- Home

- News

- Analyst Insight: Official data released on UK harvest 22, what does this mean for domestic S&D?

Analyst Insight: Official data released on UK harvest 22, what does this mean for domestic S&D?

Thursday, 15 December 2022

Market commentary

- UK feed wheat futures (May-23) fell £3.00/t yesterday, to settle at £242.00/t. New-crop futures (Nov-23) fell £3.50/t over the same period, to close at £227.00/t.

- News on heavy snowfall yesterday, across parts of the US Plain, boosted the outlook for soil moisture and therefore production for dormant winter crops. US winter wheat particularly has seen poor crop conditions to date.

- FranceAgriMer yesterday increased their forecast for this season’s (2022/23) French soft wheat exports outside the EU, due to strong demand from China and Morocco. Forecasts were increased from 10.0Mt to 10.3Mt.

- The Rosario Grain Exchange have trimmed back their wheat crop forecast again for this season (2022/23). Forecasts have been reduced 3% from 11.8Mt to 11.5Mt, due to drought and late-season frosts. This could lend some support to wheat prices today.

- Paris rapeseed futures (May-23) fell €2.00/t yesterday, to close at €568.25/t, following Chicago soy oil down.

Official data released on UK harvest 22, what does this mean for domestic S&D?

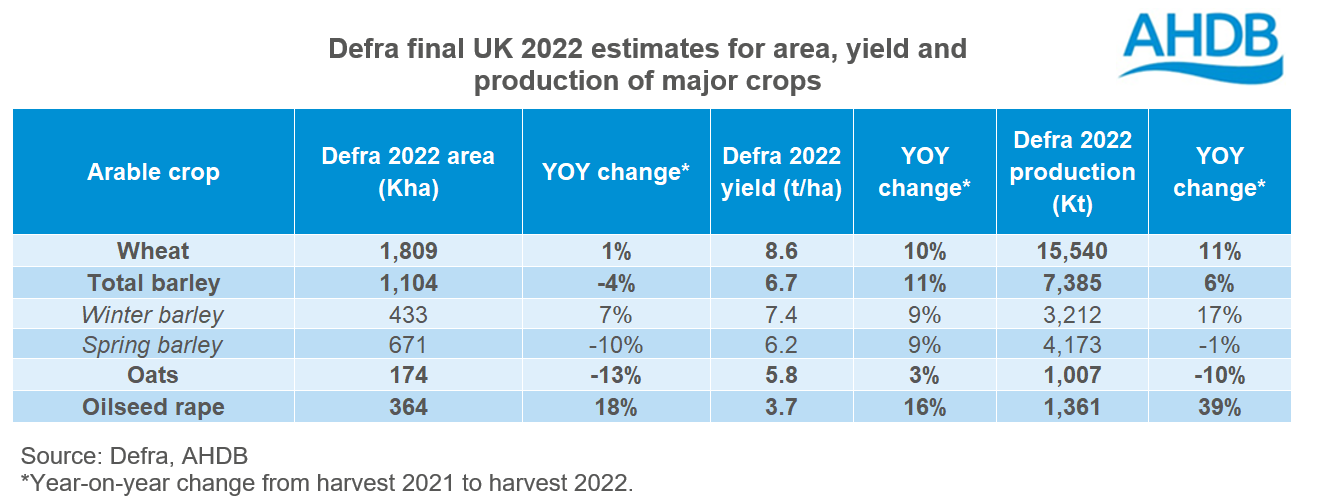

This morning, Defra released the final estimates for 2022 UK cereal and oilseed production. In October, Defra were unable to publish provisional UK cereal and oilseed production estimates, due to reduced data availability from UK regions. Todays release is the first official production estimates for 2022.

Despite the hot and dry conditions experienced this summer impacting some crops on lighter land, wheat, barley, oat and oilseed rape yields are up on the year.

With a slight increase in planted area (+1%) and a rise in yields, UK wheat production is estimated at 15.540Mt, up 11% on the year. Furthermore, this is the largest output since 2019 and 14% higher than the previous five-year average (2017-2021).

Total barley production is estimated at 7.385Mt, up 6% year-on-year and in line with the previous five-year average. Despite larger yields for winter and spring crops, spring production is down on the year due to a smaller planted area.

Oat production for harvest 2022 is estimated at 1.007Mt. This is down 10% from last year’s large crop (biggest this century) but up 2% from the previous five-year average.

Oilseed rape production is estimated at 1.361Mt for harvest 2022. This is up 39% year-on-year, but down 14% from the previous five-year average. Yields for harvest 2022 are the largest since 2017.

How does this change the domestic S&D grain balance?

