Market Report - 14 March 2022

Monday, 14 March 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

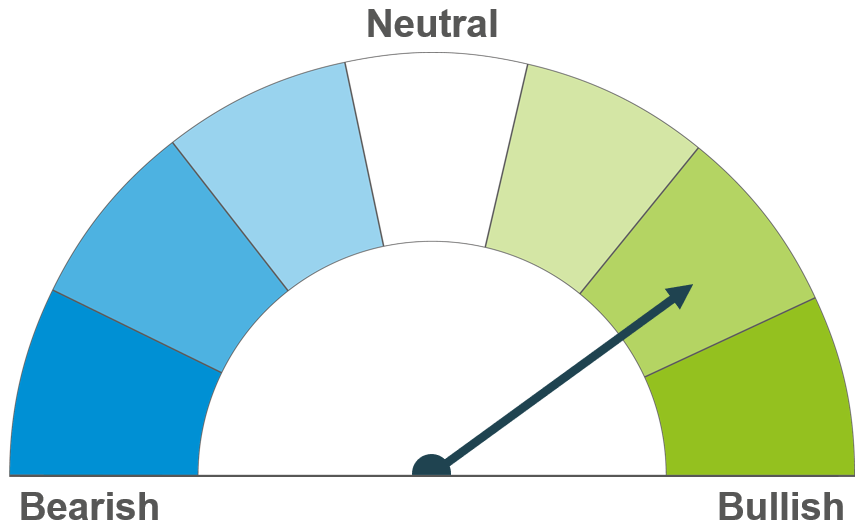

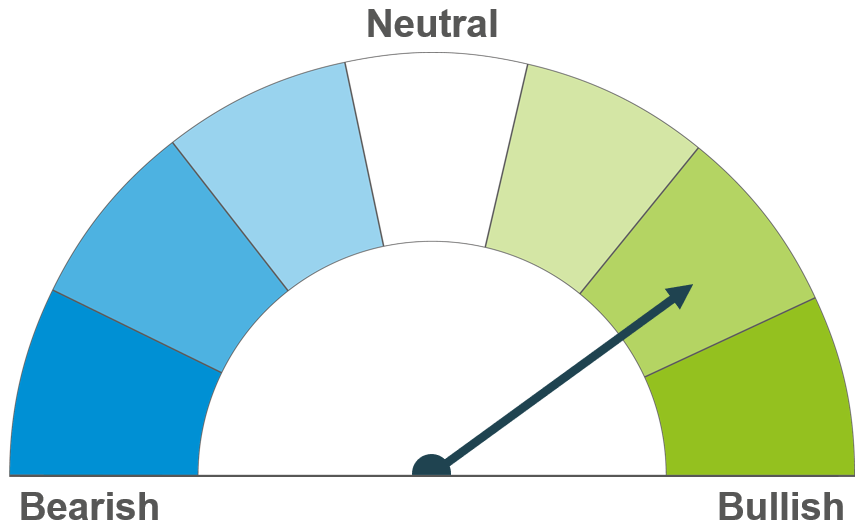

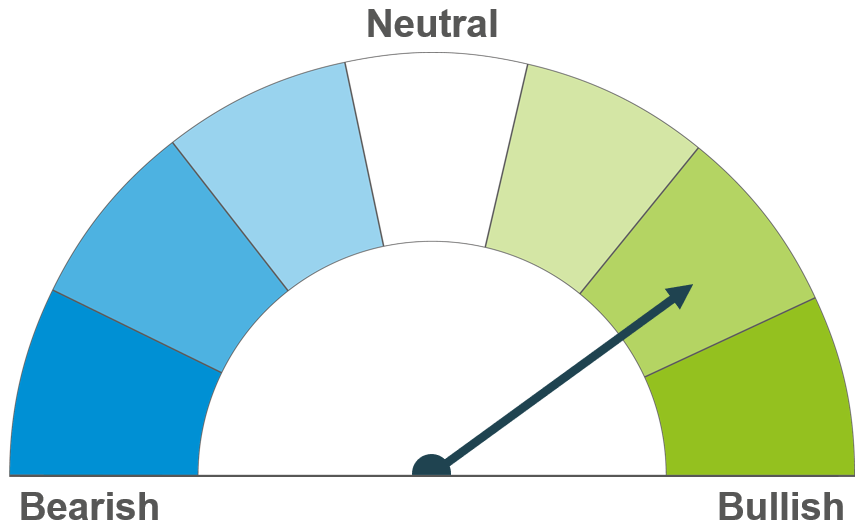

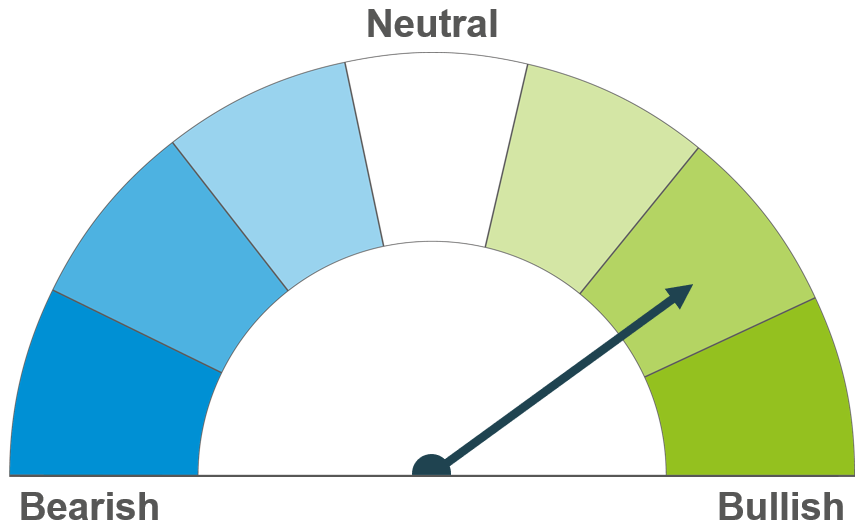

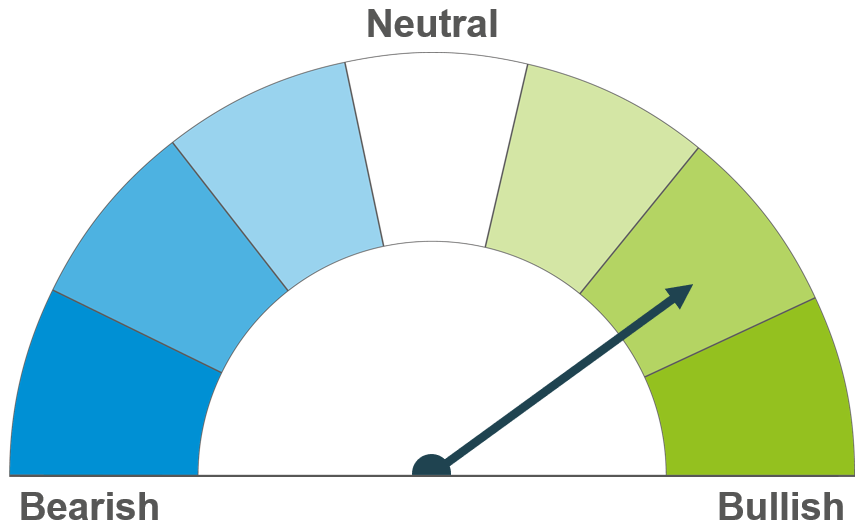

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

With Black Sea turmoil still shaping grain markets, the long-term outlook continues to be uncertain. Disruption to Black Sea markets remain in the short term, with more buyers looking to EU supplies to shore up any supply gaps caused by the conflict. After last weeks buying rally, managed money funds could be considered over bought if the more positive tone to the Russia-Ukraine talks continues.

With the Ukrainian government introducing export licenses last week on key agricultural commodities, further disruption could be felt here. While Conab pegged its total maize production this season below USDA estimates, sowing is progressing well and conditions look set to improve in the south of the country.

Barley looks set to continue tracking the wider grain market. Shifting demand to the grain may prove challenging, with a tight balance this season and sustained demand levels.

