Rabobank warn of potential downsides in the second half of the year

Thursday, 3 July 2025

Good times never last forever, or so the saying goes. The latest Rabobank research, “Global Dairy Quarterly Q2 2025: Too good to be true?” warns that underlying economic headwinds, trade tensions, and production challenges could force a gradual market recalibration in the latter half of 2025, at least globally. But how true is this? Do GB producers have grounds for optimism or pessimism?

Trade volatility

Trade uncertainty resulting from Mr Trump’s ever-shifting trade policy is a key driver of this growing sense of unease. The US/China trade dispute saw a temporary pause on 12 May, with China steeply reducing retaliatory tariffs on key US dairy exports—from 125% to 10%—for a 90-day period.

The affected shipments include whey and lactose products. This sudden reprieve, however, brought immediate downward pressure on Chinese prices on those products. US exporters now face heightened uncertainty, which complicates long-term sourcing and pricing strategies and creates potential volatility.

This also displaces some of the opportunities the EU may have seen in this space, who face challenges of their own as the 9 July deadline for returning to baseline tariffs approaches with, as yet, no deal agreed.

Total EU to US dairy exports are valued at 2.2bn euros according to Rabobank. This could displace a significant amount of product that could arrive on UK shores.

The trade deal between the UK and USA, signed at the G7 conference, has firm commitments on beef, ethanol and steel but no specifics on dairy, as yet, which remain at the 10% tariff baseline. The UK government was keen to emphasise that “any US imports will need to meet UK food safety standards".

Could supply outstrip demand?

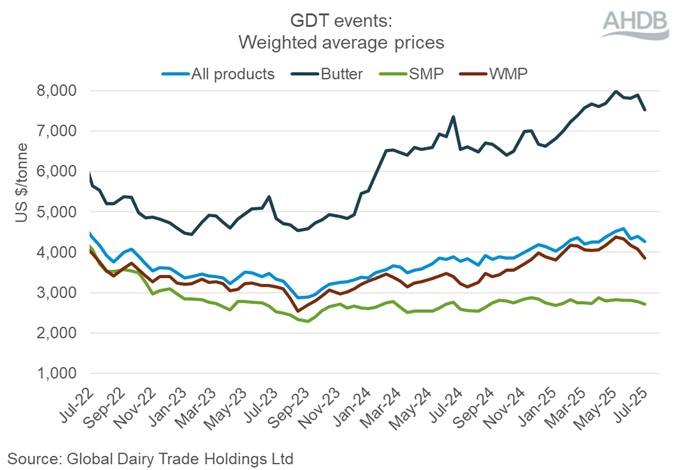

Dairy commodities, but particularly dairy fats have been booming in price terms since last Autumn, hitting record breaking levels before easing slightly. However, Rabobank’s analysis signals that rising supply levels and potentially wobbly demand could unsettle the balance.

The extent to which this proves disruptive probably depends where you are in the world. For Europe, whilst British milk supplies have been flying (up 5.6% in this milk year to date) with Ireland performing similarly, mainland Europe has been blighted by the spread of BTV and have been lacking for much of the spring.

This has led to depleted supplies of some key products such as butter, holding up prices. While BTV has now eased on the mainland, cow numbers are also depleted (in December 2024 census -2.6% for the EU according to GIRA) and very dry weather conditions has stymied production recovery.

Despite this Rabobank predict growth of 0.4% for the EU in 2025, due to higher margins, but this could be optimistic. GIRA in their latest webinar predicted a small decline of -0.1%, although this decline is mitigated by a growth in fats and proteins.

Fats could stay at high price levels because the valorisation for producing cheese/whey has been better in Europe, the cream price has been good and stocks were depleted in the race to send product to the US ahead of tariffs.

Additional cheesemaking capacity and good global demand for cheese will also increase competition for milk in the region. Irish production could be impacted heavily if they were to lose their nitrates derogation. This could force a herd reduction of 18%. A decision is expected by the end of 2025 but is one to watch.

SMP pricing has remained at fairly stagnant levels all year and GIRA predict a stable outlook with low demand in the EU and USA, lower Chinese exports and demand from Algeria (depending on the oil price). SE Asian demand is still strong and growing and could drive an increase in Q4 depending on the supply side.

Elsewhere in the world, milk production has been more buoyant than the EU with the outlook being for modest growth in the USA, Argentina and New Zealand with the whole of the big-7 exporters sitting at 1% growth, the highest annual volume gain since 2020, although they expect only 0.3% for 2026.

Growing supplies and uncertain demand could pressure prices in some quarters.

The outlook

Rabobank feel that this market recalibration could see prices aligning closer to traditional benchmarks. The tone of the market based on recent GDT results are for softening prices but have been in contrast with the European picture ahead of the summer break, showing a lack of universal direction currently.

There is also a current mismatch between US and Oceania prices with the latter sitting at a premium.

Traders will need to stay agile to stay abreast of a rapidly evolving market as the situation develops. For stakeholders across the dairy sector—from farmers and processors to exporters and ingredient suppliers—the message is to closely monitor trade policies, maintain robust risk management practices, and prepare for a potential cooling of market prices.

While the current high-price environment has bolstered revenues in the short term, the medium-term outlook calls for both caution and flexibility.

For British farmers, certainly in the short term, prices are not falling sharply but are more likely to ease in the medium-term based on this analysis. However, uncertainty remains high and the relative lack of milk on the mainland presents opportunities for British producers.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.