What does the rise in interest rates mean for UK arable farmers? Grain market daily

Tuesday, 9 August 2022

Market commentary

- Nov-22 UK feed wheat futures closed at £264.15/t yesterday, down £2.85/t from Friday's close.

- On Tuesday another two ships carrying grain departed Ukraine, bringing the total shipped since the ‘grain corridor’ opened to 12 vessels (Refinitiv).

- Paris rapeseed futures (Nov-22) settled at €655.75/t on Monday, up €2.50/t from Friday's close.

What does the rise in interest rates mean for UK arable farmers?

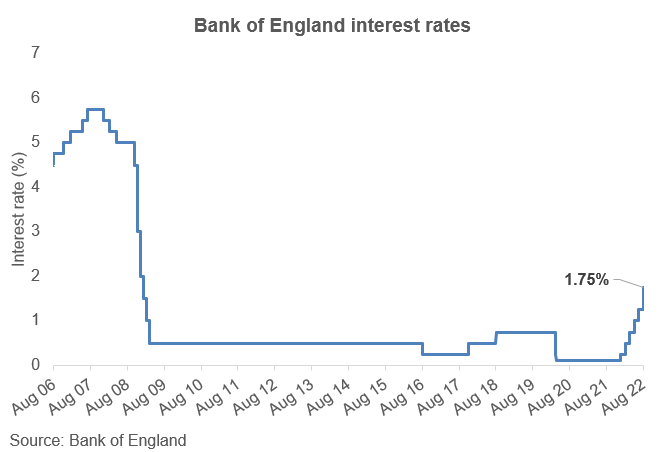

Last Thursday, the Bank of England (BoE) raised interest rates by 0.5% to 1.75%, the highest level since the start of 2009. Interest rates have been increased in an effort to combat soaring inflation, which we have seen domestically over recent months. Inflation rates started to climb in 2021 because of higher spending after the pandemic. Fast forward to this year and the invasion of Ukraine has led to surging energy prices as well as rising food costs.

So, what does this all mean for our arable farmers? Firstly, and one of the most immediate impacts is that a rise in base line interest rates, means an increase in the cost of borrowing. Although interest rates remain low historically, businesses with loans and other borrowings at rates that are not fixed, will see an increase in repayments. Furthermore, with a large proportion of farming businesses relying on borrowing to finance their investments, it will cost these businesses more. This comes at a time when farm business incomes are being squeezed by higher input prices and changes to agricultural policy.

As well as rising borrowing costs, the increases in interest rates and inflation may also have an impact on demand going forward. It is likely that inflation will continue to climb due to the impact of rising energy prices caused by the ongoing war in Ukraine. With the UK already in a ‘cost of living crisis’ households are feeling the squeeze and it is thought that we are yet to still feel the full impact of inflation rises. This will likely have an impact on consumer demand for meat, poultry, and dairy products. In turn this would have a bearing on animal feed demand going forward, as mentioned last week in an analyst insight. As well as animal feed demand, we could also see an impact to malting demand too.

It is likely that interest rates will rise again (next update in September) if inflation does continue to climb. However, it will be a careful balancing act to not tip the UK into recession. If we were to go into a recession, then we would likely see more changes to consumer demand and therefore cereal usage.

Once harvest is complete, understanding the quality you hold in store, volumes under contract and that open to market will allow for more informed marketing decisions as we head into an uncertain demand period.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.