Will imports of lamb from New Zealand return to normal in 2019?

Friday, 1 February 2019

By Rebecca Wright

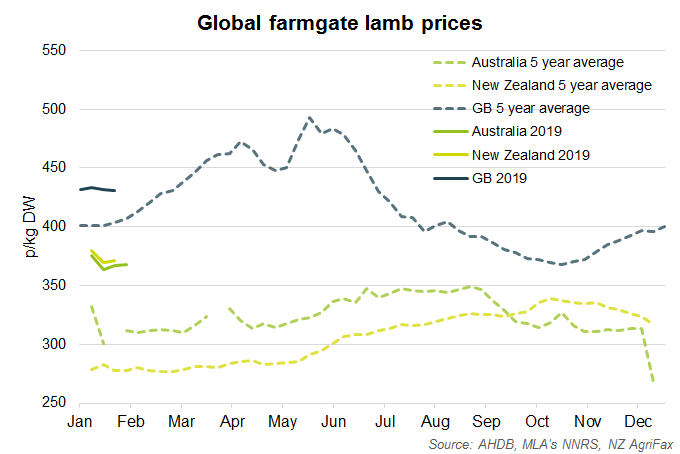

For the past two years, UK imports of lamb from New Zealand have tracked below historic normal levels while at the same time the global supply and demand balance has tightened, and global prices have continued to trend significantly above the five year average as we enter 2019.

Total volumes of imports of sheep meat into the EU-28 (including UK) from third countries between January and October 2017 declined 14% year-on-year, while the value of these imports remained stable, according to Eurostat. This indicates that the price per tonne was higher. During January to October 2018, import volumes recorded growth of 2%, which meant they remained significantly below typical levels. Looking closer to home, UK imports have been declining consistently in recent years, recording an 11% volume decline year-on-year in 2017, and a further 3% decline in 2018, according to HMRC data.

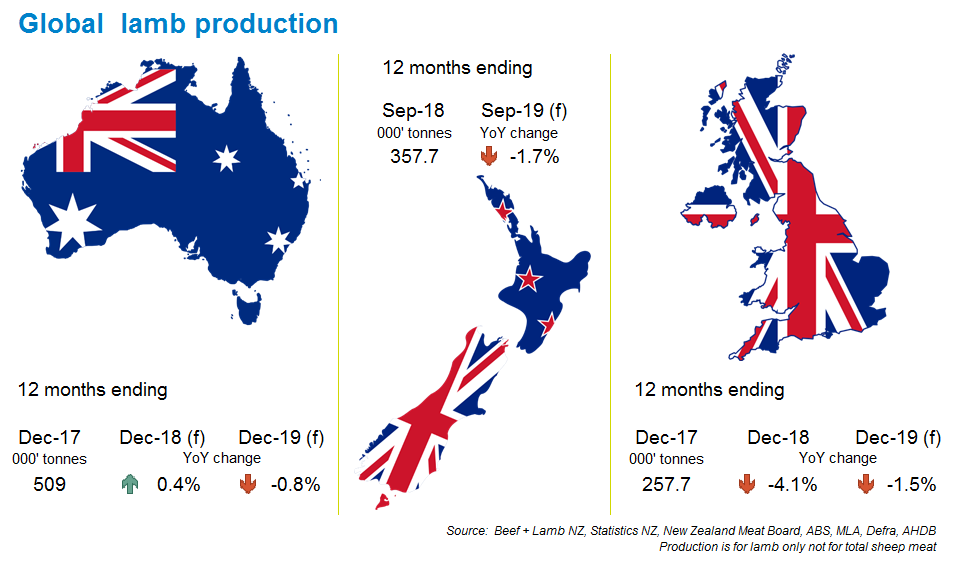

Whether New Zealand shipments to the UK return to a more typical volume this year would be influenced by both availability of product and price. During the first two months (October and November) of the New Zealand lamb production year, production of sheep meat has been stable, according to the Ministry of Primary Industries. However, Beef & Lamb NZ reports that the New Zealand lamb crop is around 1% smaller year-on-year, and expects around 4% fewer lambs to be slaughtered for export purposes. This could be used as an indicator that New Zealand exports will decline in 2019. However, if total volume declines, by itself this does not mean that less will be shipped into the EU or the UK in particular.

