Arable Market Report – 15 January 2024

Monday, 15 January 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

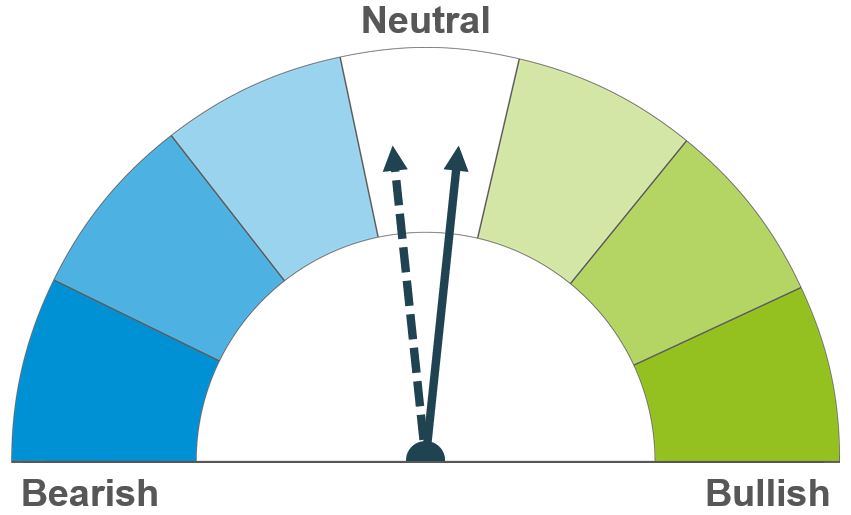

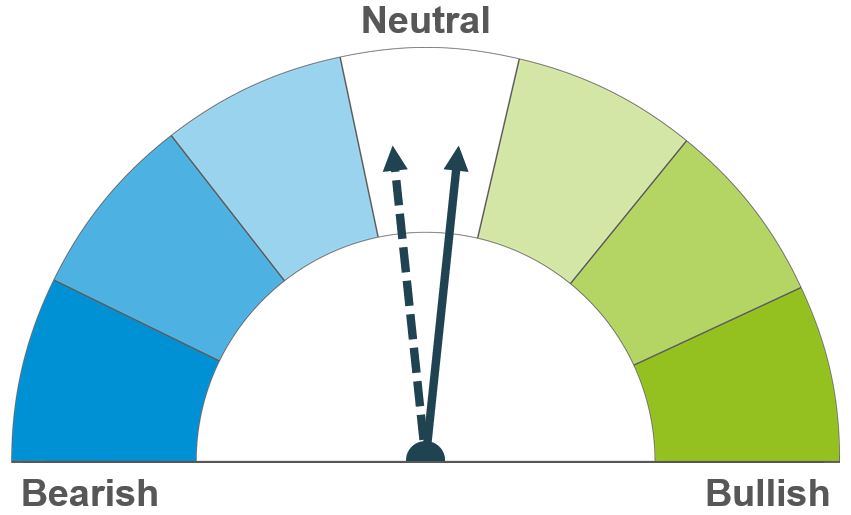

Wheat

Global export demand remains in focus short-term. Longer term, Northern Hemisphere weather is a key watchpoint as planting and conditions are followed closely.

