Animal feed in demand trough: Grain market daily

Thursday, 2 March 2023

Market commentary

- UK feed wheat futures (May-23) followed Paris wheat futures market down yesterday, to close at £225.00/t, down £0.50/t from Tuesday’s close. The Nov-23 contract closed at £227.50/t, down £0.50/t over the same period. New crop (Nov-23) continues to hold a £2.50/t premium over May-23 (old crop) prices.

- Yesterday, Russia stated it will only agree to extend the Black Sea grain deal if their own interests are considered. Russia has stated western sanctions restricting payments, logistics and insurance are a barrier to exporting grains and fertilisers. Expectations of a renewal continue to pressure markets, as well as cheap Russian wheat being exported.

- Chicago wheat (May-23) saw upward movement yesterday on bargain buying.

- Paris rapeseed futures prices (May-23) settled at €528.50/t yesterday, up €0.25/t from Tuesday’s close.

Animal feed in demand trough

Today saw the release of the latest GB animal feed production figures, with some revisions in the data back to January 2021. The latest UK Human and Industrial usage data has also been released, with some revisions back to January 2022. These revisions are due to updated data received.

Today’s analysis focuses in on animal feed demand, what is happening and what might happen going forward.

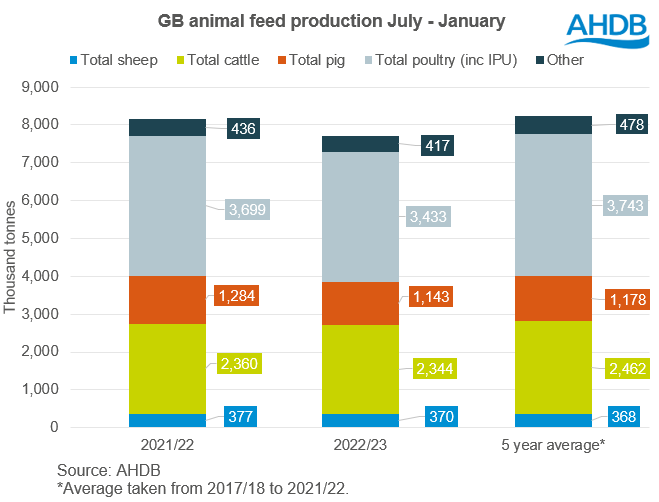

This season to date (July 22 to January 23), total animal feed production trailed the same period last season by 6%. Livestock sectors face many challenges across the board, from rising feed and input costs to the impact of the cost-of-living crisis. The data shows GB animal feed production across the board for the sectors, is down year on year.

The key sectors seeing the largest reductions from last season are unsurprisingly the monogastric sectors.

Pig feed production season to date is down 11% from last season, and back 3% from the previous 5-year average (2017/18 – 2021/22). Last year (2022) has been one of the most challenging years for the pork sector, with negative margins leading to a significant drop in the breeding herd. Backlogs of pigs to slaughter has cleared, and the AHDB Agri-Market Outlook forecast for UK clean pig throughput forecasts a decline of 11% January to March, and 15% decline April to June. Therefore, we can expect reduced overall pig feed demand for the rest of the season. Though we are expecting a recovery in the sow herd according to the Agri-Outlooks, with numbers predicted to increase by 7,000 head between June 2022 and June 2023.

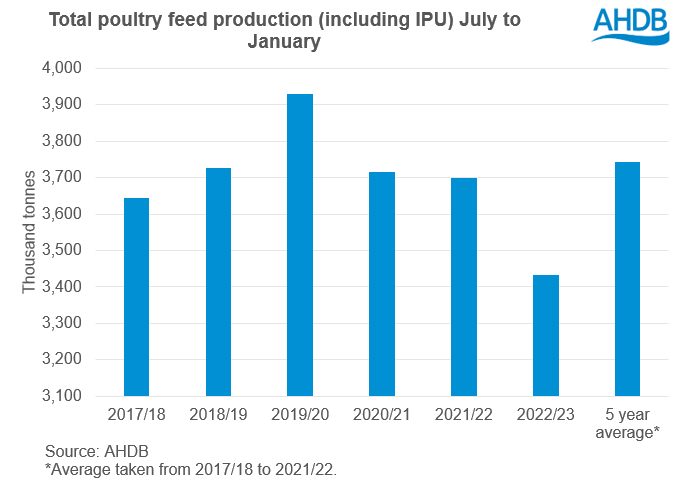

Total poultry feed production (including IPU) season to date is back 7% from last season and back 8% from the previous 5-year average. The poultry industry has been facing challenges of squeezed margins from high costs and the impacts of Avian Flu, which continue to create a challenging environment for the sector this season.

Looking to ruminants, total cattle feed production this season is back 1% from last season, and 5% from the 5-year average. The reason for this reduction on the season is reduced production of calf feed, protein concentrates, and other concentrates/blends. Whereas dairy compounds and blends are up marginally on the season in data to January. GB milk production is forecast in the AHDB Agri-Market Outlooks to record marginal growth in 2023 in the region of 0.3%, therefore we can expect this dairy demand to continue. GB beef production is forecast to grow slightly (+0.6%) too in 2023, due to higher cattle availability. Despite some areas seeing poor forage quality due to the dry weather in some regions, with feed costs high, it may be that forage is maximised where possible.

Finally on sheep, despite seeing a strong start this season from lamb finishing, as the feed production swapped to breeding ewes, we have seen a dip in demand. Season to date, total sheep feed production is back 2% on the year, but up 1% from the 5-year average. An increase in production is forecast for 2023, in the region of 8-9% year-on-year by the AHDB Agri-Outlook. This is driven by higher carry-over and a broadly stable lamb crop. Though with costs high, it may be that forage and grass is maximised with potentially less creep feeding. It is expected sheep feed demand to be subdued this season, similar year-on-year.

What does this mean?

With a reduction in GB animal feed, cereal usage too is seeing a decline. Season to date (July to January), total cereal usage for compounders (wheat, barley, oats, maize) was back 9%, with maize the only cereal increased within the ration from last season. Total wheat usage for GB animal feed (including IPU) is back 5% from last season. With domestic wheat availability strong this season, wheat is expected to remain prominent within the ration.

Overall total reductions seen in animal feed demand, and total cereal usage, is forecast to continue for the season remainder, especially for the monogastric sectors. In January’s estimates for the UK cereals supply and demand, total cereals animal feed is forecast back 3% from last season. Total wheat usage is forecast in the balance sheet for this season (2022/23) at 6.515Mt, up 8% on the season due to expectation of increased use in the ration and strong fed on farm usage. With this updated data, could we see this wheat forecast reduced and what would this mean for the UK wheat balance which is already larger year-on-year? Look out for the next UK cereal supply and demand estimates which are provisionally due to be published on 30 March.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.