Strong beef prices gave support to producers as fertiliser prices soared

Friday, 19 April 2024

Despite climbing beef prices over the past few years, cattle farmers have had to battle huge inflation in key input costs. Looking at the relative values of fertiliser and beef gives an insight to the response to high input costs on the sector.

Nitrogen fertiliser, with its linkage to energy markets, has been at the heart of the inflationary challenge for agriculture. The market calmed in late 2023, but prices remained nearly 30% above 2019 levels in the first quarter of 2024. Going into 2024 and there is a risk of complacency toward the fertiliser market following a period of calm, however it is important to be mindful of risks in global markets and changes to domestic policy as outlined in the AHDB Fertiliser Outlook.

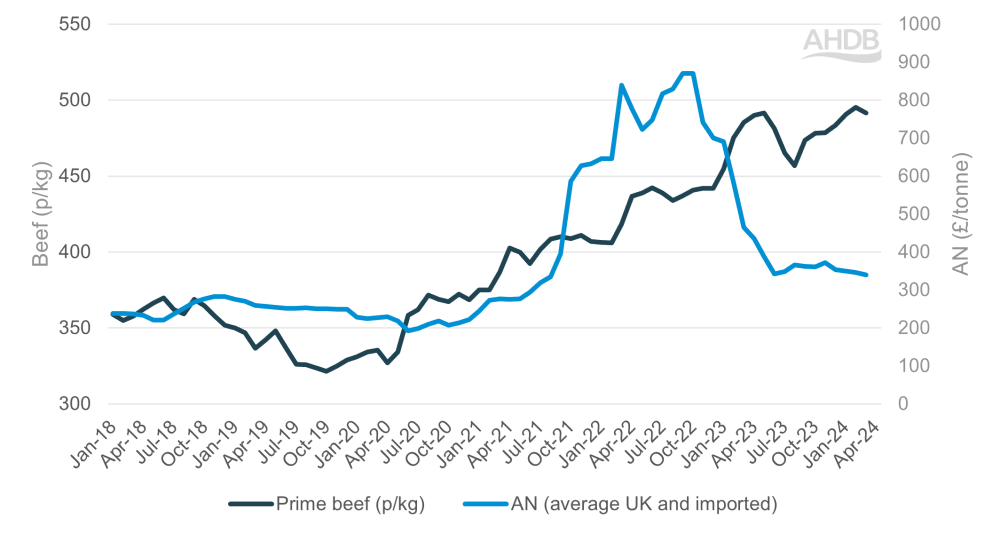

Long term tracking of beef and fertiliser prices

Looking at both beef and fertiliser prices over the past five years, we see clearly the steep increase in fertiliser prices from the second half of 2021, a response to the European energy crisis and then further climbs from the outbreak of war in Ukraine. Fertiliser price peaked in September/October 2022 but has now stabilised at £339/t for domestic AN in March, albeit at levels higher than pre-2021.

Beef prices, on the other hand, have risen considerably since 2020, driven a by contraction in supply against a backdrop of stable consumption supporting demand. Average deadweight overall all prime price sat at 491.6 pence/kg (p/kg) in March 2024, an increase of nearly 50% versus the same month in 2020.

Deadweight beef versus fertiliser price

Source: AHDB

*Beef price is represented by the monthly deadweight overall all prime price

AN 34.5% price is an average across UK and imported Ammonium Nitrate (AN).

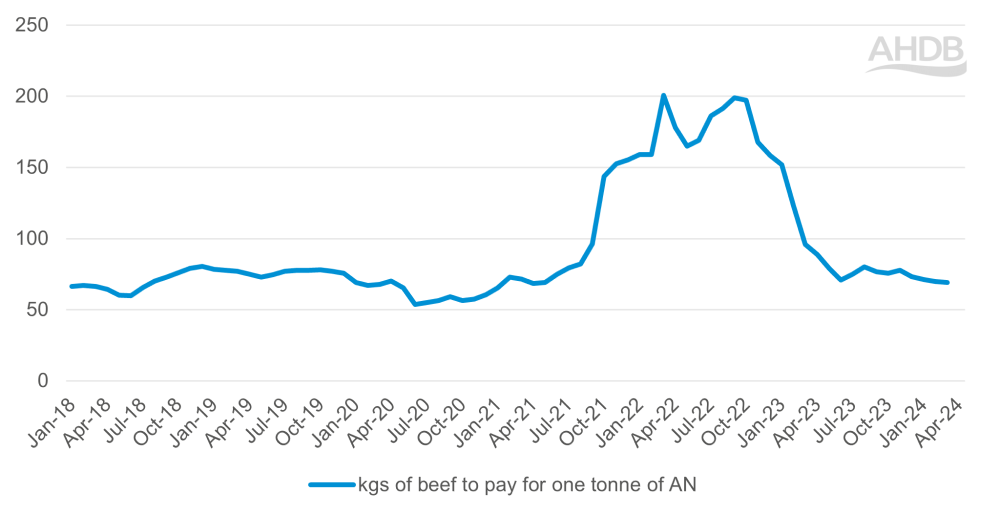

Value of beef versus fertiliser price

The value of beef relative to key inputs can be measured by assessing how many KGs of beef (deadweight, all prime cattle) it takes to buy one tonne of AN fertiliser. Despite falling back through 2023, fertiliser prices remain above historic average levels as shown above. Though this has been partly offset by strength in deadweight cattle prices.

For AN fertilisers, the value relationship with beef has seen extreme changes to say the least with clear implications for those growing cattle on forage-based systems. Through 2018-2019 it took on average, 73kg of deadweight beef to pay for one tonne of AN fertiliser. In 2022 this average was 178kg, and simply made fertiliser unaffordable for many at traditional application rates. We saw this reflected in Defra’s British Survey of Fertiliser Use, with the average field rate for total nitrogen use on grassland at 80kg/ha for 2022, down 12kg/ha from the average use for the previous three years.

Falling fertiliser prices and rising beef prices are helping a return to a more normal relationship, but farmers are likely to remain cautious to whether a return to more normal application of fertiliser is only justified because of the current strength in beef prices.

Price ratio between beef and fertiliser

Source: AHDB

*Beef price is represented by the monthly deadweight overall all prime price

AN 34.5% price is an average across UK and imported Ammonium Nitrate (AN).

Conclusions

A combination of falling fertiliser costs and strong beef prices has seen a return of the price ratio to pre-2021 levels. However, this has relied on near record high beef prices whilst input costs remaining above pre-inflationary levels mean farmers may remain cautious when considering application of nitrogen fertiliser.

Product choice and grassland utilisation will become increasingly important topic as producers make decisions on application, instead looking to evaluate their fertiliser strategy to achieve maximum cost-benefit. Factors such as market prices and weather conditions should also be considered in order to build the full picture and optimise fertiliser use on farm.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.