Beef trade in June: import destinations shift as exports rise

Friday, 18 August 2023

Beef trade in June sees imports down slightly but still holding up compared to a year ago, as Irish product mixes change. We explore the latest data and movements in GB prices.

Key points

- June imports from Ireland down from May but still up slightly year-on-year.

- Exports increase from May but remain lower than 2022.

- Australia TRQs record shipments to the UK increasing from a small base, but not yet captured through UK HMRC trade data.

- GB cattle prices have continued to fall but declines slow in latest week.

Where and what are we trading?

Despite falling on the month, imports are still up slightly from June 2022. Consumer demand and cattle price positions on the continent keep exports below last year’s level.

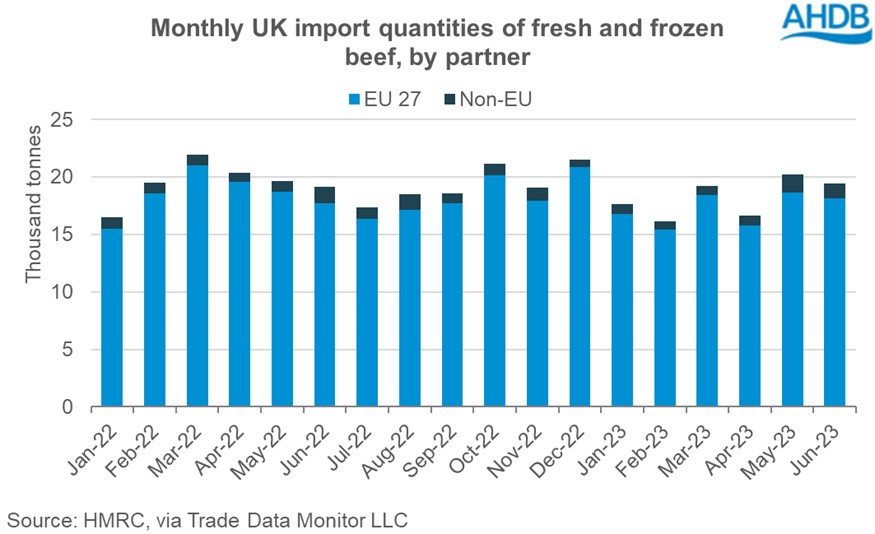

Fresh/frozen beef imports sat at 19,450 t for June, down 780 t from May. Shipments from Ireland fell by 685 t, as June’s imports sit 1,500 t below the five-year average for June. Imports grew from Poland by 330 t (+20%). Total imports were still up from June 2022 by 310 t as shipments from Ireland have grown by 750 t while shipments from Germany fell 580 t on the year.

Shipments from Ireland have shifted in the past month. Volumes of fresh boneless beef have risen by 1,500 t, largely displacing frozen volumes which fell by 1,800 t (-20%). Bord Bia predict that Irish cattle supplies will grow throughout the remainder of the year, particularly in the fourth quarter. How this affects cattle prices amid subdued consumer demand will be a key watchpoint over the coming months.

Looking into export volumes, total shipments stood at 8,400 t, up by almost 500 t from May’s levels. Growth in exports came from destinations such as Hong Kong (+150 t), while volumes fell into the Netherlands (-110 t) and France (-100 t). However, from June 2022, overall export volumes stayed subdued, down by 1,500 t, with large drops in trade into France (-600 t), the Netherlands (-340 t) and Ireland (-150 t). Weaker domestic demand in Europe, as well as strong cattle prices, have contributed to a decline in exports to the continent as consumers are squeezed by the cost of living.

Wider picture: where does the current TRQ with Australia lie?

The latest quota position for the allocated TRQ (as of 8 August 2023) sits at 669 t (6%) of beef shipped from Australia to the UK, alongside just over 100 t of the first-come-first-served quota (1%). Current HMRC data shows that the UK imported 123 t of fresh/frozen beef for the month of June, which is an increase of 27 t from May, and up 44 t from June 2022. 112 t of beef imported from Australia was fresh boneless, with the remainder as frozen. Therefore, any increases in product from Australia have not arrived in the UK in June, according to HMRC, but we will continue to monitor the estimated shipped quantities from the TRQ.

Looking into the volumes shipped from Australia to the UK according to the Department of Agriculture, Fisheries and Forestry (DAFF), just over 300 tonnes of beef product have been sent in July, which we will be monitoring when HMRC data is available in coming months. Even with these elevated trade levels, volumes from Australia are still considerably lower than our key trading partners such as Ireland, as noted above.

What does this mean for GB beef prices?

The latest trade data offers further insight into the market, and potentially why prices have moved as they have. Combining June trade data with domestic production for the month suggests the market has recently been more amply supplied than it was at this point a year ago. This would corroborate with recent industry commentary on supplies, particularly on visual lean / trim material.

Read our recent analysis on supply and demand factors driving beef prices.

On a monthly basis, domestic production levels so far this year have fluctuated above and below 2022 levels. While import/export quantities have generally been below that seen a year ago, imports (from Ireland) did pick up through May and June to just above last year’s level. At this point, Irish cattle prices were beginning to pull away quite quickly from GB.

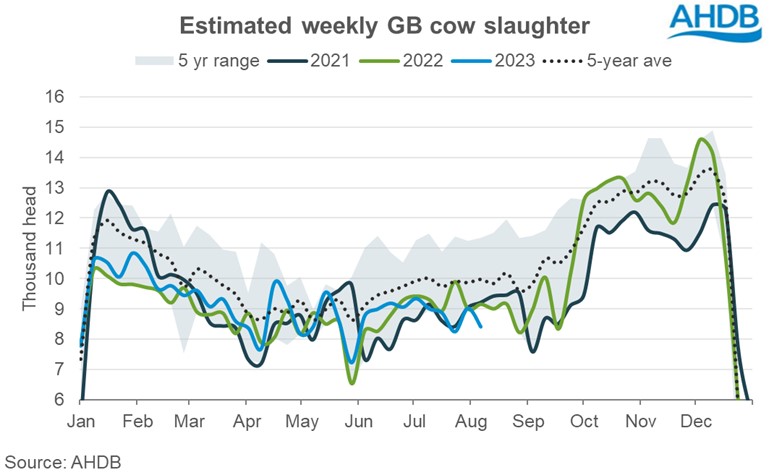

GB prime cattle and cow prices have continued to fall in August, although declines have slowed slightly in the latest reporting week (ending 12 August). The GB all-prime average deadweight price sat at 453p/kg (-3p from the week before, +21p vs 2022), while the overall cow price averaged 317p (-4p from the week before). This comes after several weeks of 10p+ declines in the average cow price and has seemingly been on the back of tighter supply as GB estimated cow slaughter during the week fell to quite a low level.

Click here to explore our deadweight cattle prices in more detail.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.