What are the market signals for dairy commodity prices now?

Thursday, 7 November 2024

Market analysts across the world are watching dairy markets with bated breath currently, watching for clues and hints to future market direction.

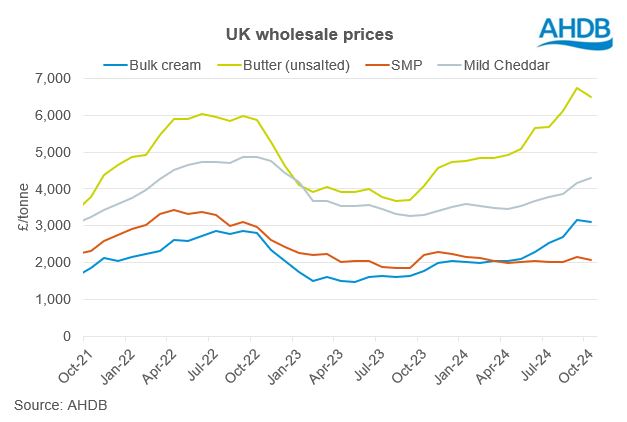

Fats prices, in particular, were sitting at record-breaking levels in September with only a marginal decline in butter and cream in October in response to signs that milk flows were back in growth in the UK. As we reported in October, butter prices fell to £6,500/t (-3%) whilst cream fell to £3,096/t or -2%.

Milk supplies for GB so far in October have been running at year-on-year growth throughout the month and including data up until 26th October are now at 2.6% ahead of October last year. Increased milk production should start to feed through to declining commodity prices further but there are some signs that may muddy the picture.

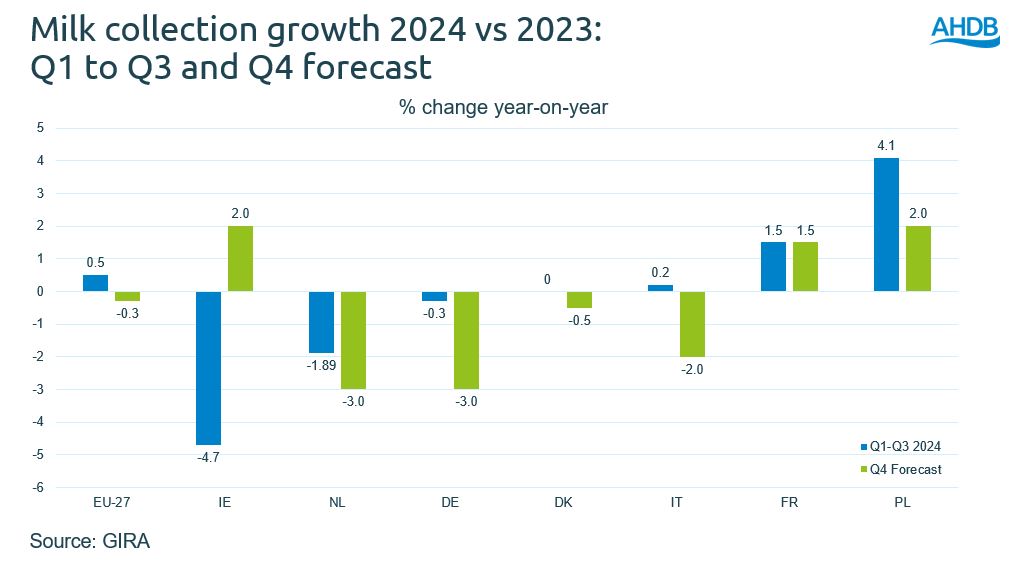

Production in the rest of Europe is facing some challenges, despite growth in milk prices. Irish milk production has been back all year (-4.9% from January to August) which has significantly curtailed the availability of Irish butter and cheese to the UK market. Elsewhere in Western Europe, bluetongue virus has had an impact on yields in markets like Germany and the Netherlands with milk volumes from these countries (Jan to Oct) down by -0.3% and -1.9% respectively. Growth is expected to come from Poland and, to a lesser extent, France according to GIRA’s latest predictions.

There are signs that butter prices on the continent have rallied after the falls seen a few weeks ago, although cream remained static. Trigona report a rise from 7400-7500 euros/t for the week of 11th October up towards 7700/7800 euros/t in the week of 1st November. The rallies have not been confined to the northern hemisphere with the latest Global Dairy trade event (GDT) , which generally reflects market sentiment coming out of Southern hemisphere trade and acts as a global “barometer”, seeing a sizeable uplift of 4.8% for 5th November 2024. Prices rose across the piece, but butter led the pack rising by 8.3% to $6,990/t. Anhydrous milk fat (AMF) also rose by 4.6%, cheddar by 4.0% and skimmed milk powder (SMP) by 4.0%.

Because of the poor milk season thus far, stocks of key commodities are likely to be growing scarce which will all take time to replenish.

What does that mean for British dairy farmers?

The market is still lacking a clear direction although the latest rises in the GDT and the continent point away from a swift decline in pricing despite GB milk supplies being on the rise. As our headline measure of the valorisation of milk, the MMV is still rising, and that would tend to predict average farmgate milk prices to rise at least until January next year. We are expecting average farmgate milk prices to rise to approximately 46.4ppl. Whether farmgate prices rises further than that will be dependent on how traders and processors react to milk flows and what happens with demand globally. With a change of administration in the United States, including hyperbolic promises of increased tariffs, significant market disruptions are possible.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.