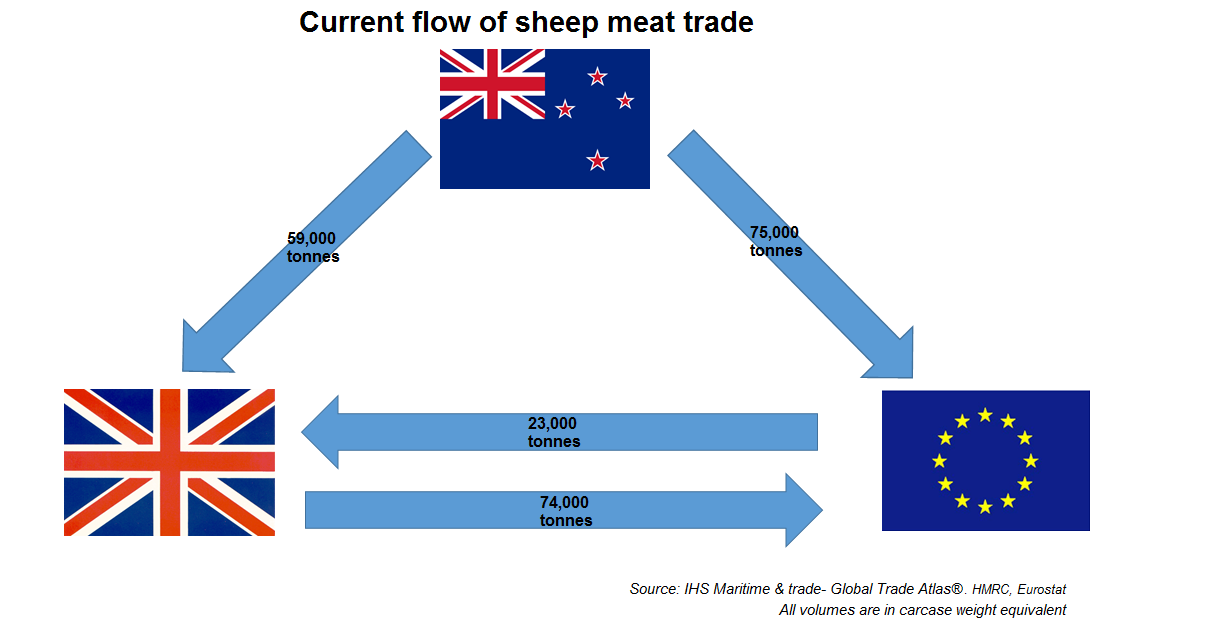

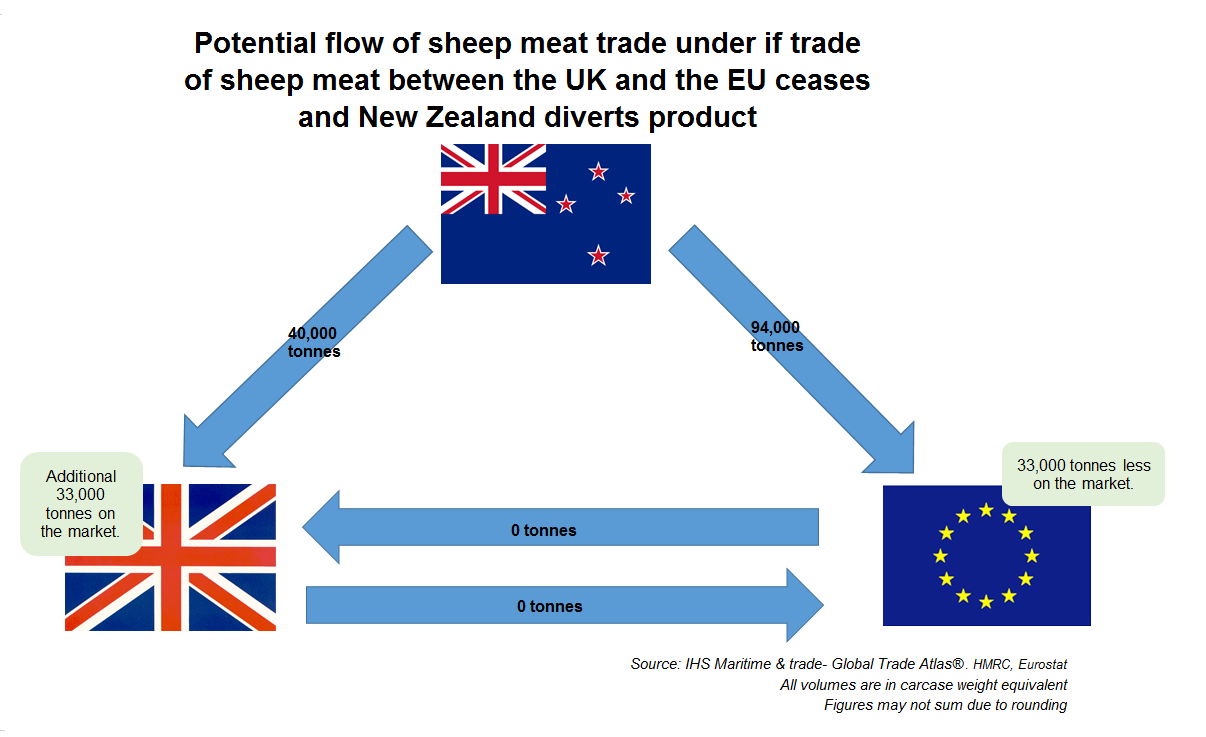

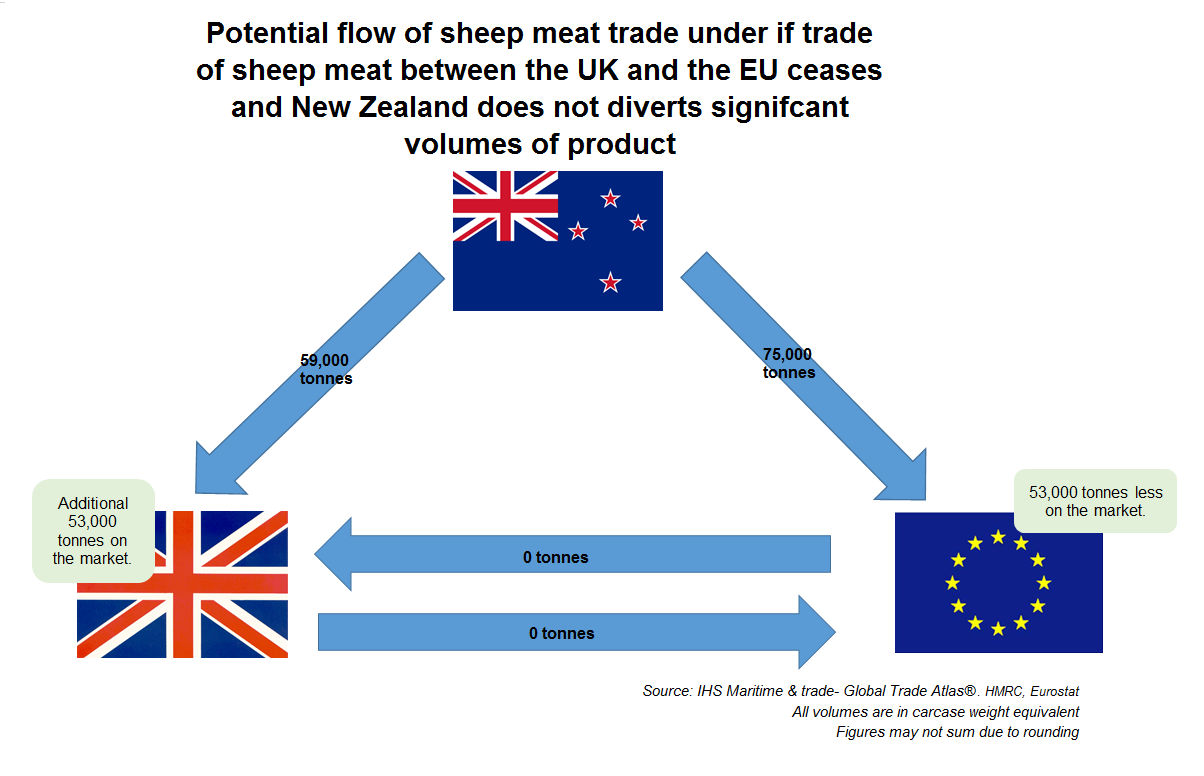

Brexit will inevitably have an effect on UK trade during 2019 and beyond. If UK prices are low, there is the potential that New Zealand exports to the UK will reduce, with at least some product being directed into mainland EU instead. AHDB has done some analysis into this data exploring what potential affect this would have sheep meat volumes available on the market. The price achieved would also be an import consideration for New Zealand exporters, therefore even in this situation it is likely the UK may continue to receive some product, most likely leg joints.

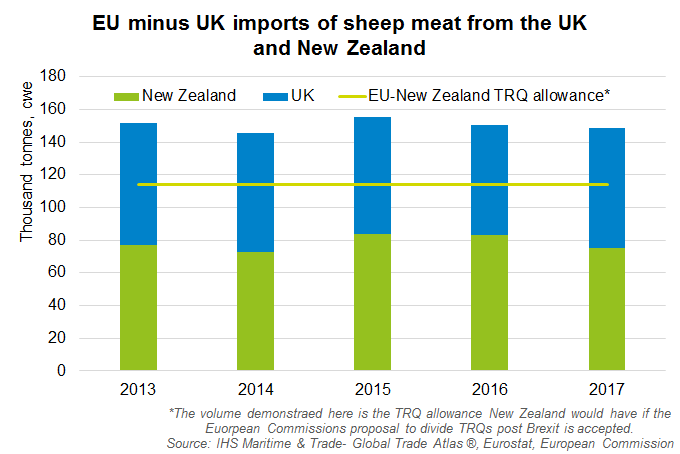

In total during 2017 the EU not including the UK, imported 145,800 tonnes product weight of sheep meat. 71,200 tonnes of this came from the UK and 64,400 tonnes came from New Zealand, according to Eurostat data. In carcase weight equivalent this is 74,000 tonnes and 75,000 tonnes respectively, reflecting that fact that more product from New Zealand is shipped boneless.

