Poultry feed production edged up in November: Grain market daily

Friday, 12 January 2024

Market commentary

- May-24 UK feed wheat futures fell £1.45/t yesterday to close at £190.50/t. This is the lowest closing price recorded to date for the May-24 contract. The Nov-24 contract also declined but to a lesser extent, down £1.05/t to close at £204.45/t.

- Global grain futures generally edged lower yesterday as global supplies continue to look sufficient. Yesterday the International Grains Council (IGC) raised its forecasts of global grain supplies this season, despite cutting its Brazilian maize crop forecast by 4.3 Mt. A larger Chinese crop offset the fall for Brazil. However, the IGC’s first forecast of wheat supply and demand in 2024/25 pointed to a further tightening of stocks, despite a larger harvest.

- Tonight, the USDA will release updated World Agricultural Supply & Demand Estimates (WASDE), along with quarterly US stock estimates and data on winter wheat planted for harvest 2024 in the US. The market expects small reductions to global maize and soyabean end of season stock forecasts, largely on the back of reduced Brazilian crop forecasts (LSEG). A 2.5% year-on-year fall in the US winter wheat area is also expected.

- Brazilian supply agency Conab cut nearly 5 Mt from its soyabean crop forecast for 2023/24, now 155.3 Mt, though still 0.7 Mt larger than the 2022/23 crop. It also trimmed 0.9 Mt from the maize crop to 117.6 Mt (131.9 Mt in 2022/23).

- Paris rapeseed futures only recorded small changes yesterday as the market awaits the USDA data. The May-24 contract gained €0.25/t to close at €428.00/t (approx. £368.50/t), while the Nov-24 contract fell €0.50/t to close at €434.50/t (approx. £374.50/t).

Poultry feed production edged up in November

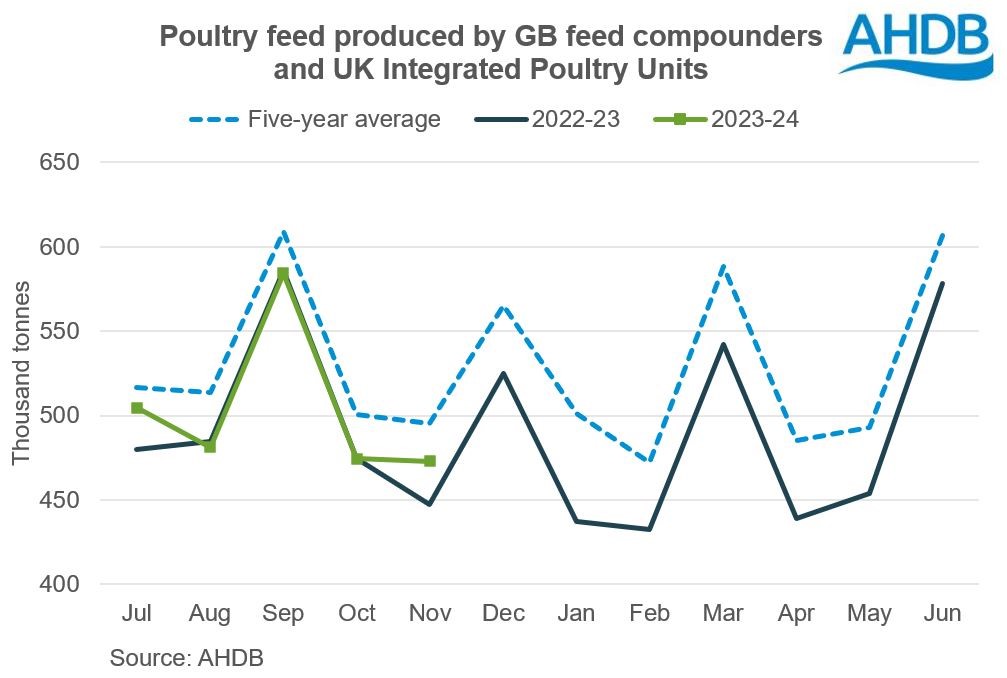

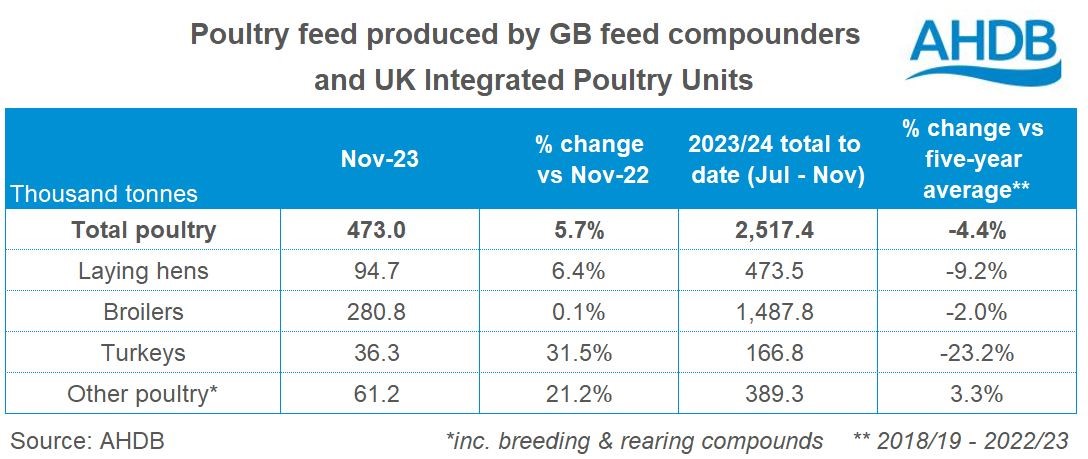

More poultry feed was produced in November 2023 than in November 2022, by GB animal feed compounders and UK Integrated Poultry Units (IPUs). A total of 473 Kt of poultry feed was produced in November, virtually unchanged from October 2023 but 5.7% higher than November 2022.

The main driver was a rise in production of feed for laying hens (+6.4% year-on-year) and turkeys (+31.5%). Meanwhile, production of feed for broilers only rose marginally year-on-year (+0.1%).

However, it’s important to note that production of poultry feed by both IPUs and GB compounders remains well back on the five-year average. The poultry industry has been facing challenges of margins squeezed by high costs, with impacts from Avian Flu as well last season.

If sustained, the edge up in poultry feed production in November could signal at least a more stable picture, or perhaps the very beginnings of a small recovery. There also been some more encouraging financial reports from some poultry businesses in the farming press.

Amongst other livestock sectors, there was also a slight rise in pig feed production, up 1.2% year on year in November. But again, output remained 5% below the five-year average. This is unsurprising given the pig herd fell to its lowest level in a decade in 2023, with margins under sustained pressure from 2020-2023.

Total cattle and sheep feed production was again below 2022 levels in November 2023, though to a lesser extent than in October. Look out for information on AHDB’s Agri-Outlook for the livestock sectors in early February.

Animal feed is a key source of demand for UK cereals and AHDB currently forecasts that 12.4 Mt of wheat, barley, maize and oats will be used as animal feed this season. This is up very slightly (+6 Kt) from last season but still well below the five-year average of 13.0 Mt. AHDB will release its next forecasts on Thursday 25 January 2024.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.