US weather watching: Grain market daily

Tuesday, 12 April 2022

Market commentary

- UK feed wheat (May-22) gained £4.95/t yesterday to close at £312.45/t. New crop (Nov-22) futures gained £7.85/t yesterday from Fridays close, to settle at a new contract high of £283.35/t. We can see new-crop futures moving upwards, closer to old-crop prices.

- Chicago maize futures (Dec-22) gained $0.79/t yesterday, to close at $282.68/t.

- Paris rapeseed futures (May-22) gained €9.00/t yesterday to close at €970.00/t. The new-crop futures (Nov-22) gained €0.50/t yesterday to close at €797.75/t.

US weather watching

The outlook for the 2022/23 maize supply looks to depend on how much is planted in Ukraine and the US, as two key global exporters. Plantings are due to begin this month (April) for both countries, and so the market will eagerly await insight into planting progress.

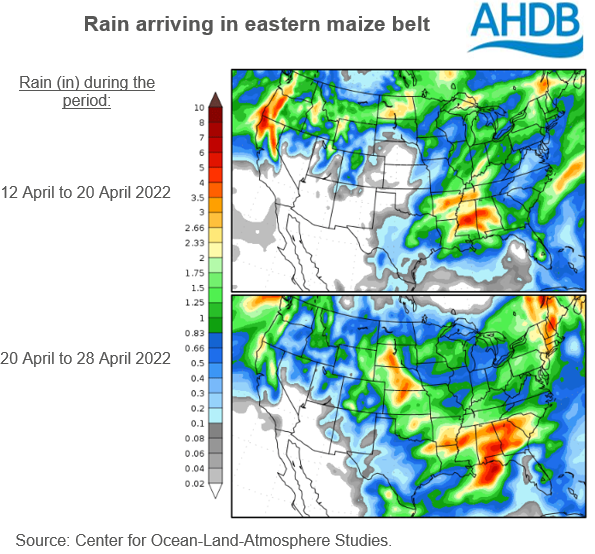

Rain in the eastern maize belt

Rain is forecasted to fall across the eastern US maize belt in the next few weeks.

As at 10 April, 2% of the US maize area had been planted according to the USDA crop progress report out last night. This is 2 percentage points (pp) behind this time last year and 1pp behind the 5-year average (2017 to 2021).

Why does rain matter? Well, April brings the start of maize planting, and rain could delay this. Not something to worry about now, but something to watch. This is especially important, given the US prospective planting survey results show the maize area will be smaller this year, in favour of area for soyabeans. All crop that goes in the ground will be important to global maize availability.

On the flip side, US southern Great Plains winter wheat could do with rain to ease the drought conditions. Therefore, where the rain falls across the US will be key in the next few weeks.

Why is this important?

The global grain supply and demand balance remains tight heading into next season, especially with the war ongoing between Russia and Ukraine.

In Ukraine, maize is expected to lose out to other crops like buckwheat, barley, oats, peas, and millet this year. This is down to a large proportion of the typical maize area being in active hostile regions, with the crop needing a significant amount of fuel and inputs (UkrAgroConsult). Maize production in Ukraine for 2022/23 has been forecast at 19.0Mt by UkrAgroConsult. If realised, this will be the smallest output since 2012.

With a cut in Ukrainian production, US maize plantings will be key to global maize availability next season. If we see strong maize prices because of tight supply, it will likely provide a floor for the wider global feed grain complex.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.