Global grain markets

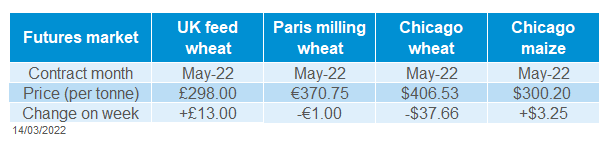

Global grain futures

Moving into a new week, market volatility continues. The May-22 Chicago wheat contract slipped from record highs seen at the beginning of last week, recovering a little ground at the end of the week to close Friday at $406.53/t. Since trading opened this morning, it has since moved down a little further (as at 09:50), off the back of seemingly more positive talks coming out of the Black Sea. This has given markets a chance to re-evaluate their positions.

On Saturday, the Ukrainian government announced a ban on fertiliser exports. This is on top of the introduction of licences on key export goods, including wheat and maize. The country’s agricultural producers’ union said a reduced area of sunseed, rapeseed and maize is likely this year, for harvest -22. The crops’ are being replaced with buckwheat, oats and millet. Prior to the conflict (01-Feb), UkrAgroConsult pegged Ukraine’s maize area at 5.475Mha. It remains to be seen how much of this is realised. However, President Zelenskiy stated on Friday that the country must sow as much as possible this spring, despite the Russian invasion.

On Wednesday, the USDA provided downward revisions on Ukrainian and Russian exports, back 7.0Mt to 52.0Mt for wheat. Ukrainian maize exports were pegged back 6.0Mt, to 27.5Mt These revisions were seen to many as modest. Russia is slowly starting to resume wheat exports, although current sanctions in place could prove a major limiting factor on volumes.

While the USDA kept EU wheat exports the same as February estimates, FranceAgriMer sharply increased its French wheat export forecasts. This is in anticipation that they would replace a decent proportion of lost Black Sea supply. The organisation pegged the number at 9.7Mt, up 0.8Mt from the month earlier.

Additionally, FranceAgriMer pegged French soft wheat conditions down a touch on Friday, rating 92% of the crop “good/excellent” versus 93% the week earlier. This is still some 4 percentage points better than last year. France has seen generally favourable conditions so far this season, although potential dryness concerns are a watch point. With the supply restrictions from the Black Sea, the condition of crops from other major exporting nations becomes all the more critical this season.

In their 6th Grain Harvest Survey, published 10 March, the Brazilian body Conab estimated total maize production at 112.3Mt for the season. This is below the latest USDA forecast of 114.0Mt, but 29% up on year earlier levels. With the soyabean harvest proceeding at pace, which dictates the rate of planting for the safrinha (second) crop, current estimates are that 74.8% of the safrinha area is now sown. Additionally, more favourable rains are forecast for the south of the country, aiding conditions for the crop.

