EU Exit: Q1 trade data released

Wednesday, 12 May 2021

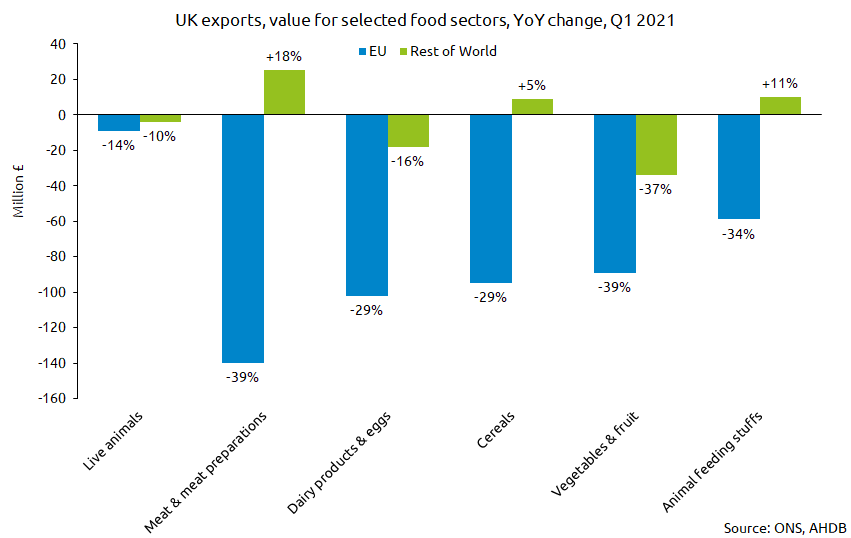

Exports of food and live animals to the EU remained depressed overall for the first quarter of 2021, when compared to the same quarter of 2020.

In value terms, food and live animals exports to the EU totalled £1.7bn, which represents a 28% decrease (-£659m) over the quarter. However, this masks the fact that exports did bounce back significantly in March 2021. Exports of live animals and food to the EU were only 2% down year on year in March, significantly better than the previous two months. This could suggest that some of the teething issues, and extra paperwork requirements are starting to become more manageable for companies. However, for sectors where paperwork burdens have been most prevalent, such as meat and meat preparations, exports were still down 10% year on year in March.

Meanwhile exports to the rest of the world for the first quarter were down 6% (-£73m) to total £1.1bn. The similar depressed trend between exports to both EU and Non-EU countries suggest that the Coronavirus pandemic has some part to play in influencing trade, however the larger declines for product destined to the EU also may suggest that EU-exit issues are disproportionately contributing to the reduciion in those trade flows. Overall, total exports for live animals and food for Q1 are down 21%, and total £2.8bn.

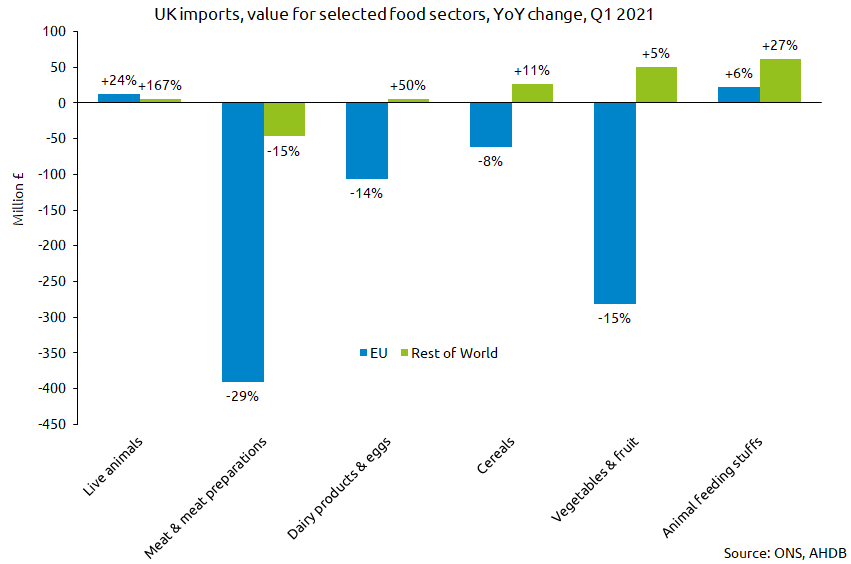

Imports from the EU have also been depressed through the first quarter of 2021. Imports of food and live animals from the EU are down around 14%, totalling £5.8bn. Contrastingly, imports from the rest of the world are up in the first quarter, by 3%. This has been primarily driven by an increase in animal feeding stuffs, potentially reflecting the lower domestic crops here in the UK and the increased need to import those sorts of products, rather than any switching of suppliers due to EU Exit issues.

Interestingly, imports from the EU in March alone, suffered from a greater decline year-on-year than UK exports to the EU; a 9% decline (-£225m) in EU to UK trade, compared to 2% (-£19m) for trade going the opposite way. This is despite the current ‘grace period’ for goods imported into the UK from the EU. The coronavirus pandemic continues to impact the food service sector, which rely on imports more so than the retail sector here in the UK, which could explain why demand for imported food products haven’t rebounded at the same pace as UK exports.

It is worth noting that trade, particularly in food and agricultural goods tends to fluctuate throughout the year as domestic supply and demand is balanced. Therefore, it is useful to make year on year comparisons, as well as quarter on quarter or month on month comparisons which may inadvertently be highlighting some of these normal seasonal fluctuations. Also, in the case of EU Exit, these comparisons may not properly take account for the ‘stockpiling’ that occurred ahead of the EU Exit deadline, as well as the abnormal trading patterns that have been apparent over the past couple of years. Indeed, the Office for National Statistics (ONS) have stated that comparing 2021 data with 2018 data provides a comparison to the UKs most recent period of ‘stable’ trade.