Feed wheat prices remain well above barley: Feed market report

Thursday, 27 August 2020

By Charlie Reeve

Grains

Feed wheat prices have remained at a noticeable premium above feed barley during August.

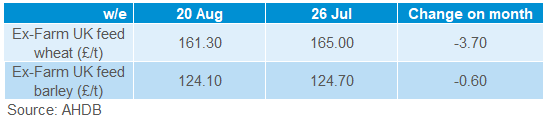

UK feed wheat prices are now beginning to recover after falling from £164.30/t at the start of the month. Ex-farm feed wheat prices reached £161.30/t on 20 August while feed barley prices sat at £124.10/t, thus creating a difference of £37.20/t on the day.

UK wheat futures have also been strengthening over the last fortnight, with the Nov-20 contract closing at £166.90 on 26 August.

The weather has been highly changeable for many on the build up to harvest. High temperatures towards the end of July carried on through early August, with little rainfall during this time. Thunderstorms began from 10 August and while this rainfall was welcomed in some regions, significant volumes in certain areas did lead to other issues, such as saturation and flash flooding. Early yield estimates from AHDB’s third harvest report peg domestic wheat yields between 7.3 – 7.7 t/ha, based on 59% harvest completion. This is back on the 5-year average of 8.4t/ha

The challenging growing season will likely see the UK wheat crop around the 10Mt mark this year – volumes not recorded since the early 1980’s. However, given the global surplus of wheat, UK prices will likely be capped at import parity, with supply fundamentals from large global exporters having a strong sway on the UK price. What could be affected in the coming months will be delivered premiums, with buyers having to incentivise wheat to move North and West to homes across the UK.

Barley prices are looking relatively bearish in the short term, the large expected production and sizeable carry from 19/20 two of the pressurising factors.

Proteins

This years rapeseed crop looks to be one of the lowest on record, with current industry predictions pegging it around the 1Mt mark. AHDB’s harvest reports have been highlighting the wide variability recorded in this year’s yields, with current estimates at 2.6 – 3.0t/ha.

UK requirements will need to be supported by imports. With NW Europe having a similar challenging year with rapeseed production, much of this early import requirement will be serviced by Ukraine. However, their production volumes are back on a year earlier. Longer term, more favourable production prospects in Canada and Australia could offer a lifeline.

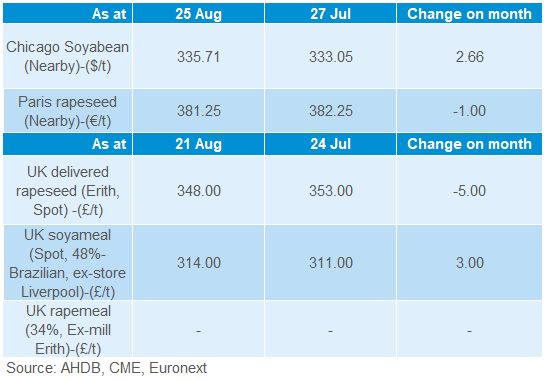

US-China trade of soybeans has been impacting on global oilseeds markets. China has been purchasing a large volume of soybeans from the US for several weeks now, which has been helping to support global prices. Storm damage in the US across the Mid-West, and the most recent USDA crop condition report being not so optimistic about US soybean conditions has given them some price support recently.

This has lent some support to rapeseed prices. After peaking in mid-July, delivered rapeseed (Nov-20) for Erith had been softening into August. This movement was reversed last week (21 August), with prices quoted at £348 last Friday.

Currency

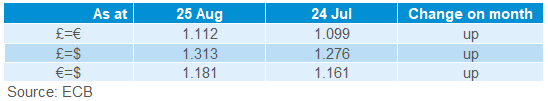

Sterling has remained quite stable in relation to the Euro so far during August. It has maintained this relatively low position against the Euro for several months now; this position continuing to help support UK export prices.

Some minor signs of growth in sterling against the US dollar have been seen, although this has started to stagnate around the 1GBP=1.32USD mark.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.