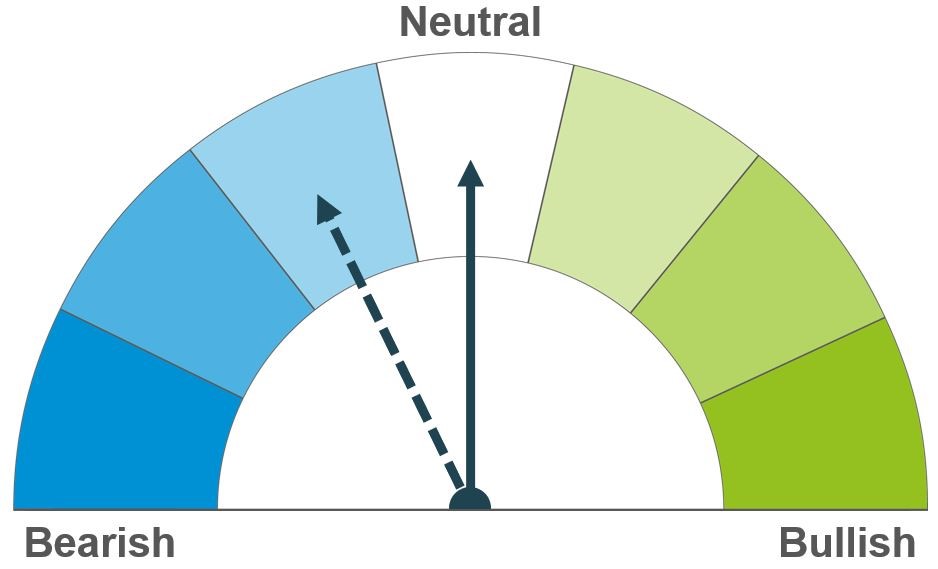

Maize

Short-term, Brazilian weather and planting progression are key drivers. Longer-term we are still expecting ample maize supplies to weigh on prices later this season and into the next.

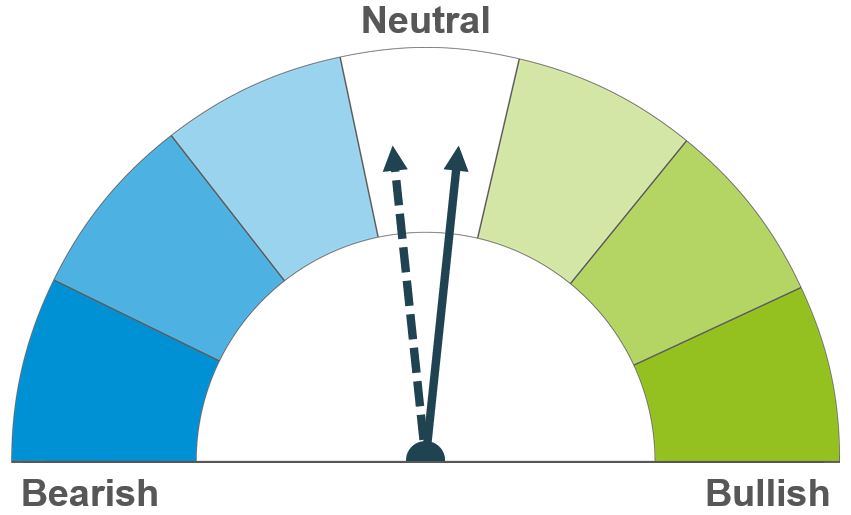

Barley

Barley prices largely continue to follow the wider grains complex, though European planting conditions in the spring could influence the market outlook.

Global grain markets

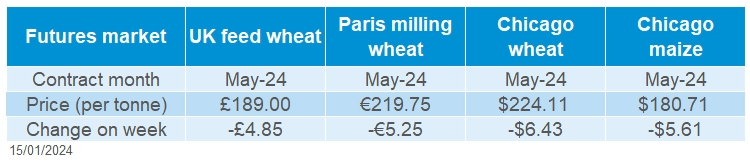

Global grain futures

Global grain markets were pressured last week, largely on the back of sluggish export demand and indications of plentiful feed grain supplies moving forward. Chicago wheat futures (May-24) were down 2.8% Friday to Friday. Paris milling wheat (May-24) was pressured 2.3% over the same period.

While US grain prices rose at the beginning of the week, futures were pressured following the release of the USDA’s World Agricultural Supply and Demand Estimates (WASDE). The report showed that global maize stocks at the end of this season (2023/24) are expected to reach a six-year high of 325.2 Mt. Having said this, ending stocks and the stocks-to-use ratio of major maize exporters (including Argentina, Brazil, Ukraine and US) were relatively unchanged from the previous month’s estimate.

The supply and demand outlook for wheat remains tight, with global ending stocks staying at an eight year low in last week’s WASDE. The International Grain Council (IGC) also released their first estimates for the 2024/25 season last week and pointed to further tightening of global wheat stocks despite a larger global harvest.

Brazilian weather is still in focus short-term, with plantings of the Safrinha maize crop a key watchpoint over the next few weeks. Over the next seven days, more rainfall is due over the Mato Grosso region, benefitting soil moisture in the key production area. Last week, Conab left the Safrinha maize crop estimate the same, though any changes to this are expected to be made in their February update, something to look out for.

