UK wheat price volatility continues: Grain market daily

Wednesday, 20 April 2022

Market commentary

- UK feed wheat futures (May-22) fell £2.30/t yesterday, to close at £317.50/t. Traded contract volume yesterday for this contract was notably higher than in recent weeks. New-crop futures (Nov-22) fell £2.35/t yesterday, to close at £288.90/t.

- Paris rapeseed futures (May-22) gained €14.00/t yesterday, to close at €1,018.00/t. New-crop futures (Nov-22) gained €1.50/t yesterday, to close at €828.75/t.

- Nearby brent crude oil futures fell $5.91/barrel yesterday, to close at $107.25/barrel.

UK wheat price volatility continues

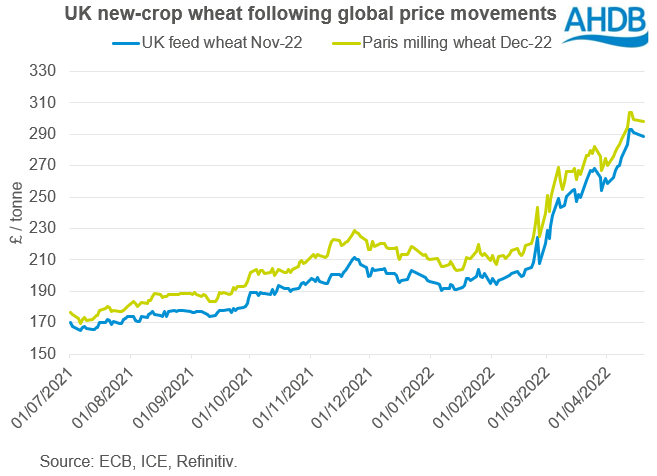

Yesterday, UK feed wheat futures followed Paris wheat futures down after the bank holiday. This was due to profit-taking, considering prices are at historic highs. Paris milling wheat (May-22) fell €1.50/t to close at €399.50/t (£331.41/t). New-crop futures (Dec-22) fell €2.00/t to close at €359.25/t (£298.02/t).

Chicago wheat (Dec-22) fell $5.33/t from Monday, to close at $404.18/t yesterday (Refinitiv). Though, US prices remain supported on poor US winter wheat crop condition scores. These are at a 26-year low (Refinitiv).

Yesterday, the United Nations World Food Programme said Ukrainian storage capacity will likely be insufficient for the grain harvest 2022 (despite this being reduced). Ukrainian exports are currently limited to rail movement, resulting in such high stocks from a lack of liquidity of farm sales. With this income needed for harvesting, this could pose a concern for production. We may see a reaction to this news today, though high prices may have factored this in, to some extent.

Maize supply remains tight

Yesterday, Chicago maize (Dec-22) fell $1.08/t from Monday, to close at $294.08/t (Refinitiv). Price remains elevated after the bank holiday as rains delay US maize planting, with existing worries that Ukrainian maize plantings could be down significantly for harvest 22.

Though important to note, this rain now may make extra US planted area of maize more unlikely. However, soil moisture may benefit plants longer term. Something to watch going forward.

How is global price volatility impacting UK price availability?

UK feed wheat futures continue to follow global market movements. Global supply and demand are tight across the wider grain complex, and the market is sensitive to any news that may alter this balance. As such, price volatility continues. However, fundamental support remains for prices.

You may have noticed that since the beginning of the war between Russia and Ukraine, less AHDB prices have been published. This is because prices need to meet a validation process to ensure accuracy and representation across the market. With global price volatility, and rapidly changing news, this means that understanding where the market is, is difficult. Quotes can vary as a result.

We recognise understanding market and price direction is crucial, with high input costs to consider. Each week we look to publish as many accurate prices as we can.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.