UK futures shrug off US price rises: Grain market daily

Friday, 6 October 2023

Market commentary

- Nov-23 UK feed wheat futures closed at £185.35/t yesterday, down £0.55/t from Wednesday and its lowest price since 12 September. But the May-24 and Nov-24 contracts fell just £0.05/t to £198.15/t and £199.10/t respectively. In contrast, most global grain futures prices lifted yesterday led by the US market (see below).

- Nov-23 Paris rapeseed futures closed at €424.50/t yesterday, down €14.50/t over the day. There were smaller falls for the May-24 contract (down €10.25/t to €449.00/t) and the Nov-24 contract (down €8.75/t to €451.25/t).

- Paris rapeseed likely followed Winnipeg canola futures, where the Nov-23 contract fell to its lowest level in more than three months. Although Winnipeg canola prices recovered the losses later in the day, pulled up by rises in Chicago soyabeans, it was after the European market had closed.

- The EU-27 2023 rapeseed crop is pegged at 19.2 Mt by grain trade association Coceral. This is below the most recent estimates from Stratégie Grains (19.5 Mt) and the EU Commission (19.6 Mt). Meanwhile, Coceral estimated the UK 2023 wheat crop at 14.14 Mt, and the rapeseed crop at 1.17 Mt. Defra and the Scottish government are due to release their first estimates of 2023 crops next Thursday (12 October).

- Dry weather could curb winter wheat plantings in Ukraine, according to the agriculture minister. By 3 October, Ukrainian farmers had planted 1.7 Mha of wheat, about 40% of the expected area. But more rain is now needed for that forecast to be reached; most of Ukraine’s wheat is winter wheat.

UK futures shrug off US price rises

Despite the rises in the Chicago markets yesterday (more below), the UK feed wheat futures prices are not following suit so far. Yesterday most of the rises in the US market happened after the market had closed, plus sterling strengthened against the US dollar offsetting the gains.

So far today (Friday 6 October), both UK and European grain futures are almost unchanged too. As of 1:00pm today, Nov-23 UK feed wheat futures are trading around £185.00/t, down £0.35/t from yesterday’s close. The sterling dollar exchange rate is proving variable, with key economic data awaited in the USA.

Despite the muted reaction in the UK futures, the below factors will stay important to grain markets in the coming weeks. So will the next US maize and soyabean yield estimates from the USDA on 12 October.

US prices rise on weather worries and short covering

Chicago wheat and maize prices rose yesterday due to weather concerns, developments in the Black Sea and technical trading:

- Black Sea tensions. The UK government suggested that Russia lay mines threaten civilian shipping in the Black Sea. Shortly afterwards, a Turkish cargo ship was damaged by a sea mine in the Black Sea, although the Ukrainian government has since said that it was probably an old mine. This reminded the market of the ongoing risks of shipping in a war zone, which has recently focused on the strong wheat exports from Russia.

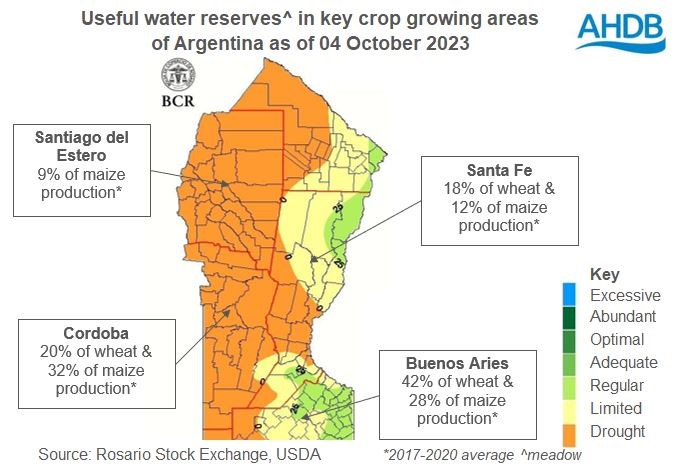

- Dry weather in the Southern Hemisphere in major grain exporting countries of Argentina and Australia.

Australia had its driest September on record, the country’s Bureau of Meteorology confirmed this morning. The Australian government has already downgraded the wheat crop expectations, but there are concerns that the continuing dry weather could shrink output further.

Meanwhile, in Argentina dry weather is causing concern for wheat crops, which are approaching grain fill, and maize planting. The Buenos Aries Grain Exchange (BAGE) estimates at 14% of the planned maize area or 1.01 Mha of the planned 7.3 Mha had been planted by 4 October. More rain is needed to help the country meet that forecast. BAGE reports that 1.1 Mha was at risk if enough rain didn’t fall. Argentina is forecast to account for 21% of global maize exports in 2023/24 (USDA).

- Technical trading may also have contributed. Speculative traders can use deviations from the underlying trend as a signal to buy or sell. Yesterday, Dec-23 Chicago wheat futures broke above the 20-day moving average, which it has failed to close above several times since 3 August. Chicago maize Dec-23 futures also settled above the 50-day moving average.

It seems likely that short covering by speculative traders added to the rise. As of last Tuesday, speculative traders held large net-short (sold) positions in Chicago wheat and maize futures. Holding a short can result in losses when the market rises, which in turn can trigger that trader to try to buy it back. Refinitiv (an LSEG Business) reports buying by speculative traders over the course of yesterday.

Chicago wheat futures (Dec-23) increased $6.71/t to $212.45/t, back to levels before last Friday’s sell-off after the USDA production and stock reports. Chicago maize futures (Dec-23) gained $4.53/t to close at $195.87/t. The momentum in Chicago grain futures spilled over to Chicago soyabean futures, pulling them higher. The Nov-23 contract gained $2.85/t to $470.55/t yesterday.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.