Ruminants reduce the drop in animal feed production in May: Grain market daily

Thursday, 29 June 2023

Market commentary

- UK feed wheat futures (Nov-23) fell £2.55/t yesterday, closing at £196.45/t.

- Forecasts of rain in the US Midwest continue to pressure markets. US crop conditions have deteriorated in recent week due to hot, dry weather, raising a risk to the USDA’s current record US maize yield forecast. A sell off by speculative traders is also contributing to the fall, ahead of key US stocks and area data which is due out tomorrow evening. Canadian farmers also planted the largest wheat area in 22 years according to Statistics Canada.

- Rapeseed prices also slipped lower, with pressure from the improved US weather outlook for soyabeans and a larger canola area in Canada. Paris rapeseed futures (Nov-23) lost €3.00/t yesterday and closed at €438.00/t.

- Farmers in Canada planted 8.9 Mha of canola for harvest 2023 according to figures from Statistics Canada. This is 3% more than last year and above trade expectations, according to Refinitiv.

Ruminants reduce the drop in animal feed production in May

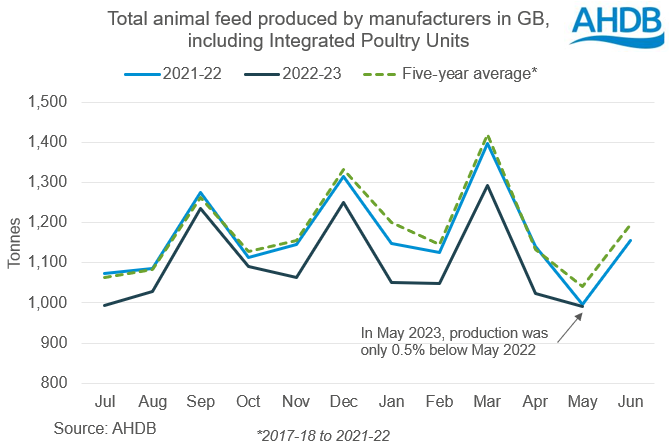

In May total GB animal feed and integrated poultry unit (IPU) feed production was only 0.5% below May 2022 at 992 Kt due to higher ruminant feed output. This is the smallest year on year drop this season.

Total cattle feed output in May was 4% above the five-year average for the month and 12% above the low May 2022 level. Production of compounds and blends for dairy cows was the main driver.

Cooler and wetter weather limited grazing opportunities due to the saturated ground. This meant farmers could not fully capitalise on good grass growth in April and May. So, more supplementary feed was needed, including compound feed.

Production of sheep feed also rose. Lamb prices were high this spring, which could have incentivised farmers to feed more compounds to get the lambs ready quicker to take advantage of the prices. In May 2023, the GB compound feed industry produced 47 Kt of sheep feed, up 36% from the low May 2022 level and 6% above the five-year average.

However, production of pig and poultry feed continued the downward trend of this season (2022/23). Pig feed production was back 12% year on year in May, while total poultry feed production (GB compounders and IPUs) was down 7%.

Looking ahead

There’s potential for animal feed demand for cereals to stabilise or potentially tick up slightly in the 2023/24 season, which begins in a few days’ time.

Beef and lamb prices were high this spring but have now started to soften. This creates an incentive to finish animals for slaughter as soon as possible, especially given the recent slowdown in grass growth. After finishing last winter with little, if any, forage stocks, farmers are likely to be mindful of managing grass growth and forage supplies this summer. This could mean some short-term support for feed demand from these sectors.

For dairy, variable grass growth after the dry spell in early June could mean higher compound feed demand in the 2023/24 grain marketing season. However, milk prices are also in decline, which could limit the incentive to supplement feed going forward.

AHDB’s latest forecasts indicate pig meat production will fall 15% in 2023, but a slight tentative recovery in the breeding herd. This suggests pig feed demand could increase on this season’s levels in the 2023/24 grain marketing season, but not by substantial amounts.

Meanwhile, the poultry sector, which is a significant part of GB animal feed demand, continues to feel inflationary pressure.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.