Market report - 19 April 2022

Tuesday, 19 April 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

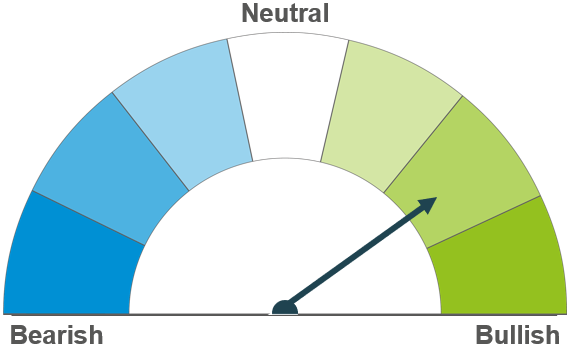

With tight global supply and continued conflict in Ukraine, US crop conditions and weather outlook continues to set the tone.

The slow start to US maize planting tightens supply concerns, with large uncertainty remaining over potential Ukrainian new crop volumes.

The tight balance sheet means barley prices continue to track wheat. UK markets remain largely illiquid.

Global grain markets

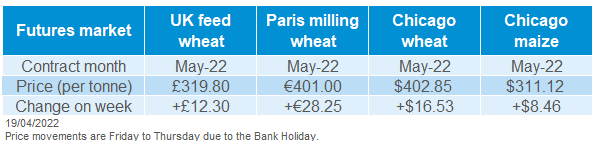

Global grain futures

Global grain prices have continued to edge higher as we move into the new week, with the latest US weekly crop progress increasing concerns around new crop availability. US winter wheat was pegged at only 30% good-excellent, the lowest at this point in the season since 1996. This was a two-percentage point downward revision on the previous week, and only the fourth time ratings in week 15 have been lower than 33% good-excellent in US records dating to the late 1980’s. As a result, Chicago wheat (May-22) prices closed on Monday at $411.71/t, up $8.81/t from Friday’s close. The Dec-22 contract followed suit, closing $409.51/t on Monday, a rise of $7.62/t on Friday’s close.

The report also lent support to maize contracts. US planting was pegged at 4% complete as of Sunday 17 April, behind analyst’s estimates of 5% and the five-year average of 6%. Cold, wet weather has delayed the start of planting for many. Following this, Chicago maize contracts jumped, the May-22 price up $9.05 on Friday’s close, to end Monday at $320.16/t and the Dec-22 contract up $5.70/t over the same period, closing Monday at $295.16/t.

Russian wheat exports, although limited, continued moving last week, despite sanction complications. The latest Egyptian (GASC) tender included a Russian shipment, alongside French and Bulgarian. This was the first successful GASC tender since the start of the war in Ukraine.

The Argentine grains truckers strike has now been lifted, with activity now back to near normal levels. Last week’s strike, in the middle of the busy maize and soyabean harvest, saw grains transport grind to a halt.

UK focus

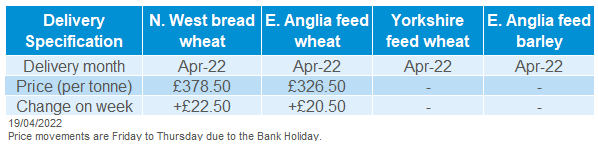

Delivered cereals

Nearby UK feed wheat futures reached record high’s last week, the May-22 contract closing on Tuesday and Wednesday at £322.00/t. Although prices softened on Thursday to £319.80/t, ahead of the long holiday weekend, they are currently trading back up at £322.00/t (as at 11am). The Nov-22 contract saw the same movement, closing the working week at £291.25/t, back £1.75/t from Wednesday’s highs. At 11am today, it is trading back at £294.00/t.

Although trading was reportedly thin on the ground, physical prices recorded another jump last week. Feed wheat (delivered into East Anglia, Apr-22) was quoted at £326.50/t, up £20.50/t (Thursday – Wednesday). New crop delivered prices also rose, with harvest-22 delivery to East Anglia up £25.00/t over the same period, at £290.50/t.

