GB animal feed production continues to fall: Grain market daily

Thursday, 4 May 2023

Market commentary

- May-23 UK feed wheat futures closed at £186.00/t yesterday, down £3.00/t from Tuesday’s close. The Nov-23 contract closed at £198.00/t yesterday, up £3.25/t over the same period. New crop prices were supported by further concerns around the extension of the Ukraine export corridor. Russia have said that they will keep discussions open with the UN around extending the corridor, but they have categorically stated that they will not agree to anything that harms their own interests (Refinitiv).

- Nov-23 Paris rapeseed futures closed at €441.25/t yesterday, down €5.25/t from Tuesday’s close, pressured by movements in the wider oil complex.

- At the end-February, 1.009Mt of home grown wheat and 885Kt of home grown barley was held in store by merchant, ports and co-ops in the UK, down 5% and up 22% respectively on the year, according to the latest AHDB data. Farmers in England and Wales had 4.499Mt of wheat in store on farm at the end of February, up 17% on the year and the highest stocks for this point in the year since 2015, according to latest Defra data.

GB animal feed production continues to fall

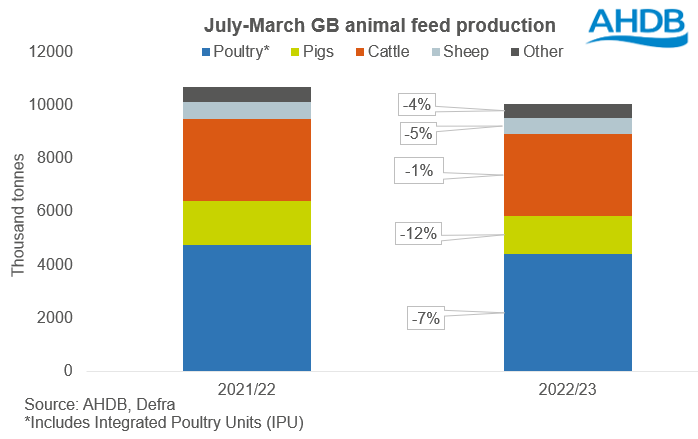

Total GB animal feed and integrated poultry unit (IPU) feed production continued to decline in March at 1.292Mt, down 8% year on year (yoy), according to data published by AHDB today. The latest data takes production for the first three quarters of the season (Jul-Mar) to 10.052Mt, down 6% on 2021/22 levels and the lowest level for this point since 2015/16.

Unsurprisingly and what has been the case for most of the season, the overall decline in animal feed production has been driven by a drop in monogastric feed. From July to March, GB pig feed production totalled 1.452Mt, down 203Kt on the year and the lowest volume since 2018/19. Poultry feed production (inc. IPU), was down 339Kt over the same period at 4.410Mt, the lowest level since 2014/15. Ruminant feed production (especially for dairy cows) is also down on the year, albeit by less, with margins continuing to be squeezed.

Looking ahead, the poultry industry continues to struggle with higher energy costs, and inflationary pressure throughout the supply chain. Despite higher input costs, anecdotal reports suggest that wholesale carcass prices are coming down, squeezing margins further, with some producers leaving the industry all together. As it stands at the moment, it’s unlikely there will be any substantial recovery in poultry feed usage until at least midway through next season. While pig prices are continuing to increase, and margins are improving, the UK pig market is somewhat finely balanced. The current tight supply situation across the UK and EU is balanced against the long-term cost-of-living pressures impacting consumer demand. Going forward, there is expected to be a somewhat tentative recovery in the breeding herd next season. Therefore, we could see pig feed demand increase on this year’s levels next season, but not by substantial amounts.

With a drop in production comes a drop in cereal usage. In the season to date (Jul-Mar), GB feed compounders have used 2.459Mt of wheat (-183Kt yoy), 896Kt of barley (-205Kt yoy), 58Kt of oats (-42Kt yoy) and 295Kt of maize(+11Kt). With animal feed production expected to continue to decline for the rest of the season at least, we can expect a continued reduction in cereal usage in rations.

With a large surplus of wheat in the UK this season, if animal feed production declines further than already forecast for the rest of the season, we could see an even larger surplus. The next 2022/23 UK cereal supply and demand estimates are scheduled for release on 25 May and will include the latest usage and trade data as well as updated forecasts.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.