Russian export curbs supporting prices: Grain market daily

Tuesday, 15 March 2022

Market commentary

- UK feed wheat (May-22) futures rose £2.50/t yesterday, to close at £300.50/t. However, at such high prices, only 137 contracts were traded yesterday (Refinitiv). New-crop futures (Nov-22) gained £3.50/t yesterday, closing at £254.00/t.

- UK feed wheat prices followed the Paris wheat contract up and reacted to a weakening of the sterling against the dollar. Paris milling wheat (May-22) futures gained €8.00/t yesterday, to close at €378.75/t.

- Brent crude oil futures fell to their lowest point in over two weeks yesterday. Nearby prices fell $5.77/t yesterday to $106.90/t. This is down to Black Sea peace talks and China’s COVID-19 infection rate concerns.

- Following crude oil, Paris rapeseed (May-22) futures fell €6.50/t yesterday closing at €898.25/t.

Russian export curbs supporting prices

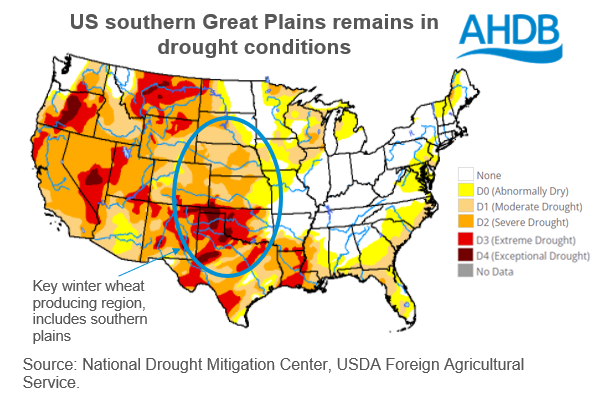

Support in wheat markets comes from news of a temporary Russian ban on grain shipments to former Soviet Union countries, and concerns about the US wheat crop condition. Though Chicago wheat futures fell yesterday, likely on Black Sea peace talks, prices look to be trading up today (as at midday).

Russia’s export curbs

Russia has temporarily banned grain exports (wheat, rye, barley, and maize) to neighbouring Eurasian Economic Union states until 30 June. This follows concerns grain is leaving Russia at a fast pace, into the free customs zone of the Eurasian Economic Union.

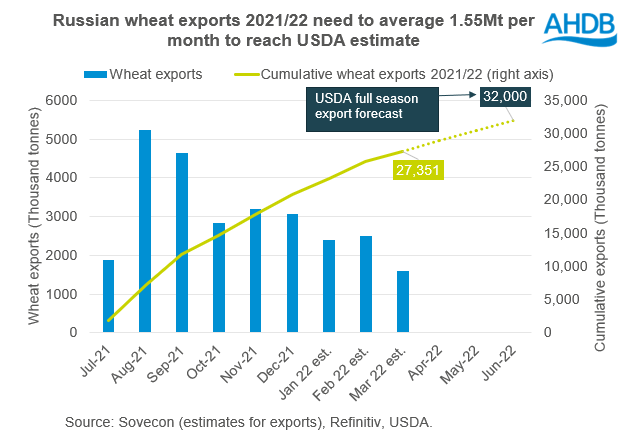

However, a senior Russian minister said special export licences within the current quotas would continue to be provided. This may be significant for major Russian wheat importers, for example Egypt and Turkey, as shipments could continue to these countries. For wheat, this quota is currently set at 8.0Mt (15 Feb to 30 Jun). IKAR consultancy understand 6.0-6.5Mt remains to be exported before the end of June.

How much wheat is, and will be, available on the global market remains a concern. This is especially given Ukraine has introduced the need for licences for key export goods, including wheat and maize. Ukraine is forecast by the USDA to export 1.5Mt another by the end of this season.

Looking ahead to harvest 22

Concerns remain for the US crop condition, following drought weather in the southern US plains. Soil moisture is critical, as plants start to send up shoots. It is still too early to tell the impact on yields but is something to watch. With a tight supply and demand balance as we head into next season, the market is sensitive to all wheat production news.

Weekly nationwide US crop condition reports resume on 4 April.

What does this mean for prices?

Curbed global wheat availability is pushing up prices this season. Plus, it is increasingly a concern for next season also. Peace talks are ongoing between Russia and Ukraine, though disruption to trade may continue. As a result, prices are expected to remain historically high.

As we head into our spring, more news will emerge on global crop conditions. What spring planting takes place in Ukraine will be important to 2022/23 supplies. Though quite rightly, Ukrainian farmers have many pressing issues to consider, not just planting.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.