What factors are driving grain markets? Grain market daily

Friday, 16 December 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £240.50/t, down £1.50/t. Whereas, new-crop futures (Nov-23) gained £0.80/t, to close yesterday at £227.80/t.

- UK feed wheat contracts followed Paris wheat futures movement yesterday, with new crop finding a little support from strong Chicago wheat and maize prices.

- Paris rapeseed futures (May-23) closed yesterday at €565.00/t, down €3.25/t. Rapeseed futures followed Chicago soyabean and soyameal futures down yesterday.

- Nearby Brent crude oil futures settled at $81.21/barrel yesterday, down $1.49/barrel.

- UK natural gas futures closed yesterday at 337.13p/therm. This afternoon, it is trading at 310.5p/therm (13:00).

What factors are driving grain markets?

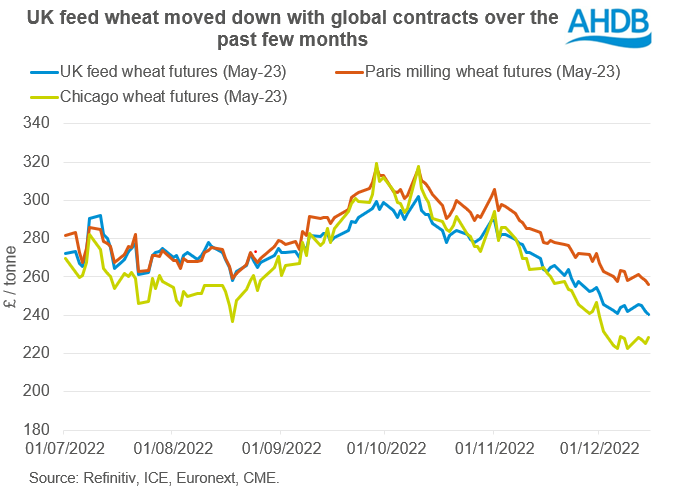

UK feed wheat futures (May-23) continue to move with global contracts. Over the past few months, we have felt overall pressure on UK feed wheat prices. Since the beginning of November (01 Nov), UK feed wheat futures (May-23) have lost £48.75/t. New-crop futures (Nov-23) fell £42.25/t over the same period.

So, what have been the key factors driving prices?

- Competitive Black Sea supplies

Russian and Ukrainian wheat continues to flow and remains competitive to other origins. On Wednesday night, Algeria’s state grains agency OAIC is believed to have bought between 480-540Kt of milling wheat in an international tender at an average cost of around $348-349/t cost and freight (Refinitiv). Origins are expected by traders to be Bulgaria, Romania, Russia, and France.

US wheat prices have particularly felt pressure from competitive Black Sea supplies, with slow demand. Net US export sales (to 08 Dec) for total wheat this season (2022/23) lag the previous year by 16%.

- Southern hemisphere supply picture is clearer

Large Australian crops are due this season. Last week, the Australian Bureau of Agricultural and Resources Economics and Sciences (ABARES) released their December crop report, showing that despite some heavy rainfall and subsequent flooding earlier in the season, the country is expecting a bumper wheat crop of 36.6Mt (up 1% on the year). This is due to good soil moisture boosting the outlook.

Whereas, the Argentinian wheat crop looks poor. This week, the Rosario Grain Exchange trimmed back their wheat crop forecast again for this season (2022/23). Forecasts have been reduced 3% from 11.8Mt to 11.5Mt, due to drought and late-season frosts. Though this is arguably factored into the market. However, continued Argentinian dryness impact on their maize crop will be important for future grain price direction.

- The ongoing concern of the impact of a global recession on demand

Economic performance data remains crucial to understand the impact of a global recession on demand for cereals and oilseed markets. With areas such as hospitality key to watch, due to how much disposable income consumers have, and the consequent impact on human and industrial use of cereals (milling, brewing, malting and distilling products). Furthermore, with livestock margins squeezed as feed and energy costs rise, protein demand remains important, and the impact to cereal usage.

Looking to this week and going forward

This past week we have seen some support levels come in for global wheat prices on bargain buying, as prices reach lows. UK feed wheat futures (May-23) as at yesterday’s close, were down £1.50/t from last Friday’s close (09 Dec). Though, new crop futures were up £0.30/t over the same period, showing markets to be moving sideways. It is important to remember, global supply remains tight from previous seasons. This is due to extreme weather trimming production in major exporters and with an active war in Ukraine ongoing, which will lend some support levels to prices.

With the picture for this season’s global wheat supply clearer, maize supply will be important to price direction. Demand too for wheat and maize will be key to future global price movement this season with recession concerns and Chinese COVID-19 policy under a close eye.

Looking to the UK specifically, large wheat availability in the UK may mean we need to be price more competitively to global markets going forward to shift stocks, something to consider. With a further interest rate rise confirmed yesterday by the Bank of England too, by 0.5 percentage points to take the base rate to 3.5%, interest earned on money in the bank as well as loans, will be something to consider when deciding to store or sell.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.