UK focus

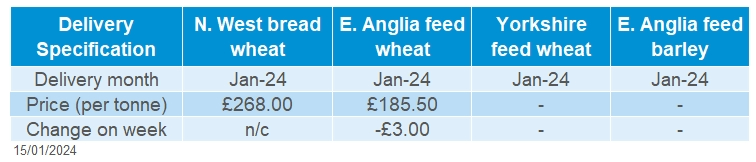

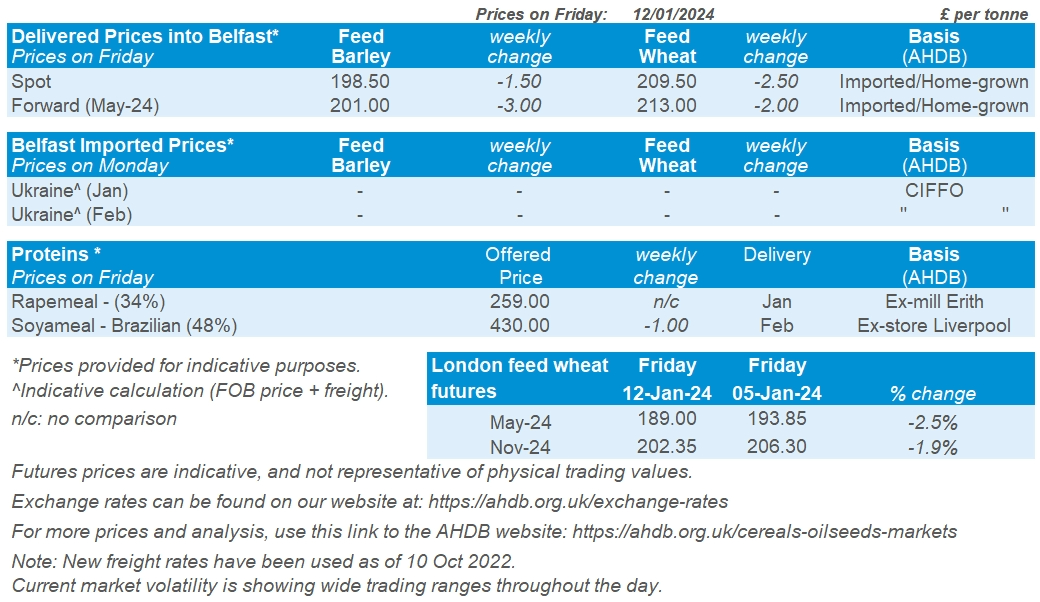

Delivered cereals

Domestic wheat futures followed global price movement down last week (Friday to Friday). UK feed wheat futures (May-24) closed at £189.00/t on Friday, down £4.85/t over the week. The Nov-24 contract was down £3.95/t over the same period, ending Friday’s session at £202.35/t.

UK delivered prices followed futures price movement (Thurs-Thurs). Feed wheat delivered into East Anglia for January delivery was quoted at £185.50/t on Thursday, down £3.00/t on the week.

Bread wheat delivered into the North West for January delivery was quoted at £268.00/t on Thursday, with no weekly comparison.

Last week, AHDB released the latest UK human and industrial cereal usage and GB animal feed production figures. The data shows a yearly rise (up 5.5%) in total wheat milled by flour millers, and an uptick (up 1%) in barley usage by brewers, maltsters, and distillers this season to date (Jul-Nov). On the feed side, the month of November also saw a rise in poultry feed production, up 5.7% than a year earlier, read more analysis on this here.

On Friday, UK trade data was updated including import and export figures up to the end of November. This season to date (Jul-Nov), wheat imports (incl. durum wheat) totalled 771.7 Kt, up 38% on the year, likely on the back of the need to import higher quality wheat for milling.

