Organic dairy shows resilience in challenging retail market

Tuesday, 2 April 2024

Due to inflation, organic grocery prices have been climbing, and price focussed consumers have traded down product tiers. Despite this, Neilsen data shows that total organic cow’s dairy volume was down by just 1.1% year-on-year (YoY) in the latest 12 w/e 24 February 2024, with butter and yoghurt categories both showing growth.

2023 delivered the twelfth year of value growth for the total organic market, though significant price rises had a large part to play. Dairy made up 28% organic sales according to the Soil Association.

Our Agri-market outlook for the dairy market highlighted that total domestic dairy demand is showing signs of returning, set for steady recovery in 2024 as consumers are expected to regain some confidence. In comparison to conventional cow’s dairy, the organic cow’s dairy sector has contracted slightly in terms of volume change, following limited demand throughout 2023.

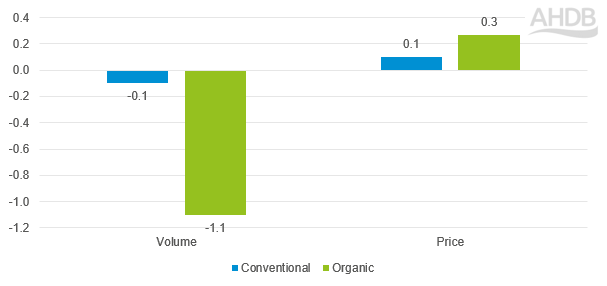

Organic vs conventional cow’s dairy YoY percentage change

Source: NIQ Homescan Panel, Cows dairy, Volume and price % change YoY. 12 w/e 24 February 2024

Organic cow’s dairy consumption experienced slight decline of -1.1% YoY (NIQ Homescan Panel, 12 w/e 24 February 2024), yet this decline is less pronounced than the decrease in volumes seen YoY across a 52 w/e period. Overall, prices were up marginally YoY, but at similar rates to conventional percentage increases, offering some optimism for the premium sector.

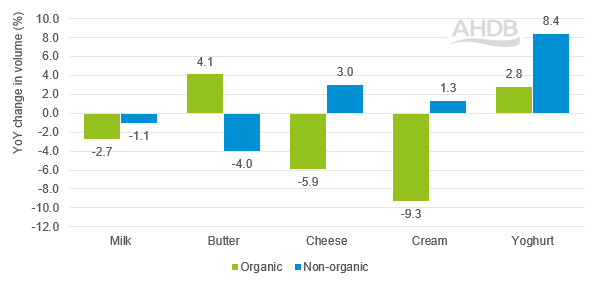

YoY percentage volume changes for cow’s dairy products

Source: NIQ Homescan Panel, Organic and conventional dairy products, Volume % change YoY. 12 w/e 24 February 2024

Some categories within organic cow’s dairy have seen positive performance when comparing the latest 12 weeks YoY. Organic cow’s butter and yoghurt have seen growth in volumes sold and organic butter exceeded its conventional counterparts in YoY change. A 13.1% reduction in price paid supported this, due to more units sold on deal, according to Neilsen.

Following butter, yoghurt was the next best performing product for organic cow’s dairy, driven by more households purchasing YoY. Not included in the graph is drinkable yoghurts, where organic options have experienced 20.1% volume change YoY, also driven by an increase in buying households.

However, organic cow’s milk, cheese and cream categories all experienced declines. Organic cream has experienced an increase in price YoY, putting greater pressure on consumers, who may swap and choose conventional alternatives. Organic milk and cheese have been reducing in price, but volumes are yet to catch up.

Production

We reported in November that organic milk producers had faced challenges surrounding low demand, heavy increases of input costs, and poor availability of organic feed. Since then, farm gate prices have improved slightly, but not enough to alleviate tight margins.

GB organic milk deliveries so far this year (up to and including February 2024) are running at 10% behind 2023 figures). As total dairy production is back by only 1% for the same period, this suggests that a proportion of organic dairy farms have converted back to conventional production.

Opportunities for organic dairy

YouGov’s consumer confidence monitor suggests that consumers have become more optimistic in recent months and the dairy market outlook forecasts growth within the premium sector in 2024. Export markets prove to bring in opportunities for trade.

We know from our consumer research that there is room to improve the clarity of what organic production entails. Perceived values including time outside, grass-rich diets, and a ban on the routine use of antibiotics should be communicated. As regenerative agriculture gains greater traction, there is a need to ensure organic messaging does not become diluted.

According to Neilsen’s Homescan Survey (November 2023), sustainability credentials are having a bigger influence on choice of product. Although any change to shopper habits is likely to be gradual, organic links to sustainability could be a leverage in marketing and communications.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.