Competitive Black Sea wheat pressuring prices, explained: Grain market daily

Tuesday, 6 December 2022

Market commentary

- UK feed wheat (May-23) fell £3.20/t yesterday, to close at £242.50/t. New-crop futures (Nov-23) closed at £230.30/t, down the same amount over the same period.

- This movement followed global grain contracts down yesterday, pressured by a large Australian crop forecasted despite recent flooding and competitive Black Sea supplies.

- Today, ABARES released their latest report stating that this season’s winter crop production is set to reach 62Mt. This is the second highest on record. Favourable spring conditions have boosted the outlook for production in Western Australia and South Australia. Eastern states are due to see high overall forecasts despite widespread losses from record spring rainfall.

- Paris rapeseed (May-23) contract remained relatively unchanged at close yesterday, up €0.25/t to close at €572.25/t.

- Nearby brent crude oil futures fell $2.89/barrel yesterday to close at $82.68/barrel. In recent news, the G7 have put a price cap on Russian crude oil by sea. Though Russia has said it will not abide by the measure even if it has to curb production (Refinitiv).

Competitive Black Sea wheat pressuring prices, explained.

In recent weeks, global grain contracts have felt some pressure from competitive Black Sea wheat supplies in recent global tenders.

Chicago wheat markets especially have been feeling pressure from a lack of competitiveness on global markets in recent months. Over November, Chicago wheat futures (May-23) have fallen 16% to 02 December. Demand and recession will also be key reasons for this fall in US price level, though Black Sea supplies continue to be a key pressuring factor.

So, how competitive is Black Sea wheat?

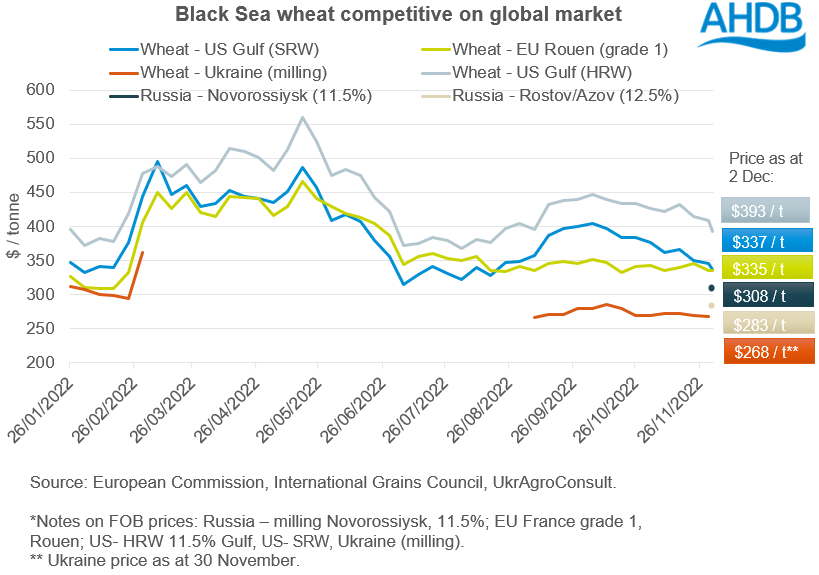

As shown in the graph below, Black Sea wheat continues to be competitive on the global market. The Russian 2022 harvest forecast range is between 90-100Mt, depending on forecaster, resulting in large supplies available.

With the establishment of the Black Sea grain corridor too, grains (particularly wheat and maize) continue to flow from Ukraine. Though November exports totalled 400Kt down from October (at 1.58Mt) according to the UGA Ukrainian grain traders’ union, down due to Russian delays in inspection of vessels.

Whereas at the other end of the market, US wheat remains higher priced than EU and Black Sea supplies.

Argentinian wheat price too remains at the top of the market, due to recent drought trimming yields. As at 2 December, Argentina Grade 2 (Up River) FOB price was $405/t.

As a result, we are seeing Russian wheat especially succeed in gaining global demand. Last week, 1Mt of Russian grain was reportedly exported according to Sovecon consultancy using port data (Refinitiv).

As stated by European traders yesterday, a government agency in Pakistan is believed to have purchased 500Kt of wheat at $372/t CIF. This is optional origin, but traders expect to be substantially Russian origin. This is in addition to a deal announced yesterday by Pakistan to take 450Kt of Russian wheat in the new year.

Last week, Turkey’s state board TMO provisionally purchased c.455Kt of wheat, with most expected to be sourced from Ukraine. Algerian state grains agency OAIC also purchased between 450-500Kt of milling wheat, expected to be sourced from countries including France, Germany, Bulgaria, and Russia.

Important to note, reportedly wider Black Sea grain including Romanian and Bulgarian also continues to be competitive.

What does this mean, and will it continue?

Black Sea wheat continues to be competitive, lending some pressure to global price contracts and impacting on UK prices. Though some challenges continue for Black Sea exporting, with rail cart availability in Russia limited and with long waits. For Ukraine, challenges surround delays in inspections for ships leaving as well as the ongoing conflict.

For other origins, EU demand continues keeping EU prices supported. With US wheat continuing to feel pressure too, we could see increased demand? Today, the USDA stated that US exporters prepared 334.7Kt of wheat to export in week ending 1 December, beating trade expectations (Refinitiv).

Finally, with a big Australian grain crop due too, this is something to consider in whether this will add further pressure to prices when this comes available. Though key to remember, the global grain supply and demand balance still feels tight which will provide some support level.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.