- Home

- An introduction to options

An introduction to options

Building a marketing strategy is a constantly evolving process. Each year will need different tools and techniques to protect against, and benefit from, price volatility. Here we provide the basics of how options work to protect grains and oilseeds form price volatility.

What are options?

Options are contracts that gives the owner the right, but not the obligation, to buy or sell a specific asset i.e wheat or rapeseed, at a pre-determined price at or before contract expiry. These can be purchased on any dated futures contracts on different exchanges.

For example, options can be purchased on the London Nov-21 feed wheat futures contract, or the MATIF May-21 milling wheat futures contract. The options contract does not represent ownership of a futures contract and so the risk of taking delivery at expiry is not an issue.

If the option contract is exercised, the owner must buy or sell the underlying assets however. This is the choice of the contract holder on if it will be exercised or not, there is no obligation to. The options contract can be left to expire worthless if returns are not possible.

To keep it in simple terms, there are two basic choices for an options contract depending on personal opinion of market direction.

Click here for examples of marketing strategies in practice.

What can be done for the future when prices are high at the moment?

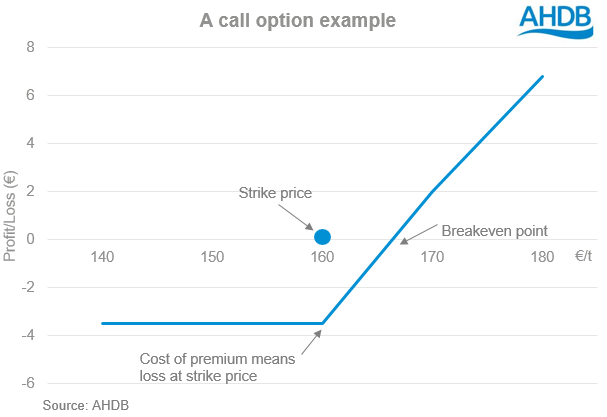

Call options

An individual who foresees the futures contract increasing can purchase a call option that gives the holder an option to purchase the futures contract at a specific fixed price within a specified time frame. This fixed price is known as the ‘strike price’. If the futures contract price increases above the strike price, the holder will make a profit.

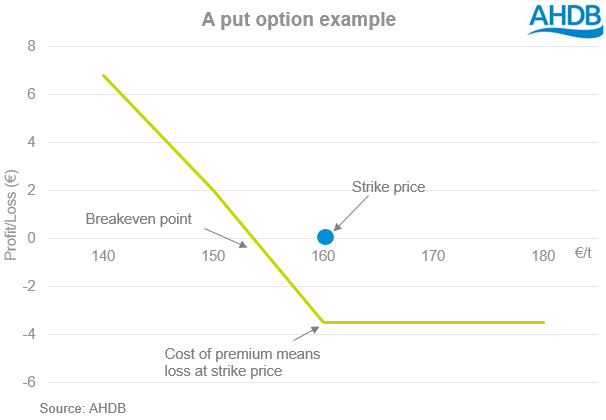

Put options

A Put option is the opposite. An individual who foresees the futures contract decreasing from its current price in a specified time frame can purchase a put option. This put option enables the holder to sell the futures contract at a specified ‘strike price’. If the futures contract price then declines below the strike price, the holder will make a profit.

Each option contract is based on an underlying futures contract, of which has an expiry date. The proximity to this expiry date will affect the price of the option contract due to the relative time potential for the price to change.

The options contract will lose value each day, known as time decay, or ‘Theta’. This rate of decline quantifies risk, as options contracts have a set time before expiry and is displayed as a negative number. The theta value is always lower in options contracts with a longer time to expiry due to the higher potential or more time for the underlying price to move.

For example, an option with 12 months to expiry may have a Theta of -0.01, whereas an option with 1 month to expiry will have a Theta of -0.2. As such, the options closer to expiry lose value quicker, as they will expire sooner and so have less chance of providing intrinsic value to the holder. These values are theoretical as an example to help explain the concept.