Oilseeds

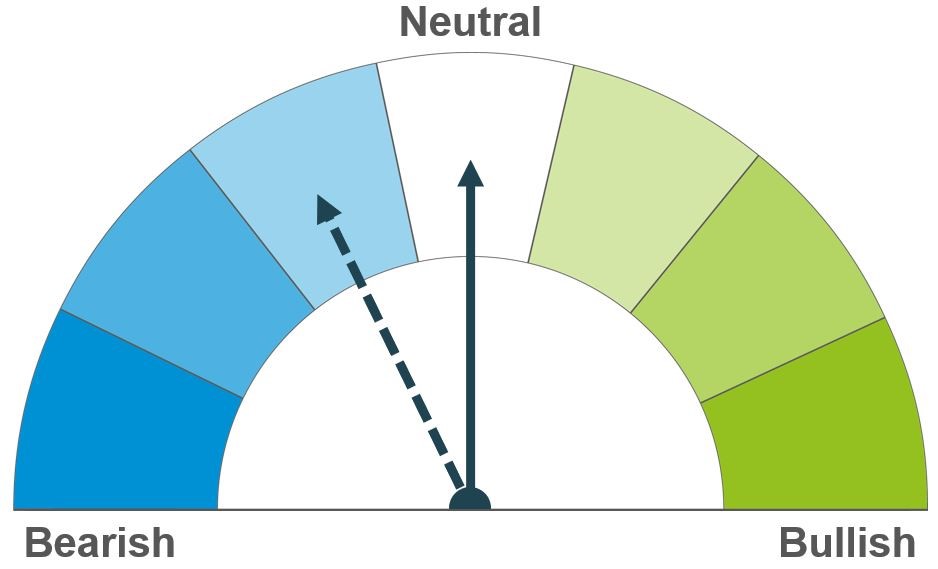

Rapeseed

Short-term, rapeseed markets are following the sentiment of soyabeans. Longer-term EU rapeseed production is a critical watchpoint to determine rapeseed’s trading relationship with soyabeans into the 2024/25 marketing year.

Soyabeans

For the short-term, weakening soyabean demand in the US weighs on the market. Longer-term, an increase to the 2023 US crop, plus improvements in Argentina’s soyabean crop are expected to offset production losses in Brazil.

Global oilseed markets

Global oilseed futures

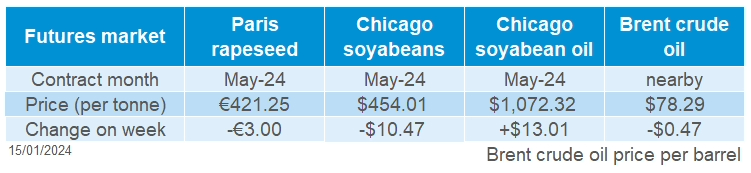

While Chicago soyabeans futures experienced pressure over the week, Malaysian palm oil futures buoyed. Although some concerns arose following recent yield observations from early soyabean harvests in Brazil, a slow-down of US soyabean exports and improved Argentinian soyabean production weighs on global soyabeans outlook. Gains in the vegetable oils market were supported by lower palm oil stocks and production in Malayasia.

After a challenging November and December, rains in Brazil earlier in the week helped to alleviate some concern regarding the outlook for the soyabean crop. Soyabean harvesting has begun earlier than usual in Brazil as the high temperatures, from the El Niño weather event, have accelerated the growing cycle. Currently harvests show mixed yield outcomes, influenced greatly from the varying weather across Brazil. The USDA reduced Brazil’s soyabean production by 2.5% on Friday to 157.0 Mt. However, Conab, Brazil’s supply agency, dropped soyabean production by 3.1% to 155.3 Mt last week.

For Argentina, the soyabean outlook continues to look favourable as sufficient rainfall continues to replenish moisture levels and temperatures remain adequate. As a result of improved growing conditions, the Rosario Exchange increased Argentina’s soyabean production by 4% to 52.0 Mt.

A weakening of soyabean exports from the US, aided from a strengthening of the dollar, also weighed on soyabean prices. The latest USDA export data (29 December 2023 – 04 January 2024) show exports down 14% over the previous week and 27% down from the four-week average.

In contrast, Malaysian palm oil was supported last week. While exports have slowed down, palm oil inventories reached a four-month low as production has declined to a six-month low. The substantial drop of production was unanticipated by some market participants, raising pre-existing concerns regarding supply.

Rapeseed focus

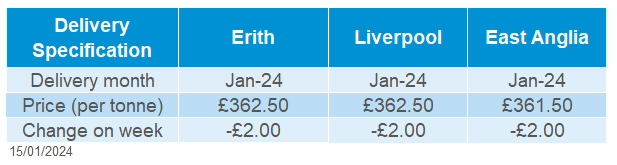

UK delivered oilseed prices

Paris rapeseed futures gained in the earlier half of the week due to support in the vegetable oils complex. But, these gains were lost on Friday in anticipation of bearish soyabean production data in the USDA’s WASDE report.

Rapeseed delivered into Erith for January 2024 delivery was quoted at £362.50/t, falling £2.00/t over the week (Friday – Friday).

In the latest WASDE report, global rapeseed production is estimated at 87.1 Mt, up 13.7% over the five year average (2018/19 to 2022/23). While world stocks of oilseeds has been revised down by 0.92 Mt to 780.29 Mt since December’s estimate, supply is forecasted 3.8% up from last year.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.