Last year, the European Commission and the UK government announced plans to split current quotas based upon average usage. This would split New Zealand’s sheep meat quota (currently 228,389 tonnes cwe) 50/50. New Zealand, along with various other countries, has objected to splitting the quota in such a way to the World Trade Organisation (WTO), however no decision has yet been reached.

This could therefore leave the EU market short of sheep meat by just over 30,000 tonnes in the no-deal Brexit scenario. It would also leave the UK market over supplied by approximately 30,000 tonnes (equivalent to approximately 11% of production/supplies available for consumption). This would be likely to have knock on effects for farmgate prices if the UK did not find another outlet for this product, although the price effect would be expected to boost UK demand. Due to the seasonal nature of British sheep meat production and domestic demand price could become more volatile and have a more pronounced seasonal pattern.

Alternatively, New Zealand may choose not to divert product away from the UK into the EU, or may not be able to, in which case the UK could potentially be over supplied by more than 50,000 tonnes (equivalent to 18% of production). This could be expected to have a greater effect on farmgate prices.

This analysis takes no account of carcase balance for the UK, which would to continue to be an issue, and perhaps even worsen. The UK typically imports a large number of roasting leg joints, but exports most sheep meat as carcases. Timing may also be an issue, as the UK imports more during the first half of the year and exports more during the second. It may be that changes in how frozen stocks are managed balances some of the timing difficulties, however there is of course a cost associated with this.

AHDB recently published a report analysis different scenarios, with the focus on how UK production could decline by 11% and 12%, click here to read the report.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.