- Home

- Fertiliser outlook 2025

Fertiliser outlook 2025

The latest outlook for nitrogen fertiliser prices.

Key points

- Compared to the last couple of years, input markets have settled down, and this is expected to continue over the next year

- Fertiliser markets are expected to remain stable unless there are significant changes to the market or global impacts

- Fertiliser prices have settled down over 2024 compared to the highs in 2022 and 2023

Over the last couple of years, we have seen huge changes within the fertiliser markets. Huge hikes in fertiliser prices due to the energy crisis in Europe and changes in domestic supply have impacted the price of fertiliser for farmers.

2024 was a more stable year in terms of prices, which dropped in the latter half of 2023 but have managed to remain relatively stable since. However, prices are still above the pre-inflationary levels.

Demand for nitrogen fertilisers in GB

The latest British Survey of Fertiliser Practice report shows that total use of nitrogen across core products increased by 4% year-on-year in 2023. This increase in usage was expected, as fertiliser prices have reduced considerably since their highs in 2022.

Looking at field level, total nitrogen usage per hectare increased slightly by 8 kg, mainly due to the increase in straight nitrogen applications, whereas compound nitrogen application rates remained in line with 2022 levels. Around 82% of crops received a straight nitrogen application in 2023, an increase of 2% compared to 2022.

This increase is mainly due to an increase in urea and urea ammonium nitrate (UAN), while the use of ammonium nitrate (AN) and calcium ammonium nitrate (CAN) fertilisers has reduced compared to 2022. This is unsurprising as AN market shares have been decreasing annually as legacy gas issues and structural changes to the supply base have come to fruition.

Fertiliser prices

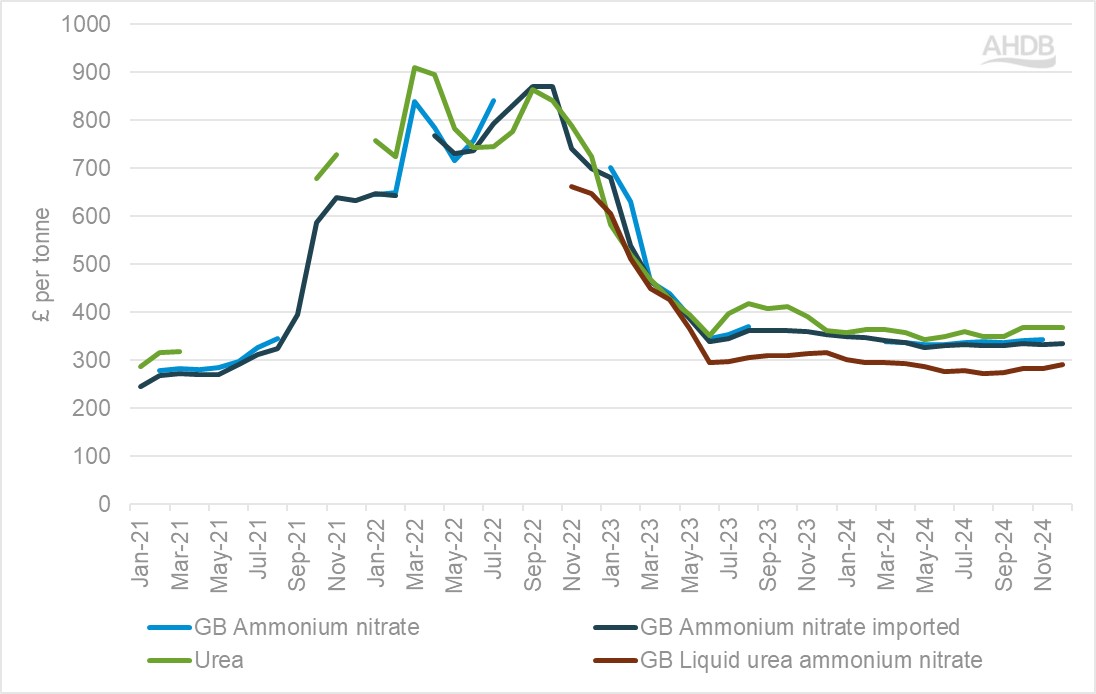

We publish GB fertiliser prices across six fertiliser products with the aim of increasing transparency in the market and helping levy payers understand the price trends. GB fertiliser prices remained relatively stable throughout 2024, with the AN fertiliser price averaging around the £336/tonne mark, a drop of 22% since the highs in 2023 and a drop of 55% since 2022.

There is not much freely available information regarding fertiliser markets, unlike other agricultural commodities. This lack of information presents an issue for the resilience of food systems if we consider the turmoil in the markets that we saw through 2022 and 2023.

Figure 1: Nitrogen fertiliser prices 2021–2024

Source: AHDB

What could impact fertiliser prices going forward?

Nitrogen fertiliser markets have remained relatively stable after the instability we saw in 2022 and early 2023. Prices of GB fertilisers have remained consistent over the last 18 months, and unless there are significant changes to the markets or global impacts markets, they will remain relatively calm over the next year.

There is continued instability in the Red Sea region and broader Middle East, which could continue to present uncertainty, especially around shipping fertilisers. There are also ongoing supply chain uncertainties for natural gas which may intensify further, depending on how the war in Ukraine progresses.

Fertiliser prices are impacted by global crop prices. The prices are impacted by other energy costs and crop values to both keep production online and maintain demand from farmers. Therefore, if crop prices were to increase, this would allow the fertiliser values to follow if the markets have confidence in farmer demand. This is not a new risk; however, as prices are higher, the risks are also increased.

Looking forward, the UK government is consulting on the introduction of a Carbon Border Adjustment Mechanism (CBAM). This is expected to be implemented from the beginning of 2027 and will place a carbon price on certain goods imported to the UK in certain emission-intensive industries.

The price will reflect the difference between the carbon price of the product in the country of origin and the equivalent price had it been produced in the UK. There are concerns that this could push up the cost of fertilisers in the future and will be a watchpoint as the policy develops.

Sign up to receive the latest information from AHDB