Strong exports still supporting the EU pork market in March

Monday, 21 June 2021

By Bethan Wilkins

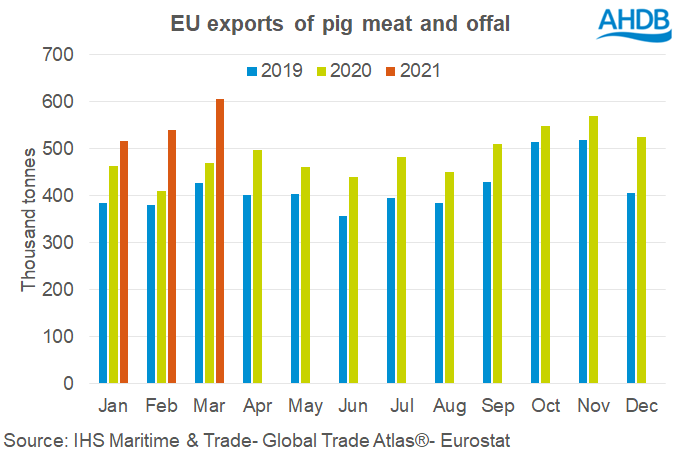

EU exports of all pig meat products were up by 29% in March 2021 compared with a year earlier, totalling 606,500 tonnes, according to the latest EU Commission figures. All the main categories of export were higher, on the back of strong demand from Asian markets.

Fresh/frozen pork exports to China were up by more than a third to 238,000 tonnes, while sales to the Philippines were nearly five times higher at 20,200 tonnes.

The UK and Japan were the only major markets to take noticeably less product this March (down by 19% and 16% respectively).

Offal sales to Asian markets were also strong, with increases again to the Philippines. Growth in shipments to Hong Kong offset declines to mainland China.

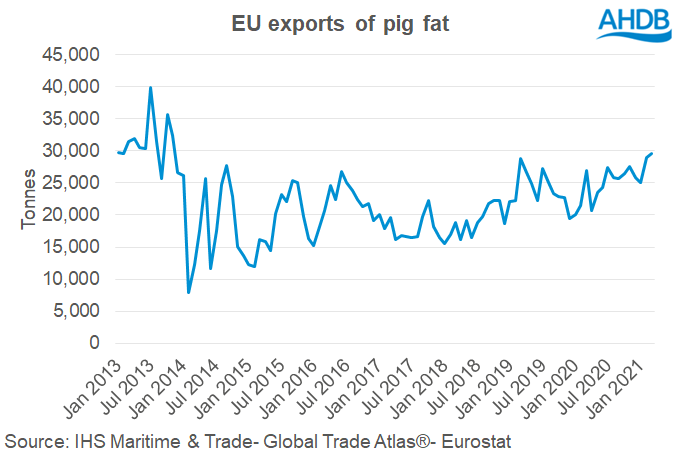

Interestingly, pig fat sales also reached the highest level since 2013 (before the Russian ban) in March, at just under 30,000 tonnes. China has been buying increasing volumes in recent months and volumes to the Philippines were also strong.

Not all of the EU’s significant exporters have been experiencing year-on-year growth in third country exports this year. Spain has led the way, with shipments up by over 70%, however Germany saw a decline of nearly 40%, reflecting the fact it has lost access to the Chinese market. Denmark’s exports were up by 22% and the Netherlands increased by 37%. The mid-ranking exporters also generally saw noticeable increases.

The strength of exports sales in early 2021 has helped provide some support to the EU pig market at a time when demand within the EU is still struggling with the consequences of the coronavirus pandemic. However, more recent reports suggest that exports sales have now started to weaken, and with domestic demand still faltering, this has knocked pig prices back. Both the USDA and EU commission had forecast EU pork exports to reduce this year, and with signs export demand may now be falling, the EU pork market could be facing further challenges. Of course, much will also depend on how many pigs are available for slaughter in the coming months. However, overall EU breeding sow numbers had only fallen slightly at the end of 2020, so it’s not clear that total supplies will to reduce in the short-term.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.