Analyst Insight: How competitive is UK wheat on the export market?

Thursday, 1 December 2022

Market commentary

- UK feed wheat futures (May-23) were up £1.75/t on Tuesday’s close, closing at £254.50/t yesterday. The Nov-23 contract closed at £238.50/t yesterday, up £1.85/t over the same period.

- Paris rapeseed futures (May-23) closed yesterday at €601.00/t, up €11.75/t on Tuesday’s close. This tracked strength in crude oil, support for Canadian canola from crusher buying and support for soyabeans following optimism of demand increases in China from hopes that restrictions will be eased.

- AHDB GB animal feed production and UK human and industrial cereal usage data is now published for the month of October.

How competitive is UK wheat on the export market?

With the bumper harvest this summer resulting from higher-than-average yields, the UK’s feed wheat supply is outweighing demand. In the UK cereals supply and demand estimates this season the UK has 2.25Mt of wheat surpluses to be exported, or remain as stocks.

With the UK’s surplus 158% larger than the 5-year average of 872Kt, and the higher human & industrial demand accounted for in the North of England. To reduce these grain stocks, we are going to have to export wheat.

Since the start of this marketing year (2022/23) UK feed wheat futures (May-23) have been trading at a discount to Paris milling wheat futures, based on yesterday’s (30 Nov) close this discount is near £17.00/t.

With the domestic market trading lower than the Paris market and the potential of large exportable surplus’. This could mean our physical traded market will need to price to be export competitive.

How has our physical market been trading?

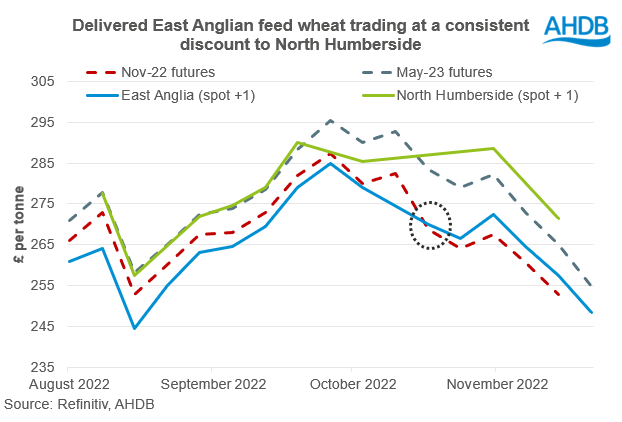

With increased demand in the North of England, delivered North Humberside feed wheat has been trading at a premium between £9.00/t to £16.00/t in comparison to delivered feed wheat into East Anglia since the start of August.

Delivered feed wheat into East Anglia has been at a consistent discount to Nov-22 until approaching expiry from the end of October (see graph) when May-23 futures would be switched to for price setting.

Based on last weeks value, Dec-22 East Anglia delivered was quoted at £248.50/t, a £6.00/t discount to May-23, meaning based on its carry it is at near parity to the futures market, assuming a £1.00/t-£1.50/t per month carry.

However as mentioned above we have a large surplus of wheat for this marketing year even with higher bio-ethanol demand taken into account, therefore could we see this physical market further discount from the futures values going into 2023?

What is happening to export prices?

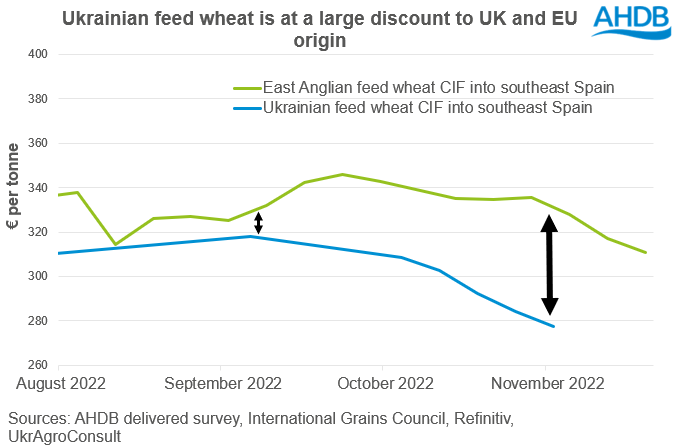

With physical domestic prices trading so tightly with our futures market, our internal market is not trading to be export competitive in comparison to Ukrainian and Russian origin feed wheat.

Based on a series of datasets, indicative analysis shows that the UK Cost, Insurance and Freight (CIF) price* to export domestic feed wheat out of the east coast to southeast Spain has been significantly higher than Ukraine’s CIF price into the same destination. This discount has just been growing as Ukrainian supplies have become available. Russian supplies have been at a large discount too in comparison to other origins.

However, this does not mean our prices are suddenly going to drop as supplies from EU origin are at a premium to the low Black Sea export price, which is inherently keeping our domestic prices supported.

What is critical to note though, if we see EU origin feed wheat export prices pressured, this could pressure our domestic prices further.

What could happen?

Ultimately Russian and Ukrainian wheat is very cheap on the market, in comparison to other EU origin. With an exportable surplus for this marketing year the UK will have to price competitively with the European markets. For the moment EU prices are supporting our domestic market, but if there is a shift in these values, we could see UK prices react accordingly.

Though it must be noted that volatility from conflict between Ukraine and Russia will ultimately dictate the direction of this global market, and losses could be limited if A) the export corridor ceases in March 2023, or B) we have an extreme weather event.

*The CIF price was calculated using UK delivered feed wheat prices, freight rates from the International Grains Council and an average port loading fee of £7.00/t and exchange rate data.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.