What does the EU Short-Term Outlook say about the meat markets?

Wednesday, 14 July 2021

By Bethan Wilkins

The EU Commission has recently published its Short Term Outlook for EU agricultural markets in 2021. Here, we highlight some of the pertinent points for the meat markets.

Growth prospects for EU GDP are now thought to be better than earlier in the year, with economic recovery already underway and stronger than previously forecast. The European Central Bank now expects 4.6% growth in EU GDP this year and 4.7% growth in 2022. However, uncertainties and economic risks remain, with COVID-19 still a challenge for now.

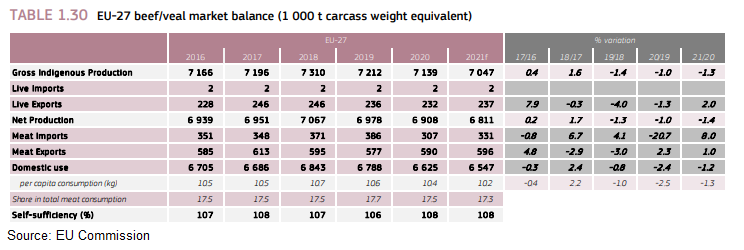

Beef

For beef, the shrinking cow herd is expected to feed into lower beef production this year, with a 1.4% decline forecast for 2021 overall. For Q1, beef production fell by more than this (-3.7%); mainly due to a decline in Ireland. In particular, we saw an increase in slaughter in Q4 2020 as Ireland looked to get animals through before the end of 2020 Brexit deadline. This has a knock-on impact on the Q1 2021 slaughter figures.

Exports are expected to recover as the year progresses, with 1% growth forecast for 2021. In the first quarter, logistical challenges supplying the UK limited volumes, which were 10% lower year-on-year. However, this is expected to become less influential, and volumes will also be supported by strong demand from some high-value markets such as the US and Hong Kong.

Similarly, imports are expected to recover by 8% this year. In the first quarter, volumes were still 13% behind year earlier levels due to foodservice closures limiting demand. As this market opens up again, demand should also increase. Nonetheless, consumption is still expected to fall by 1.1% this year overall, even with a recovery in demand during Q3 and Q4.

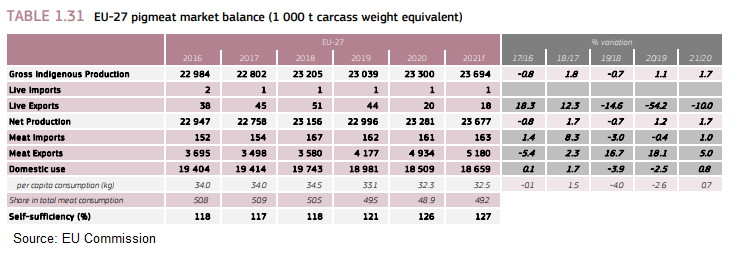

Pig meat

EU pig meat production is expected to continue increasing this year, with an annual growth of 1.7% forecast. Even though German production is likely to fall, extra production elsewhere should more than compensate for this.

Export growth is also forecast for 2021 overall, but at only 5.0%. Considering that exports in Q1 showed strong growth of 26%, this suggests a significant ease back in the latter part of the year. The additional production is expected to outpace this export growth, meaning supply for consumption is forecast to pick up slightly (+0.8%), following two years of decline.

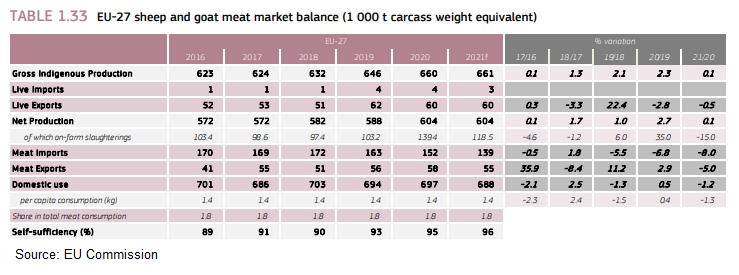

Sheep/goat meat

Sheep and goat meat production in the EU was 8.6% higher than last year in Q1. This is partially due to the changing dates of religious festivals, though high sheep prices have also encouraged more slaughter. Nonetheless, production is expected to be stable (+0.1%) for the year overall, as a declining EU flock will limit slaughter going forward.

A tight global supply of sheep meat is expected to limit imports this year, with an 8% decline forecast for the year overall. Imports were 21% lower in Q1, with falling volumes from both the UK and New Zealand. However, increased logistical costs in the UK due to our departure from the EU are expected to be less influential as the year progresses. Exports of EU sheep meat are also forecast to decline by 5%; again, this is a smaller decline than the 14% drop recorded in Q1. Considering the UK in a key importer of EU sheep meat, this suggests some recovery in our import volume is expected; however, the impact of this from our perspective may be minor, as imports from NZ/AUS are more important for us overall.

Altogether, with lower import volumes expected, sheep meat available for consumption in the EU is expected to fall by 1.2% this year.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.