In the money contracts (ITM)

‘In the money’ is a term that is used to class an option that possesses intrinsic value, i.e. the option has value because its strike price is more favourable given the current market price of the underlying asset.

An ITM call option means the strike price is below its current market price. So a €170 call option on the futures contract that is priced at €186/t would be an ITM call option. This is because if the holder exercises the option, they hold a contract to buy grain at €170/t when the current price is €186/t.

An ITM put option means the strike price is above its current market price. So a €170 put option on a futures contract that is priced at €160/t would be an ITM put option. This is because if the holder exercises the option, they hold a contract to sell grain at €170/t rather than €160/t.

ITM options have much higher premium costs to purchase than out the money options, because of the value already present in the contract.

Out the money contracts (OTM)

‘Out the money’ is a term that is used to class an option that possesses only extrinsic value, i.e the market has to move in a direction to provide any return.

An OTM call option means the strike price is below the underlying asset’s current price. So a €170 call option on a futures contract that is priced at €165/t would be an OTM call option, because the futures contract has to move above €170/t to be profitable.

An OTM put option means the strike price is above the underlying asset’s current price. So a €170 put option on a futures contract that is price at €175/t would be an OTM put option, because the futures contract has to fall below €170/t to be profitable.

As such, OTM options are much cheaper to purchase.

At the money contracts (ATM)

‘At the money’ is a term that is used to class an option that has its strike price identical to the current market price of the futures contract. Both call and put options can be ATM, but don’t hold intrinsic value as there is no difference between the strike price and the underlying futures contract.

ATM contracts will hold extrinsic value, as there will be a time value until expiry. This type of options contract is a longer term hold strategy with less premium loss risk than an OTM contract, as there is no large price movement required initially before profit.

Why should I use an options contract?

Options contracts can bring a monetary return for farm businesses. One example is if the plan is to sell the entire new-crop tonnage at harvest. In this case, options contracts can be used to remain invested in the market over the course of the season.

Options contracts can also be a method of ‘insuring’ unsold grain, if markets move downwards. In this case, a put option would return profit from a falling market. This can offset losses from not selling grain at the favoured price.

Risk summary

Marketing strategies centre on the individual’s appetite for risk. Some strategies are relatively safe, e.g. selling to a local home. Increased risk can but does not always equate to an increased reward.

However, there are methods to guarantee a level of income. These include hedging against the volume of physical grain held on farm. Each marketing strategy also demands the knowledge of both the underlying market and options contracts to better protect against unforeseen circumstances.

Options contracts bring a limited risk of loss. They also have the advantage of leverage to increase returns. For example, you can buy an option for 50 shares, without needing the capital to buy 50 shares. Each option contract has a ‘minimum contract multiplier’ that effectively means the contract holder has the right to a set volume of underlying contracts. For Paris futures, this minimum contract multiplier is 50, so if an option is worth €1, it will cost €50 to purchase.

The maximum loss possible with standard options contracts that a holder can endure is the price of the option premium, plus any transaction and commission costs.

Which options are best suited?

Stock exchanges such as Euronext and the Chicago Board of Trade (CBOT) offer high levels of open interest and volume for options contracts. The exchange for UK futures, The Intercontinental Exchange (ICE), has lower levels.

Higher levels of open interest and volume mean it’s easier to buy and sell the options. However, taking out options contracts on foreign futures contracts means the results will be affected by currency movements.

Options pricing depends on the intrinsic value, implied volatility and the period of time before contract expiration:

- Implied volatility is a measure by how likely the price of the contract is to change.

- Intrinsic value is the difference between the underlying asset (i.e. May-22 Wheat) and the strike price of the options contract.

- The period of time plays into the price too, with ‘out the money’ options very low in value when close to expiry due to the unlikelihood of the underlying asset ever reaching the strike price.

Additional information

Examples of marketing strategies