Analyst insight: What does the 'cost-of-living crisis' mean for malting barley usage?

Thursday, 28 July 2022

Market commentary

- UK feed wheat futures (Nov-22) gained £1.00/t yesterday, closing at £267.75/t. The Nov-23 contract saw a larger increase of £7.05/t over the same period, to close at £240.05/t.

- The uncertainty surrounding Ukrainian grain exports continues to support global wheat prices. However, Ukraine expects the first shipments to depart from its Black Sea ports within days (Refinitiv).

- Paris rapeseed futures (Nov-22) also gained yesterday, as the global oilseed market strengthened and energy prices rose, closing at €667.50/t up €24.00/t from Tuesday’s close.

- Forecasts of hot and drier weather across the US saw Chicago soyabeans futures (Nov-22) rise for their fourth consecutive session, up $9.64/t to close at $518.03/t yesterday. The Nov-23 contract rose $5.60/t over the same period, to close at $480.01/t.

- UK natural gas prices continue to climb, reaching highs not seen since March. This is down to uncertainty in the EU over Russian supplies through the Nord Stream pipeline.

Analyst insight: What does the ‘cost-of-living crisis’ mean for malting barley usage?

A large proportion of the malting barley grown in the UK is used to make malt for domestic brewing and distilling. With malting barley varieties estimated to make up around 60% of this season’s barley area, it’s important to consider the effect that the current high living costs could have on the sector.

Domestic inflation rates started to rise in 2021 as a result of higher spending after the pandemic. Fast forward to this year and the invasion of Ukraine has led to soaring energy prices as well as rising food costs. The UK’s annual inflation rate increased to 9.4% in June, the highest it’s been since 1982. Higher prices are known to take effect on buying habits across the UK, so what could this mean for alcohol sales?

The UK is currently not in a recession. However, the economy is struggling due to rising inflation and other factors such as supply chain issues. It’s been said that generally alcohol sales are ‘recession-proof’. Looking back to the 2008/09 recession, while sales of the wine and spirits category either increased or stayed the same, beer sales were hard-hit. Beer and cider sales fell from a 6% year-on-year growth in 2007, to a 1% decline in 2009.

2022 retail trends so far

Maltsters in the UK buy around 1.8Mt of malting barley each year and produce about 1.5Mt of malt annually. If we look at how malt usage is divided, we can see that during 2021, 53% of malt usage was allocated to distillers and only 31% to brewers, with the rest going for exports or for use in food. With a larger proportion going to distillers, the industry usage as a whole is more effected by the sale of spirits than beer.

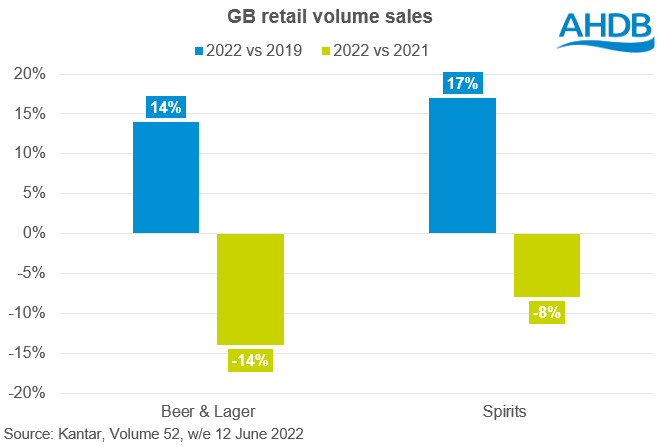

So far this year, alcohol retail sales have eased compared to 2021 sales, with beer and lager declining at a faster rate than spirits (Kantar). Beer and lager retail sales are down 14% from last season, but up 14% from pre-pandemic levels. Spirit sales are down 8% from last season but up 17% compared with pre-pandemic figures (Kantar, 52 w/e 12 Jun 22).

It is thought that part of the reason for these changes is that even though the out-of-home market is up on last year, it is not yet back up to pre-pandemic levels. Out-of-home consumption occasions are 10% smaller than they were in 2019. As more consumers decide to drink alcohol at home post-pandemic, it’s reported that off-trade sales favour spirits over beer or lager, hence potentially why the spirits sector is faring better.

During the 2008/09 recession, frequency and intensity of drinking was said to have increased, with an estimated 4.2% rise in heavy drinking throughout the recession. With inflation rising, whether we see a similar situation this year if a recession occurs remains a watchpoint.

UK malting barley usage

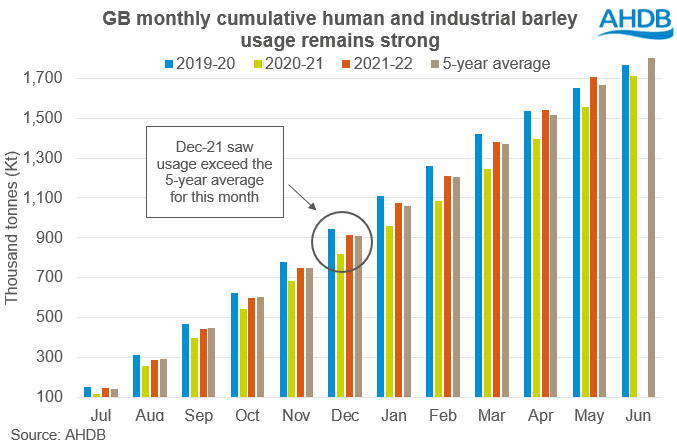

The lockdowns that took place across the UK saw 2020/21 barley usage for human and industrial consumption down 3% from the previous season, as out-of-home sales fell due to the pandemic. However, in 2021/22, even with recessionary fears, barley usage from July to May was up 9.7% on the year, as out of home consumption started to pick back up. 2021/22 usage figures are back up to near pre-pandemic levels.

When we look back to the recession, the 2007/08 and 2008/09 season saw little impact. In fact, the seasons saw a 2% and 4% increase on the 2006/07 period respectively. It wasn’t until the 2009/10 marketing year that the effects of the recession were felt, with a 9% decline in barley usage from the previous year. This dip could suggest that there was a lag in the effects of the financial crisis. With beer sales and consumption down because of the recession, it’s likely there was a surplus of malt and barley that was being used the following season, resulting in lower usage levels in 2009/10. This could mean that while we’re not seeing much effect from a drop in beer or lager sales so far this year, it could be that we may see a dip in usage following on from the cost-of-living crisis. Though inflation and economic conditions will need to be monitored.

What does this mean for UK malting barley demand?

To conclude, retail alcohol sales look to be easing and data shows out-of-home consumption occasions (to June) as being 10% smaller than 2019. However, industry anecdotal reports indicate out-of-home demand to be increasing and usage heading above the 5-year average for this time of year. With evidence that in previous recessions the frequency and intensity of specifically spirit consumption increases, it’s unlikely that spirit sales will lose much support over the coming months. On the other hand, sales of beer and lager could be more at risk, but the knock-on effect of this loss of sales may not be felt anytime soon. As malt usage for beer and lager is a smaller proportion than for spirits, it’s unlikely that the cost-of-living crisis will have a considerable impact on demand. However, if we start to see recessionary behaviour, a slight delayed dip in usage could be seen at some point in the future, should we follow the same trend as seen between 2007-2010.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.