Australian wheat and rapeseed production at record levels: Grain market daily

Wednesday, 7 December 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £240.95/t, down £1.55/t on Monday’s close. This close is the lowest point since early March. New crop futures (Nov-23) closed at £227.75/t, down £2.55/t over the same period.

- UK prices followed global contracts down as large Black Sea supplies, and record-high Australian production, continue to weigh on wheat markets. More on this below.

- Paris rapeseed futures (May-23) gained €2.50/t yesterday, closing at €574.75/t.

- Chicago soyabean futures felt support yesterday on concerns over dry weather negatively impacting the Argentinian soyabean crop and easing Chinese COVID-19 restrictions.

Australian wheat and rapeseed production at record levels

This week, the Australian Bureau of Agricultural and Resources Economics and Sciences (ABARES) released their December Australian crop report. Despite heavy rainfall and subsequent flooding during the southern hemisphere spring, Australia is set for record-high wheat and rapeseed production.

With tight global supply for global grains especially, considering recent seasons of drought weather in global exporters and with the ongoing war in Ukraine, availability of Australian supplies will be important for price direction on global markets short and long term.

What’s the situation in Australia?

Winter crop production for this season (2022/23) is forecast to reach 62Mt, the second highest on record. A third consecutive La Niña has brought rainfall over spring. Record spring rainfall caused flooding and as such, crop losses in eastern states. Though overall, improvements in production in Western Australia and southern states outweighed losses in eastern states. This was due to favourable conditions, with the wet and cool spring bringing soil moisture and extending grain fill, and the dry end to spring benefitting harvesting.

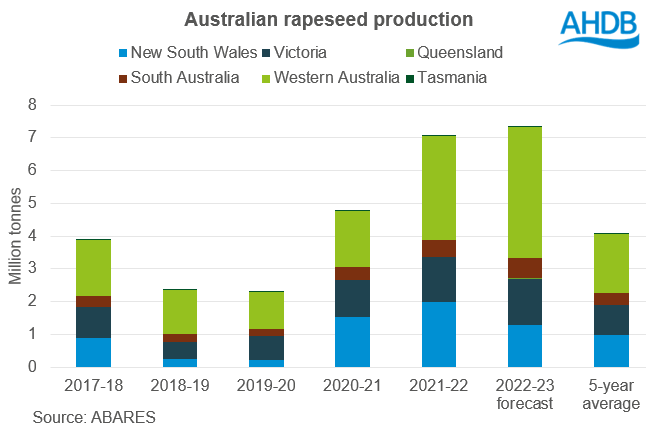

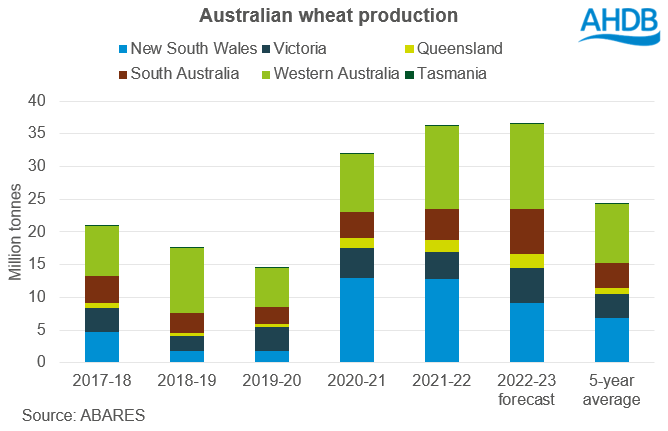

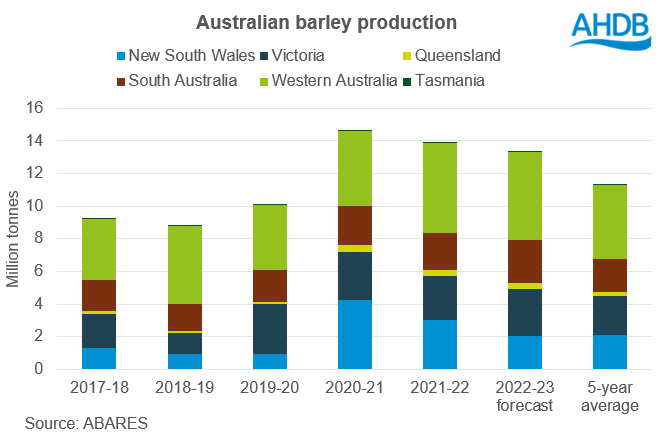

For this season’s harvest, total wheat production is forecast at a record high of 36.6Mt (up 1% year-on-year) and rapeseed production to reach a new record at 7.3Mt (up 4% year-on-year). Whilst barley production is forecast down 4% on the year at 13.4Mt, this is still the fourth largest on record. The 2022/23 barley production has been revised up 9% on September’s estimate. Oat production is forecast down 8% on the year, to 1.5Mt.

Crop losses were seen in eastern states, especially in New South Wales where waterlogged fields in part caused a reduction in winter crop planted area. Production for 2022/23 is forecasted down for wheat (down 28%), barley (down 33%), rapeseed (down 35%) and oats (down 20%) on the year for New South Wales. Quality of crops in eastern states is also flagged by ABARES, considering wet conditions limited grower opportunity to apply fertiliser and pesticides.

Something to note, the Australian Bureau of Meteorology forecast the chance of exceeding median rainfall in December to be below 50% for much of Australia. Though eastern regions, for example Victoria, are likely to receive above average rainfall. This could delay harvest, and as stated by ABARES, could lead to a higher proportion of low-protein wheat, should rains arrive.

Planting of summer crops for 2022/23 is reported to be “well-above-average” by ABARES due to soil moisture levels and large areas left fallow over winter.

What could this mean?

Australian supplies are important to the global market. The USDA forecast Australian exports for 2022/23 for wheat at 26Mt (joint 3rd largest globally), for barley at 7.2Mt (top global exporter), for rapeseed at 5.2Mt and oats at 0.5Mt (both projected to be 2nd largest globally).

With Black Sea supplies pressuring the market in recent weeks, the addition of large Australian production could also weigh on global markets, as we are already seeing, impacting UK grain prices. Though, as stated yesterday, global supply and demand remain tight for grains, which may lend support levels longer term. Whereas global rapeseed supply looks plentiful.

Freight will remain key for the availability of Australian supplies globally, and rainfall in December for some areas, remains a watchpoint for harvest progress and grain quality.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.