North West bread wheat prices (Apr-22 delivery) followed suit, up £22.50/t Thursday – Wednesday, to £378.50/t.

Oilseeds

Rapeseed

Soyabeans

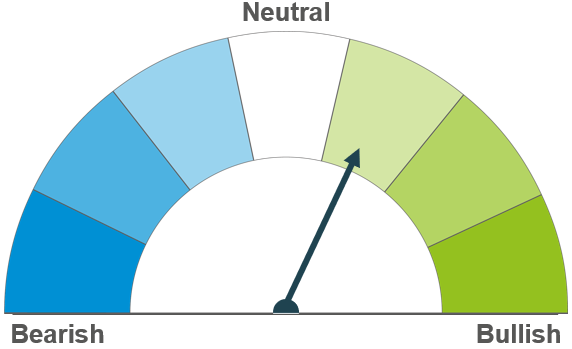

The rapeseed supply and demand balance remains tight, continuing to support prices. Looking to next season, focus is on Ukrainian sunflower plantings and weather in the Canadian prairies.

Strong Chinese demand combined with strong crushing demand is supporting the soybean market currently. Longer-term focus now turns to US soyabean plantings, which currently stand at 1% planted. Progress will ramp up in the coming months.

Global oilseed markets

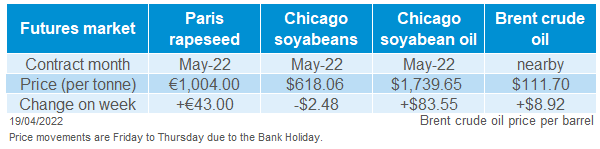

Global oilseed futures

With US markets closed on Friday 15 April, Chicago soyabean futures (May-22) ended down Friday-Thursday to close down 0.4% across the week at $618.12/t. Soyabean contracts saw more profit taking last week, shoring up positions, although remained in a net long position.

Although soyabeans were down across the week, the market did recover from it’s weekly low on Monday 11 April of $608.14/t.

Driving this recovery was strong Chinese demand, as the USDA reported 132Kt of soyabean sales to China on Thursday. On Friday a further 838Kt old and new crop sales to China and unknown destinations were reported through its daily reporting system.

Since last Thursday the market has recovered closing yesterday at $630.06/t gaining 1.93% . Supporting this is the US export data and National Oilseed Processors Association (NOPA) data, which estimated that 181.8 million bushels of soyabean were processed last month, up 10.1% on month and 2.1% on the year. The largest March crush on record among NOPA members (Refinitiv).

In oils, Chicago soyoil (May-22) closed at a contract high on Monday at $1,763.48/t strong demand is supporting prices (Refinitiv).

Based on yesterday’s close, Malaysian palm oil (Jul-22) futures have gained 9.15% since 08 April, tracking strength in other oils. Exports of Malaysian palm oil products for Apr 1 – 15 fell 13.9% to 495.1Kt from 574.9Kt shipped during the same period last month (Societe Generale de Surveillance). Although exports are down across the month strength in other oils and continued concerns of Russia-Ukraine conflict support the palm oil market (Refinitiv).

Rapeseed focus

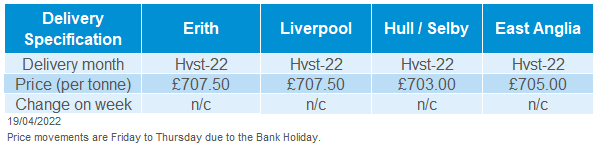

UK delivered oilseed prices

With the European market closed on Friday, Paris rapeseed futures (May-22) closed Thursday at €1,004.00/t, gaining €43.00/t across the week.

New crop futures (Aug-22) closed at €860.25/t gaining €36.00/t over the same period. In the AHDB delivered survey oilseed rape (into Erith, Aug-22) was quoted at £707.50/t with no comparison across the week.

Canola regions in Canada had weekend snowstorms, raising concerns about planting delays. Eyes are currently on plantings in Canada for replenishing global rapeseed stocks going into the 2022/23 marketing year.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.