Q1 sees sheep meat exports boosted and imports falling

Thursday, 18 May 2023

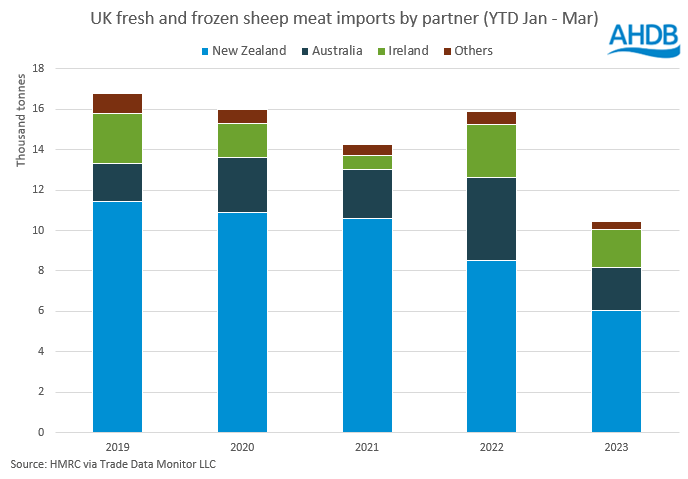

Now we have the first quarter of sheep meat trade data for 2023, we can see trends in imports and exports. Fresh and frozen sheep meat imports in the year-to-date (January – March) have totalled 10,700 tonnes, which is down 33% (5,350 tonnes) from the same period in 2022. Exports show a different picture, reaching 21,200 tonnes for the year-to-date so far, which is growth of 3,800 tonnes (22%) from the same period last year.

Imports

Imports of fresh and frozen sheep meat have grown throughout the first quarter, with an increase of 2,400 tonnes from January to March. Imports for the month of March totalled 4,750 tonnes, an increase of 1,150 tonnes from February, but a drop of 2,200 tonnes from March 2022. This has contributed to imports in Q1 2023 sitting 6,300 tonnes behind the 5-year average for this time period.

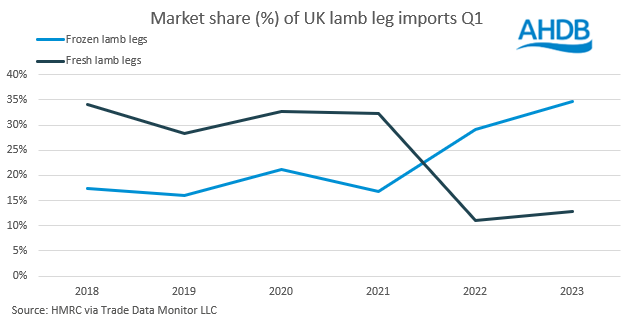

Frozen lamb legs made up 35% of total imports during Q1, at 3,700 tonnes. This sits over 300 tonnes above the previous five-year average, as the market share of frozen lamb legs has risen from 17% in 2018. Fresh lamb legs made up 13% of the total during Q1, at 1,400 tonnes, down from a peak of 34% in 2018. Fresh lamb legs saw an uplift in imports from February to March, up 600 tonnes. A similar pattern was seen in 2022, with an uplift during this time period. Frozen boneless lamb totalled 1,800 tonnes during Q1, 17% of total imports.

Imports from New Zealand have fallen to 6,100 tonnes in Q1, down almost 5,500 tonnes from the 5-year average, and 2,500 tonnes down on 2022 levels. Key products, such as fresh lamb legs have seen a considerable drop in volumes totalling just under 1,000 tonnes in Q1 2023, down from the 5-year average of 4,100 tonnes. Destinations of New Zealand’s sheep exports have been evolving, so we could see further falls in imports in the future.

Exports

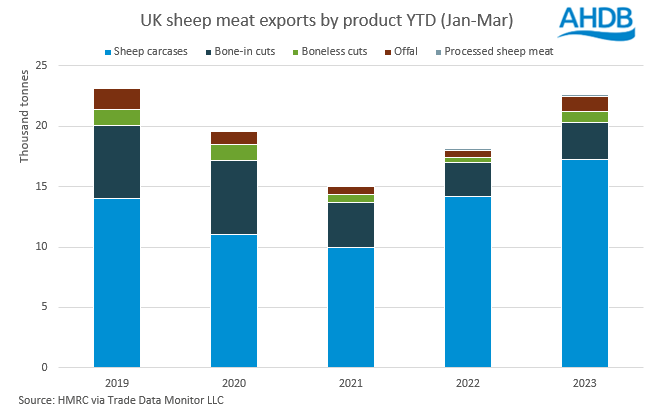

Exports of fresh and frozen sheep meat were up 22% in Q1 compared to last year by 3,800 tonnes. This is an increase of 2,700 tonnes (14%) on the 5-year average. This has been driven by an additional 2,600 tonnes being exported in March compared to February. Export volumes in March are also up 2,100 tonnes year on year. One aspect of this could be the falling domestic consumption of lamb. According to our latest retail data, for the 12-week period ending 16 April 2023, the volume of lamb purchased in retail has fallen nearly 12% from the previous year. This drop in consumption could allow for a greater volume of product to be exported.

Carcase volumes provided much of the uplift on the month and year, totalling 17,300 tonnes for Q1. Volumes sent in March totalled 7,100 tonnes, up 2,000 tonnes on February, and up 1,600 tonnes from March 2022. Carcase volumes are up 3,100 tonnes on Q1 2022, and up 4,800 tonnes from the 5-year average. Carcases made up 82% of total sheep meat exports in Q1 2023, in line with 2022 levels.

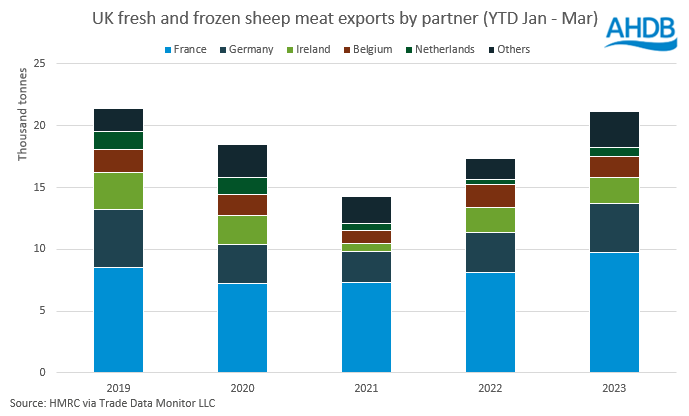

Tighter supplies in the EU are set to remain, as production is down, which could boost our exports in the meantime. Exports to France have grown 20% from Q1 of 2022, up 1,600 tonnes and sit 1,800 tonnes (22%) above the previous 5-year average. The majority of this volume is fresh lamb carcases, which for the year to date (Jan-Mar) sit 3,000 tonnes up on the 5-year average. March saw exports of lamb carcases to France hit 3,300 tonnes, the highest level seen in the past five years. Exports have also grown to Germany where they totalled 3,900 tonnes for Q1, up nearly 700 tonnes from Q1 2022 and 500 tonnes up on the 5-year average.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.