UK trade data – season to date round up: Grain market daily

Tuesday, 13 December 2022

Market commentary

- UK feed wheat futures (May-23) closed at £245.50/t yesterday, up £3.50/t on Friday’s close. New crop futures (Nov-23) closed at £230.00/t, up £2.50/t over the same period.

- UK and European wheat markets tracked US markets higher, with prices supported by concerns over Black Sea grain exports following Russian attacks on Odesa’s energy infrastructure, temporarily suspending operations at the port.

- Yesterday, Paris rapeseed futures (May-23) lost €9.00/t on Friday’s close, closing at €562.25/t.

- Rapeseed markets tracked soyabeans lower, following rains in Argentina over the weekend easing concerns over soyabean production, and reduced demand for soyabeans and palm oil due to increasing COVID-19 cases in China.

UK trade data – season to date round up

Yesterday, HMRC published the latest UK trade data figures, with an update for grain imports and exports for the month of October.

With a substantial domestic exportable surplus of wheat for this marketing year, combined with large competitively priced exports continuing to leave the Black Sea, what could this mean for our domestic balance and trade for this rest of this season?

Wheat

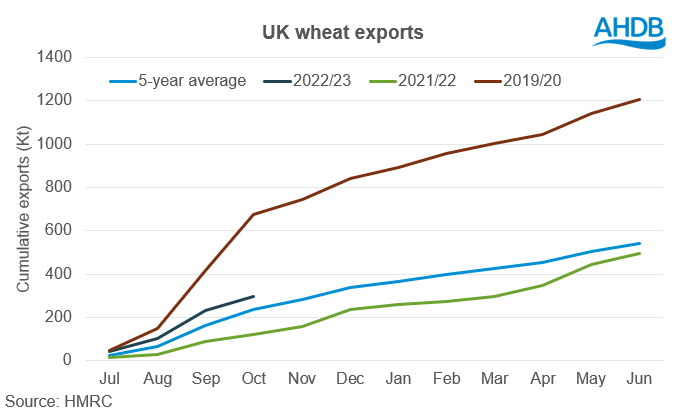

So far this season (Jul-Oct) UK wheat exports (including durum) have totalled 313.7Kt, up 190Kt (154%) on same period last year.

This doesn’t come as a surprise as total domestic wheat availability, based on November’s cereals supply and demand estimates is up 8% year-on-year, from larger opening stocks and production from higher-than-average yields.

The wheat surplus (either export or free stock) for this marketing year (2022/23) is currently estimated at 2.252Mt. This figure is comparable to 2019/20, where there was an exportable surplus of 2.093Mt. By this same period in 2019/20 the UK had exported 673.8Kt of wheat, 53% higher than the same period this marketing year.

Recently the UK has not been competitive on the export market as it has been kept afloat by the EU market, with Black Sea grain undercutting both of these origins.

With a larger domestic surplus this season, UK wheat will have to become more export competitive to shift these stocks. If not, it would result in larger end-season stocks and carry in stocks for next season. This is a key watchpoint going forward.

Barley

Season to date exports (Jul-Oct) of barley are at 391Kt, up 60.9Kt (18.4%) compared to this time last year. The barley surplus (either export or free stock) for this marketing year (2022/23) is currently estimated at 1.288Mt, up 39% on last year. However, this is the second lowest since 2018/19, which was 1.174Mt.

With a larger exportable surplus this season, if UK barley prices competitively, it is likely that full season exports will increase from last season, which was the lowest level in nine years. However, with the barley balance remaining relatively tight this season, exports will likely be capped.

Oats

From July to October 2022, the UK exported 67.4Kt of oats, up 58.5Kt (663%) compared to the same time last year, but remains in line with the export pace seen during the last four months of the 2021/22 season.

With November’s 2022/23 UK supply and demand estimates pegging oat exports at 115Kt for this season, the UK has already exported 58.6% of this amount in just four months.

With a smaller domestic crop this season as well as the Canadian crop coming to the global market, the pace of UK oat exports is expected to slow as the season progresses.

Maize

Season to date maize imports (Jul-Oct) are at 840.7Kt, up 332.5Kt (65.4%) compared to the same period last year. It is likely that a proportion of these imports would have been forward purchased, when maize was more competitive against wheat earlier this year.

In the November balance sheet estimates, maize imports are forecast at just over 2Mt. During the second half of this marketing year imports are expected to steady, with the higher domestic availability of wheat and the diminished price competitiveness of maize.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.