Options contracts - A viable marketing strategy? Analyst Insight

Thursday, 1 April 2021

Market Commentary

- The UK May-21 feed wheat futures contract gained £4.00/t yesterday, closing at £194.00/t. New crop (Nov-21) contract gained too yesterday, up £3.25/t, closing at £164.50/t.

- Global commodities markets were fuelled by the US stock and prospective planting reports. Both US maize and soyabean futures hit daily increase limits as the figures were lower than expected.

- US maize futures (nearby) rose to its highest price since 2013 (bar 8 March 2021) at $5.64/bushel (£161.44/t). US farmers are expected to plant 91.14 million acres of maize, the highest since 2016. However, analysts had expected 93.21 million acres (Refinitiv poll). This missed estimate provided the incentive for US maize futures to close limit up.

Options contracts - A viable marketing strategy?

During our Spring Grain Market Outlook conference, we talked about marketing strategies that growers can use to better mitigate volatility in crop markets. In this article I want to answer some of the questions you asked about options contracts and their practicality for growers.

Introduction to options

Options are contracts. They give the owner the right, but not the obligation, to buy or sell a specific asset e.g. wheat, at a pre-determined price, at or before a point in time. They can be purchased on any dated futures contracts on various exchanges. For example, options can be bought on the London Nov-21 feed wheat futures contract or the Paris May-21 milling wheat futures contract.

Marketing strategies with options

Options contracts can be used to supplement your existing marketing plan rather than replace it. Using options can provide returns even when stores are empty of physical grain, but it requires familiarity of potential future market direction.

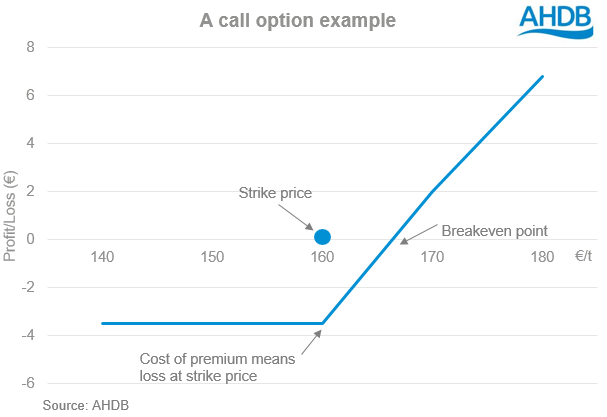

Below are two examples of how a call and put option could supplement a marketing plan.

In this example, a farm business opts to sell all grain at harvest off the field. Options contracts can enable that business to make additional income through the rest of the season. This is despite having no grain on farm to sell later on.

On 6 August 2020, Farm business A (FB A) sold all its wheat tonnage for feed at £163.50/t, due to a lack of storage facilities on farm. On this day, Paris milling wheat futures for May-21 were at €183.50/t (£165.20/t).

FB A had inclinations that the domestic wheat price would increase through the season. So FB A took out a call option on Paris May-21 futures with a strike price of €190.00, at a theoretical cost of €10 per contract*. This had a minimum contract multiplier of 50, so the total cost is €500 (€10 x 50). The maximum loss FB A can incur on this options contract is €500.

FB A held the options contract until 30 March 2021, when the May-21 futures contract had increased to €209.75/t. At this point, the €190.00/t call option was worth €20* per contract, giving a return of €1,000 (€20 x 50). This would give a profit of €500 on the option itself (€1000 - €500), minus commission and currency exchange values.

When it was bought this €190.00 call option contract was classed as ‘Out the Money’. This is because the strike price (€190/t) was higher than the underlying May-21 futures contract (€183.50/t). But, when FB A decided to sell the call option, the contract was classed as ‘In the Money’. The strike price (€190/t) was now below the price of the May-21 futures contract (€209.75/t).

*Theoretical cost due to lack of historic data.

