Milling wheat premiums to hold firm? Grain market daily

Friday, 5 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £195.10/t yesterday, up £1.55/t from Wednesday’s close. The Nov-24 contract was up £0.75/t over the same period, ending the session at £206.90/t.

- Domestic wheat futures followed both the US and European wheat markets up yesterday. Concerns are rising further in parts of western Europe, with areas that suffered flooding now due a cold spell, a watchpoint for potential damage for emerged crops that are exposed to frost (LSEG).

- Paris rapeseed futures (May-24) were down €5.00/t, ending yesterday’s session at €432.25/t. The Nov-24 contract was down €4.00/t over the same period, closing at €436.75/t.

- Paris rapeseed futures followed US soyabeans down yesterday as more rain in the Mato Grosso region of Brazil over the last few days eased concerns over crop losses in the country.

Milling wheat premiums to hold firm?

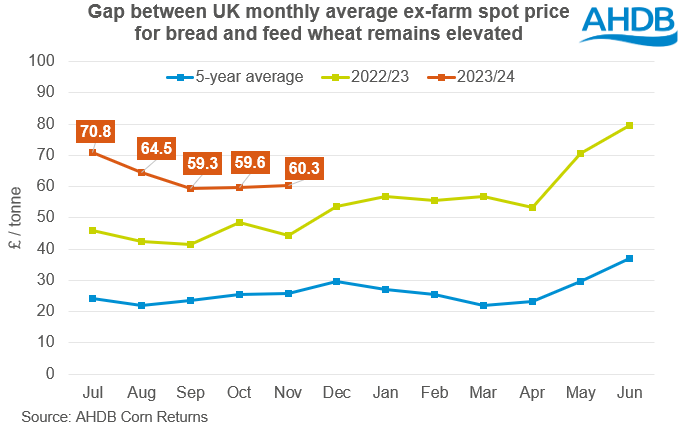

As discussed in previous analysis, bread wheat premiums reached record highs at the beginning of the season. While they have eased slightly since then, they remain historically firm. So, can we expect these elevated prices for high quality wheat to continue moving forward?

In November 2023, the gap between the UK average spot ex-farm bread milling wheat and feed wheat prices averaged £60.30/t. While this is down from the beginning of the season (£70.80/t in July), it remains well above the five-year average for that month of £25.70/t. On 21 December 2023 (latest data), UK spot ex-farm bread milling wheat was at a £64.20/t premium to feed wheat, up from the previous month’s average.

Looking at historical trends in AHDB’s cereal usage data over the past five years, the volume of flour (excl. ‘other flour’ which is largely made up of bioethanol and starch demand) produced in December tends to climb, before falling back in January post-Christmas. This pattern of demand has generally been reflected in milling wheat premiums in previous years too, and therefore we may see some slight pressure this month in premiums. However, historically, premiums tend to then climb towards the end of the season, as we approach harvest and availability of domestic milling wheat becomes tighter before a new crop arrives.

Aside from historical trends, a tight supply and demand picture for milling wheat will likely keep premiums firm moving forward. Domestic production of wheat was down 10% this season, and AHDB’s Cereal Quality Survey released in October, showed that just 13% of group 1 milling wheat samples met a typical group 1 specification. This was down from 33% in 2022 and 20% in 2021, and is likely due to the wet start to harvest impacting the quality of the crop.

As a result of lower domestic availability, imports this season are forecast up 6% on the year. This season-to-date (Jul-Oct), wheat imports have totalled 580.8 Kt, up 20% on the year, showing that imported wheat is pricing competitively on the domestic market. Imported wheat milled is up 27% this season to date (Jul-Oct). On the demand side, despite the impact of the ‘cost-of-living crisis’ wheat usage by flour millers is expected to remain relatively stable this season due to lower extraction rates.

Summary

To summarise, milling wheat premiums are no longer at the highs seen at the beginning of the season, with some competitively priced imports coming in. However, they remain well above average and with the tight supply and demand picture this season, it can be expected that they will hold relatively firm at least in the short to mid-term. Of course, premiums will depend heavily on the price of imported milling wheat. Looking further ahead to next season (2024/25), delayed winter wheat plantings in western Europe could mean a tighter supply of milling wheat on the continent which in turn could make EU wheat more expensive to import. This combined with delayed plantings domestically, could see more support for premiums longer-term. This will be something to watch out for.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.