When will EU pig meat demand pick up?

Thursday, 27 May 2021

By Bethan Wilkins

Demand for pig meat in the EU has been under some pressure in 2020 and into early 2021. Long-term trends and disruption due to the coronavirus pandemic have influenced these developments. This has had a negative impact on pig prices, though fortunately export demand has remained a brighter spot for the EU market overall.

In the UK, the demand for British pig meat in particular seems to have been relatively robust. As a net importer, difficulties stemming from the ongoing disruption to the eating-out market can be mitigated by reducing import requirements. British pork is more popular in retail rather than foodservice outlets. In contrast, the major EU pig meat producers are net exporters, and so producers are more directly exposed to overall demand fluctuations.

Market reports indicate that pork demand on the continent has been difficult. Demand is suffering due to unseasonably cool spring weather, a lack of tourist trade, and ongoing coronavirus restrictions affecting the foodservice market. Nonetheless, there are now early signs the situation may be improving. In some areas, there has been a partial reopening of catering which reports indicate is helping to recover demand.

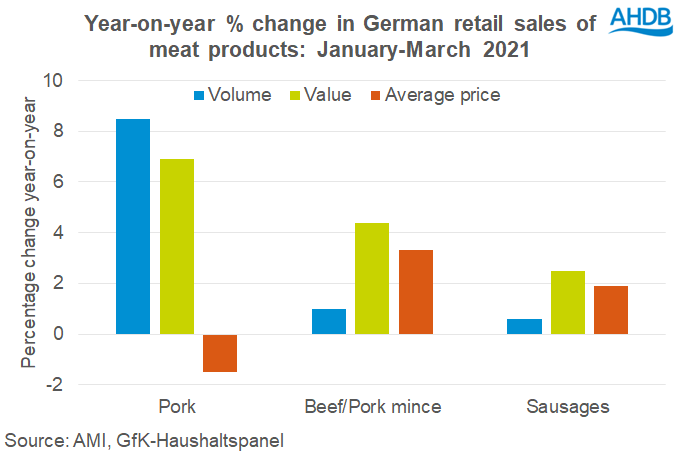

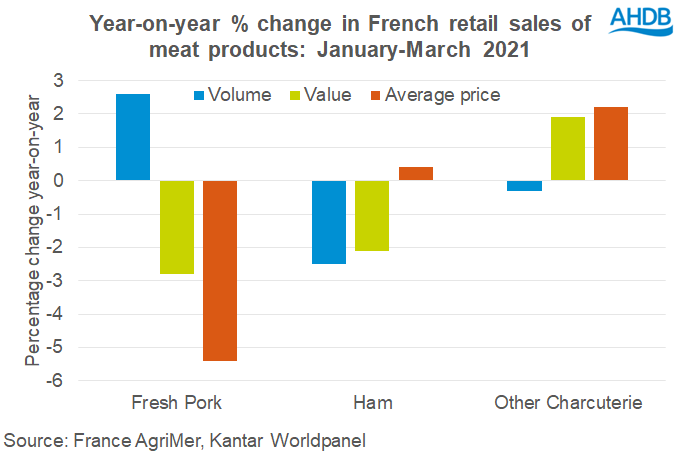

Below, we look at retail purchases of pig meat in Germany and France (key EU pig meat producers and consumers) early this year. It’s worth noting that both these nations imposed restrictions on eating-out in mid-March last year, so retail volumes in the latter part of Q1 2020 will have already been elevated. Nonetheless, even where volumes are higher than early last year, it seems this has not been sufficient to compensate for declines in foodservice, considering reports of struggling demand for much of this year.

In Germany, household purchases of fresh pork were up by almost 9% in the first quarter of 2021, though sausage and mince sales were more stable.

Kantar Worldpanel data for France shows only a 3% rise in fresh pork retail sales over the same period. Charcuterie sales were actually 1% down on a year earlier, particularly driven by declining ham purchases.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.