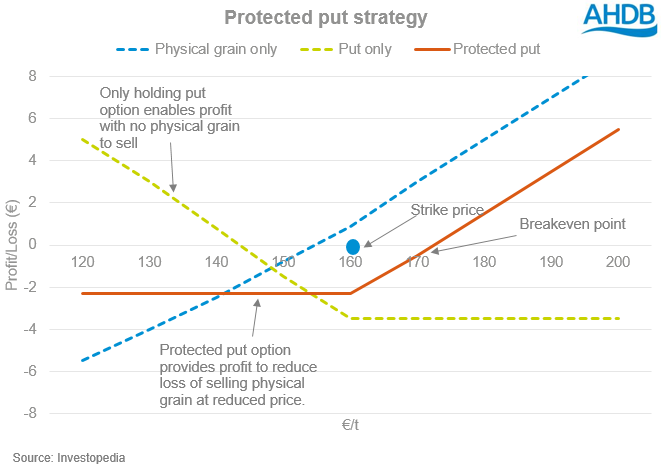

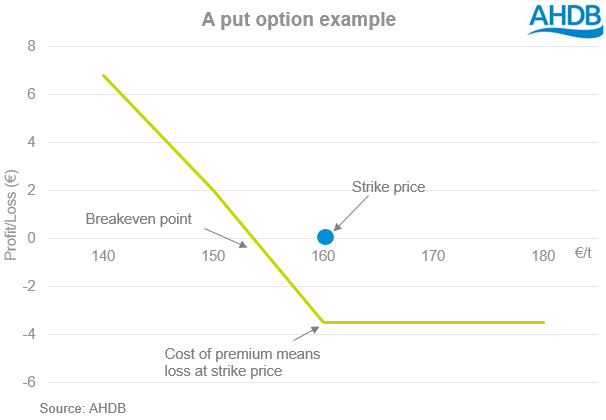

In this example, a farm business opts to sell grain in smaller tonnages throughout the season. Here, options contracts can enable the business to ‘protect’ the value of physical tonnage. This is done using Put options, which profit when the underlying asset falls in value. This method is successful in seasons where prices have risks of large swings in value.

Farm business B (FB B) plans to sell its grain tonnage in blocks every couple of months. This marketing plan helps to provide returns when prices spike on certain global news points throughout the season, e.g. risks of winter crop failures.

In this scenario, FB B has 2,000 tonnes left in store to sell six months into the season.

The price of wheat looks set to be affected by rumours of a winter storm that could bring heightened winter kill for the Black Sea crop. This is a rumour that would likely increase the global price of wheat owing to the risk of reduced supply in Black Sea regions. FB B will look to sell into this price rise.

But, the price of wheat could fall back, if storm damage is underwhelming. So, FB B will take out a put option with a strike price that is ‘Out the Money’ (OTM). It is likely the cost of the option will be lost. This put option will serve as a hedge. It is there in case the rumours of severe damage are baseless, and provide a return if the underlying wheat futures contract falls in value. This is like car insurance, which only pays out if there is an accident, theft or fire.

I will explain this scenario with values. The Paris May wheat futures contract was priced at €160/t. An OTM €155 put option would cost €2 per contract with a total minimum cost of €100 (€2 x 50). This is the minimum cost and covers 50 contracts. As many contracts can be purchased as needed. However, the value paid (€100) would be lost if the underlying contract price increases and the options contract remains OTM until expiry.

In this scenario, the winter storm turns out to be much less impactful than previously forecast and the wheat crop is unaffected. The May futures contract price subsequently declines over the course of two weeks to €150/t. The €155 put option becomes ‘In The Money’ (ITM) and thus more valuable.

Although FB B has lost potential income from the physical price of grain declining, they have made a return from the options contract. The €155 put option increases in value to be worth €7.50, which totals €375 (€7.50 x 50). When we minus the premium cost of €100, it gives a profit of €275, before any commission or currency exchange costs are factored in.

Conversely, if the winter storm caused significant damage that stimulated a rise in wheat prices, then the maximum loss for FB B would be the €100 cost of the options. However, this loss would be ‘absorbed’ into the return made by selling physical grain into the rising market.

In conclusion

This article gives a peek into how options can be used in marketing strategies. If you want to know more background information on options, click here or there is a multitude of information available online.

If you want to use options, it is vital to understand the system. This will help maximise returns and prevent losses. Also, keep up to date with the market for the underlying asset e.g. wheat, to help influence your thinking on future market direction.

Marketing plans are different for each farm business. There is not a ‘one size fits all’ strategy as everyone has different business margin requirements and risk appetites. The risk element is very present in the use of options, as it requires the market price to move in a specific direction to provide returns.

I will take an in-depth look at specific marketing strategies later this month. In the meantime, staying up to date with the latest cereal and oilseed news is vital to identify future price trends as we move towards next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.