Speculative traders still betting on price falls: Grain market daily

Thursday, 18 January 2024

Market commentary

- May-24 UK feed wheat futures closed at £185.25/t last night, unchanged from Tuesday when the contract fell to its lowest price to date. The Nov-24 contract lost £0.20/t yesterday to close at £199.75/t.

- Global wheat prices were broadly steady yesterday after falling on Tuesday under pressure from expectations of high global maize supplies this season. Last Friday, the USDA increased its estimate of the 2023 US maize crop and global maize end of season stocks.

- Yesterday Egypt’s state buyer, GASC, bought 360 Kt of wheat in a tender. The majority (300 Kt) was Russian wheat, but GASC also bought 60 Kt of French wheat, the first since late-August. Egypt is the world’s top wheat importer.

- May-24 Paris rapeseed futures gained €2.25/t to close at €429.50/t, shrugging off pressure from Chicago soyabean futures. May-24 rapeseed futures seem to be supported by technical moves on the Feb-24 contact, which finishes trading on 31 January and still had over 26,000 open contracts. Meanwhile, the Nov-24 contract gained just €0.50/t to close at €432.25/t.

Speculative traders still betting on price falls

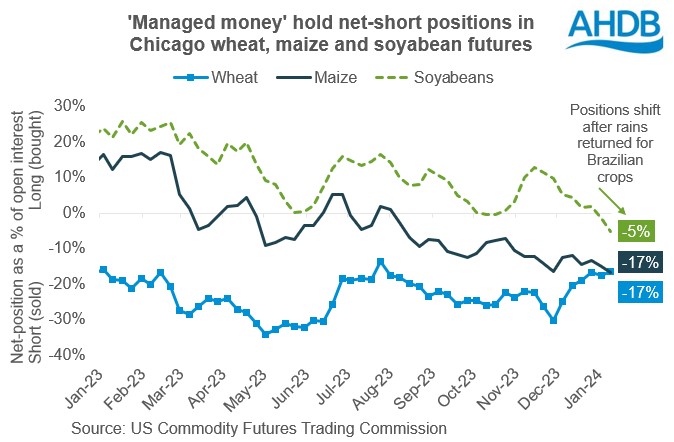

Speculative traders still hold large net-short positions in Chicago wheat and maize futures, which can be seen as predicting a bearish outlook for wheat and maize prices. While the latest official data is for positions held on 9 January, anecdotal information suggests that investment funds have been net-sellers since then (LSEG).

This reflects that, despite uncertainty over the Brazilian maize crop size, currently the global grain supply and demand forecasts show a surplus for 2023/24. Plus, the forecasts for US maize end of season stocks have increased. As a result, the net-short, the speculative traders hold in Chicago maize on 9 January was larger than in mid-November.

In Chicago wheat, the net-short was smaller than it was in November. The US wheat export pace remains sluggish this season, keeping pressure on prices. But the USDA has now confirmed that the US winter wheat area is smaller for harvest 2024 than 2023, which could mean a smaller US wheat crop in the coming season.

Speculative traders have also increased the net-short position they hold in Paris milling wheat futures. It was equivalent to -7% of open interest in late-September but had reached -17% on 12 January. This shift in position likely reflects the fall in May-24 futures over this period as EU exports remained sluggish but may also have contributed to the fall.

Now betting on price falls for soyabeans too

But in a change from the autumn, speculative traders also now hold a small net-short in Chicago soyabean futures too. In late-2023 they held a net-long position reflecting worries over dry weather in Brazil, and growing concern over the potential crop size.

Rains returned to the key growing areas before Christmas, though there’s still a wide range in forecasts for the Brazilian soyabean crop. Both the USDA and Conab cut their forecasts last week. Based on these current forecasts, the global outlook still points potentially surplus supplies in 2023/24, tying in with the shift in positions held by speculative traders.

This outlook is by no means certain, and some private forecasts have estimates far lower than Conab. But the Brazilian soyabean harvest is underway (1.7% complete by 13 Jan) so we will gain a lot more about the oilseeds outlook over the coming month.

It’s also worth noting that investment funds hold much larger net-short positions in Paris rapeseed futures, equivalent to 16% of all open positions.

Looking ahead

If prices rise while speculative traders still hold sizeable net-shorts, they are likely to need to re-position. In turn, such re-positing could add to the speed of a price rally. However, the market is likely to need to see disruption to supplies for sustained price rises, such as further sharp cuts to the Brazilian maize and soyabean crop forecasts.

The next Conab and USDA forecasts are both due on 8 February.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.