applying at the usual economic recommended amount in 2022 and 2023,

- apply 75% of the typical application rate each harvest year 2022 and 2023

- using July 2021 and 2022 fertiliser prices or

- using November 2021 and 2022 fertiliser prices

- apply 50% of the typical application rate each harvest year 2022 and 2023

- using July 2021 fertiliser prices or

- using November 2021 fertiliser prices

The virtual farm crops 428ha with 66% down to feed and milling winter wheats, 8.5% winter beans, 7% winter oilseed rape and 18.5% spring feed barley. The analysis used this rotation to examine five potential nitrogen (N) fertiliser strategies.

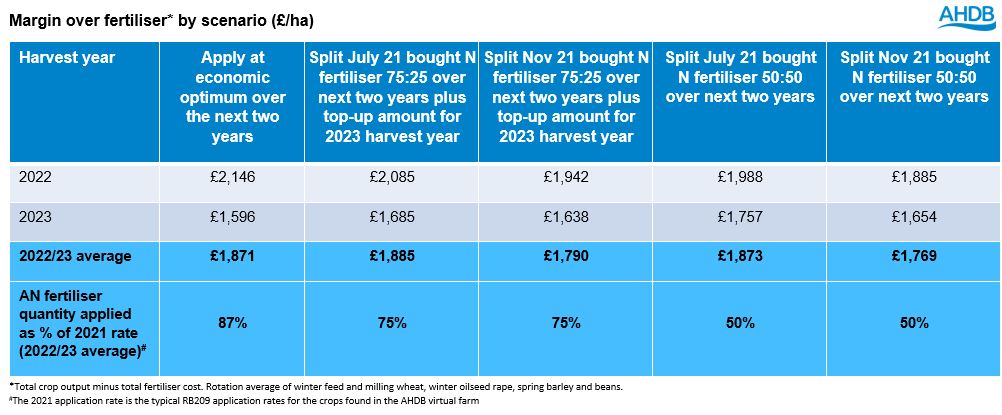

Results were calculated as total crop output minus total fertiliser cost – margin over fertiliser. The figures also took into account the impact on yields and futures prices of grains and oilseeds.

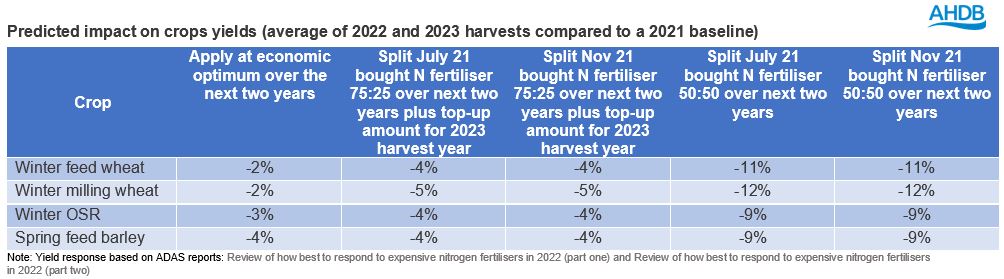

Yields were predicted to fall 2% under the economic optimum for winter feed wheat compared to 11% if AN (ammonium nitrate) fertiliser was applied at half rate. For winter rape this was a decline of 3% under the economic optimum and a fall of 9% if AN applied at 50% of the typical amount.

When averaged over 2022 and 2023 harvest years there was no real difference between the margins over fertiliser for the three scenarios where AN fertiliser was bought on July 21. Between £1,871 to £1,885/ha. The highest margin being due to higher use of N fertiliser in OSR and barley and hence less impact on yields. It was no surprise that scenarios 2b and 3 b's margins at £1,814 and £1,769/ha respectively were lower if fertiliser was bought at the higher prices in November 2021.

The right strategy will depend on the attitude to risk to yields and where you feel fertiliser and grain prices will go over the next 18 months or so. However, according to this scenario analysis, there is no significant difference between these expected common approaches. So whether fertiliser was purchased before the higher prices of late or not, some judicious reduction in application rates will pay off.

About the figures

- According to fertiliser delivery patterns in the last 2 years, July and Nov are the most common for straight nitrogen on arable farms. Source: AIC

- Fertiliser prices in 2020 and 2021 are sourced from AHDB’s monthly fertiliser prices survey Fertiliser information | AHDB

- AN fertiliser prices for July 2022 and November 2022 are assumed to be £900/t based on recent energy price increases which are assumed will remain high for the remainder of 2022

- Grain and oilseed prices and futures are sourced from AHDB market prices Cereals and Oilseeds markets | AHDB

- Fertiliser prices used:

- Imported AN prices

- July 2020 @ £200/t

- July 2021 @ £311/t

- Nov 2021 @ £638/t

- July/Nov 2022 @ £900/t (AHDB forecast)

- TSP

- July 2020 @ £251/t

- July 2021 @ £559/t

- Nov 2021 @ £715/t

- July/Nov 2022 @ £745/t (AHDB forecast)

- MOP

- July 2020 @ £307/t

- July 2021 @ £474/t

- Nov 2021 @ £525/t

- July/Nov 2022 @ £665/t (AHDB forecast)

- Futures grain and oilseed prices as at 29 April 2022:

- Feed wheat

- Nov 2022 @ £299/t

- Nov 2023 @ £262/t

- Milling wheat

- Nov 2022 @ £320/t

- Nov 2023 @ £292/t

- Feed barley

- Nov 2022 @ £289/t (£10 less than feed wheat)

- Nov 2023 @ £252/t (£10 less than feed wheat)

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.