Red Meat summary of the FAO & OECD Agricultural Outlook 2022-2031

Thursday, 7 July 2022

The latest FAO & OECD Agricultural Outlook 2022-2031 has been released and here we summarise the key points.

Consumption

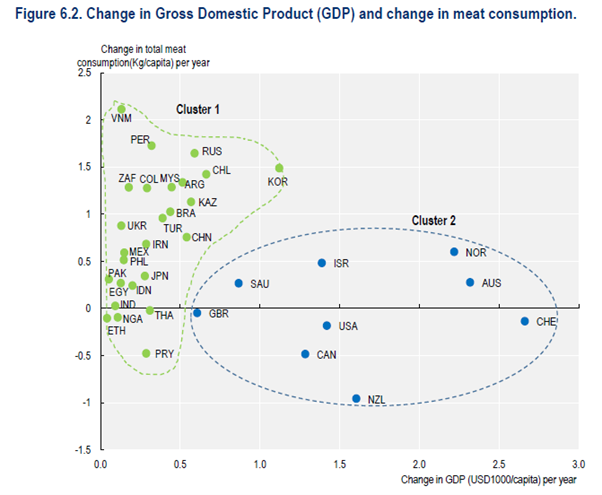

The shift in meat consumption from foodservice to home cooking that occurred during the COVID pandemic is expected to be short term and will revert back as restrictions are lifted. The main drivers of consumption growth are population growth and economic growth, both of which will continually increase in lower income countries. In high income countries (where per capita consumption is already high) demand is anticipated to level off or trend down as ageing populations and greater awareness of dietary and environmental concerns influence consumer behaviour.

Global pig meat consumption is projected to increase to 129 Mt over the next ten years. However, on a per capita consumption is expected to stagnate. Pork will remain the meat most eaten in the EU, even though it will remain stable in per capita terms, as changes in diets will favour poultry as a cheaper and perceived better food choice. In most of Latin America prices have positioned pork and poultry as the favoured meats for rising demand from the middle class. Several Asian countries which traditionally consume pork such as Korea and Viet Nam, are also projected to increase consumption on a per capita basis.

Global beef consumption is projected to increase to 76 Mt over the next ten years. However, per capita consumption is projected to fall 2% by 2031. Asia and the Pacific is the only region where per capita beef consumption is projected to increase. China is the world’s second largest consumer of beef and per capita consumption is projected to rise 10% by 2031. Most countries with high beef consumption will see a decline in favour of poultry meat especially in the Americas and Oceania, where preference for beef is among the highest in the world (per capita consumption will fall in Argentina -5%, Brazil -2%, the US -4%, and Oceania -15%).

Global sheep meat consumption is projected to increase to 18 Mt. A niche market in some countries and considered a premium component of diets in many others, consumption worldwide is comparable in both developing and developed countries. In some Near Eastern and North African (NENA) countries, where sheep meat is traditionally consumed, per capita consumption is projected to continue its long-term decline despite increasing disposable income.

Production

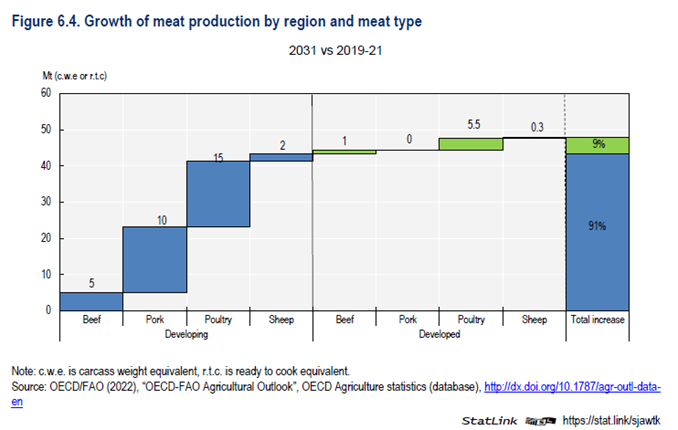

Most meat production growth will occur in developing regions. The production share of the world’s top five meat producers (China, US, EU, Brazil, and Russia) will gradually trend downward reflecting a decline in production from the EU and an emerging broader base of global production. The market share of the Asia and Pacific regions will return to historical levels, after dipping during the ASF crisis. Globally, livestock expansion will be facilitated by the increasing size and consolidation of production units towards more integrated systems, especially in emerging developing countries.

Pig meat output is projected to rise by 17% by 2031. The ASF outbreak across Asia, starting in late 2018, will continue to affect many countries in the short term, with China, the Philippines and Viet Nam experiencing the greatest impact. Production in China is expected to continue to increase and attain pre-ASF (2017) levels by 2023. Most of the pig meat production increase in ASF-affected regions will be due to conversion from largely small-scale backyard holdings to large-scale commercial enterprises. Viet Nam is projected to become the sixth largest pig meat producer just below Brazil and Russia. Its domestic policy rests on vaccination to control the spread of ASF, and trials have proved to be safe and efficient. In the EU production is projected to decline as environmental and animal welfare concerns are expected to limit domestic demand and the decline in imports by China weigh negatively on trade. Production in Brazil and the US will remain high given their strong competitive position in global markets but are expected to drop a little from current levels due to expected decline of Chinese import demand and high feed costs.

Beef production will grow to 76 Mt by 2031. In the short-term beef producers will have greater ability to increase slaughter but have less flexibility to increase carcass weights with high feed prices. In North America, the largest producing region, a modest herd expansion, is projected to increase beef production by 4% by 2031. Production in the EU is projected to fall as inventories of dairy cows decrease (responsible for approximately two-thirds of the beef supply), and a reduction in suckler cowherds due to low profitability, steep competition in export markets, and declining domestic demand. Pakistan is projected to have the strongest growth rate of any country at 26%, as calf and milk producing cows are being slaughtered to meet the high demand of meat protein from the Middle East. In Australia production is projected to increase due to greater cattle availability and the return of labour to processing plants.

Growth in sheep meat production will mostly originate in Asia, led by China, India, and Pakistan but significant increases are also projected in Africa, particularly in the least developed countries of Sub-Saharan Africa, despite limitations linked to urbanisation, desertification, and the availability of feed. In New Zealand sheep meat production is expected to remain stable due to competition for pastureland from the beef and dairy sectors and forestry. The larger availability of sheep meat in Australia will enable it to respond to growing global demand despite being constrained by its currently small, but growing sheep flock. Sheep meat production in the EU is expected to increase slightly, underpinned by CAP support.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.