UK focus

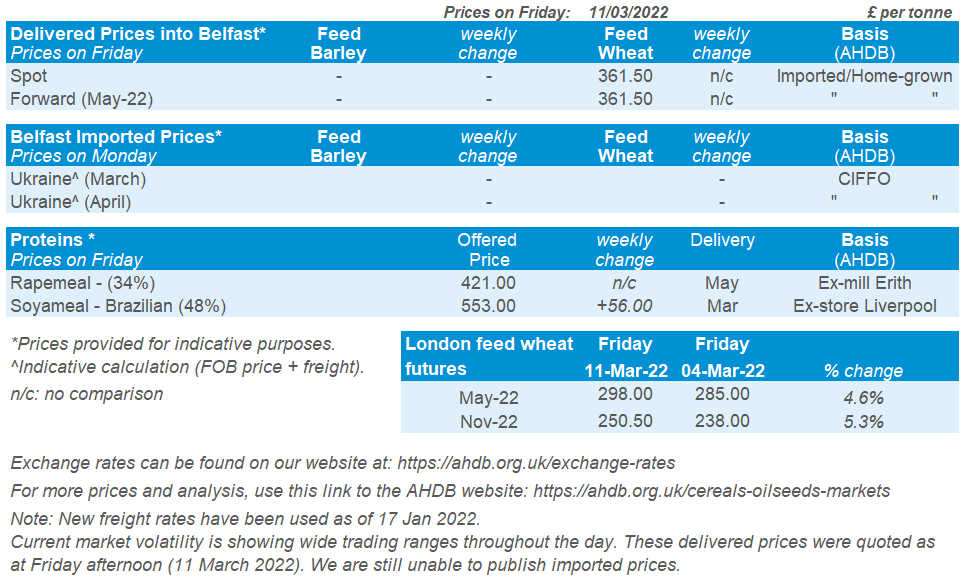

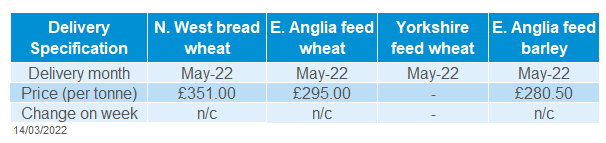

Delivered cereals

UK feed wheat futures followed the global trend last week, with the May-22 contract hitting a record high on 7 March (£303.00/t). They did soften slightly from this position, but still finished the week at £298.00/t, £13.00/t more than the week earlier close.

New crop (Nov-22) showed more support, closing the week at a contract high of £250.50/t. However, volumes traded on Friday were the lowest of the week. Since markets opened this morning, the contract has ticked up a further £0.30/t (09:50am).

Market volatility fed through into the domestic market last week, with wide swings in prices causing trade to stagnate. New crop feed wheat for November delivery (East Anglia) was up £14.00/t on the week, at £245.50/t.

Oilseeds

Rapeseed

Soyabeans

With global rapeseed supplies tight, Black Sea tensions will continue to support the market in the short-term at least. Sun oil exports remain a watch point and gains in soy oil markets could also offer support.

Further cuts to South American soyabean crops offer some support in the short-medium term. Some oil contracts have eased off, but tight alternative supply may offer support to soyabeans.

Global oilseed markets

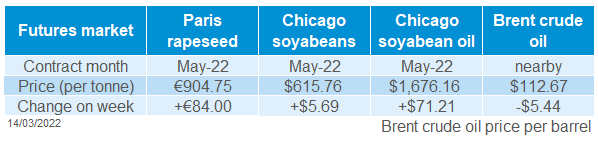

Global oilseed futures

Black Sea tensions continue to be a key driver of commodity markets. Last week also saw the release of the March world agricultural supply and demand estimates (WASDE).

After an up and down week, Chicago soyabeans (May-22) ended Friday (11-Mar) up $5.69/t at $615.76/t. The new crop (Nov-22) extended gains further (+$14.97/t) to close the week at $547.79/t.

Despite some recent rain in South America, dryness is continuing to hamper crop prospects. The USDA trimmed their Argentine soyabean production estimate by 1.5Mt, to 43.5Mt, but this sits 1.5Mt above local reporter Buenos Aires Grain Exchange (BAGE). Similarly for Brazil, the USDA estimate (127.0Mt) now sits 4.2Mt above local reporter, CONAB, who trimmed a further 2.7Mt from its estimate last Thursday (10-Mar).

Reduced crop prospects are also coupled with an announcement from Argentina that registration of soy oil and meal exports are halted. This announcement was made over the weekend and could squeeze supplies in an already tight picture. Argentina is the world’s top exporter of soy products.

This follows news from Indonesia, the world’s top palm oil exporter, that 30% of palm oil of their planned exports must be sold domestically. This is up from 20% previously. This resulted in nearby Malaysian palm oil futures jumping 8.2% across the week, closing at $1,756.92/t. The gains have since retracted somewhat, on the back of profit taking but also softening of rival Dalian oils and crude.

Rapeseed focus

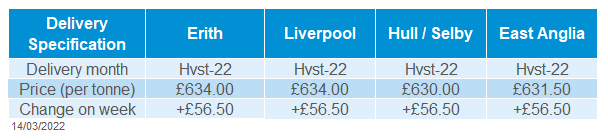

UK delivered oilseed prices

Paris rapeseed (May-22) continued to climb to new highs last week. The contract closed the week at €904.75/t, up €84.00/t from the week before. The Nov-22 contract also closed higher on the week (+€42.00/t) at €733.50/t.

Domestically, physical trade is slow for old crop. New crop markets have followed the upwards trend in Paris rapeseed. Average price for delivered rapeseed into Erith (harvest-22) was £634.00/t, up £56.50/t from the previous week.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.