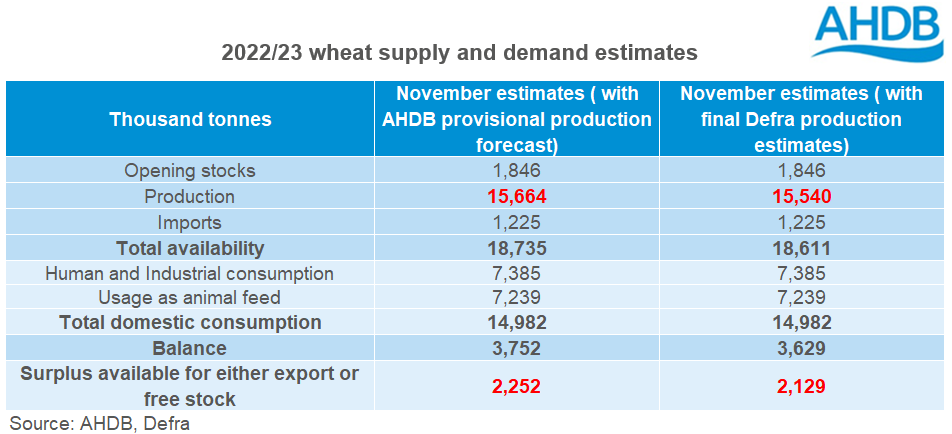

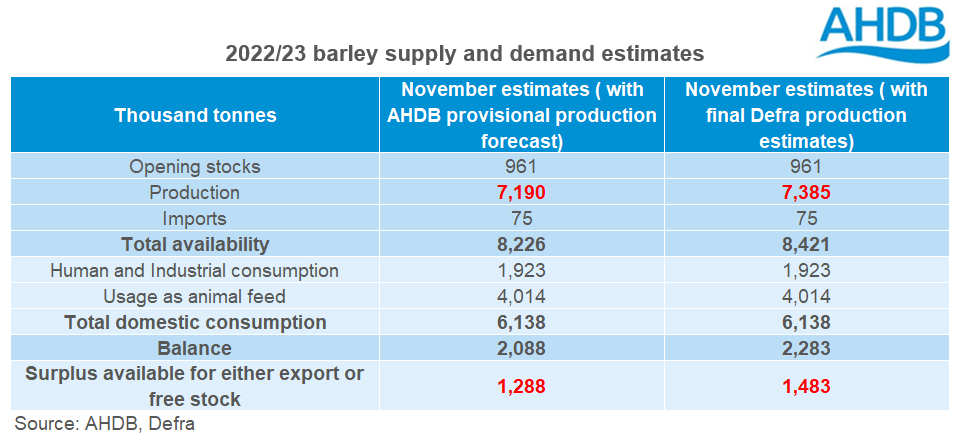

For the first official UK cereal supply and demand estimates, which were released in November, AHDB estimates were used for wheat, barley and oat production. With the official Defra figures released today, how do these differ from the provisional AHDB production forecasts?

For wheat, the Defra UK production figure is 123Kt less than the provisional AHDB estimate of 15.664Mt. While the final Defra production figure is down slightly from the provisional estimate, it remains the largest crop since 2019. Therefore, if applied to the current supply and demand forecasts, the surplus available for either export or free stock remains the largest since 2015/16.

For other grains, the Defra total barley production figure, is 195Kt larger than the provisional AHDB estimate. This increases the surplus available for either export or free stock to 1.483Mt. This surplus is larger than last season, but still 5% smaller than 2020/21 levels.

For oats, Defra’s production estimate is 74Kt smaller than the provisional AHDB forecast for harvest 2022. Using Defra’s estimate in the current supply and demand forecasts, total availability would be 6% lower, while the balance would contract by 28% to 184Kt. This would be the tightest balance since 2018/19.

What does this mean for UK pricing going forward?

Despite a small tightening of the UK wheat availability, harvest 2022 is forecast the largest since 2019 and as such the surplus available for either export of free stock is the largest since 2015/16.

Pace of wheat exports through the season will be crucial to shift these stocks. With competitive Black Sea supplies pressuring global prices in recent weeks, as well as large Australian supplies to soon come on the market and large French wheat exports forecast, it is likely the UK will need to price more export competitive in the coming months to increase export pace.

Looking to barley, Defra’s production forecast boosts the outlook for domestic barley availability. Though the domestic balance still looks, and reportedly feels, relatively tight. The discount of UK ex-farm barley to ex-farm wheat, stands at c.£20/t (08 Dec).

Though when considering the domestic grain supply and demand balance, questions remain around domestic demand. Challenges face domestic livestock sectors, including high feed and energy costs and Avian flu. And of course, the impact of recession and ‘cost of living’ crisis on bioethanol, brewing, maltsters, and distillers, as well as premium and alternative milling products.

The next UK cereal supply and demand estimates are provisionally scheduled for release on 26 January 2023. These will include the final 2022 Defra production estimates which were released today.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.