Pork market strong in the face of uncertainty- can this continue?

Thursday, 30 April 2020

By Bethan Wilkins

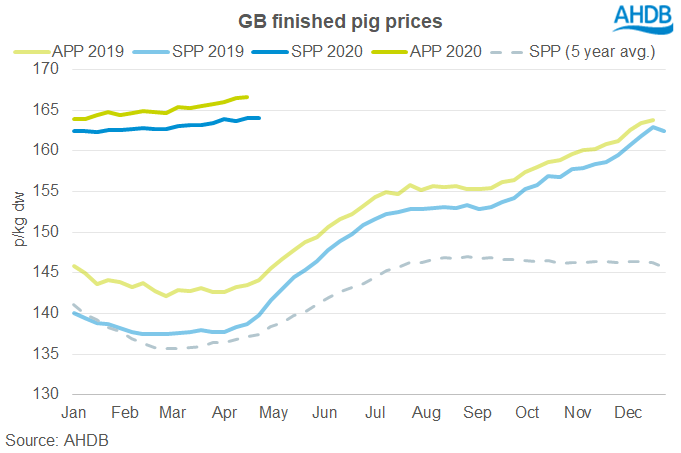

Pig prices in Britain have barely moved so far this year. This week, the SPP remained at 164p/kg, just over 1.5p above the start of 2020 and nearly 27p above the five-year average for the time of year. The stability contrasts with developments in the wider world, where the coronavirus pandemic has led to widespread disruption.

A significant global shortage of pork continues to underpin the market. China has been battling African Swine Fever (ASF) since 2018 and last year Chinese pork production fell by over 11 million tonnes (21%). This meant that worldwide, pork production was 10% lower. In 2020, Chinese production is expected to decline similarly, further constraining global supplies.

Suppliers to the Chinese market, including the UK, would be expected to reap the benefits of another year of strong export demand. However, the coronavirus pandemic throws a number of challenges into the mix that threaten to derail this optimistic outlook.

What challenges is the British pork industry facing?

Maintaining pig meat production

Self-isolation requirements mean there are concerns staff availability at abattoirs could start to limit slaughter capacity. However, this has not been the case so far.

In the first quarter of 2020, UK pig meat production was 6% higher than last year. Slaughter was particularly high in March; producers were encouraged to send pigs for slaughter a little earlier where possible, to reduce the risk of a backlog generating if slaughter capacity was subsequently limited.

Finished pig supplies have therefore tightened in recent weeks, also influenced by typical seasonal patterns, and stagnating herd performance in late 2019. However, breeding herd expansion last year means slaughter levels should remain higher in 2020 overall.

With the pandemic ongoing, risks of disruption to slaughter remain. In the US, reports indicate COVID-19 cases in abattoirs have led to the closure of at least 20% of pork processing capacity, causing significant disruption in the supply chain and depressing farmgate pig prices. President Trump has recently ordered meat processing plants to remain open, but exactly what impact this will have on slaughter capacity remains unclear.

Export competition and logistics

UK pig meat exports (including offal) were stable in volume across January and February. However, higher prices meant the value of these shipments was up by 20% on last year. This largely reflects strong Chinese demand boosting market values.

Nonetheless, the lack of export growth highlights challenges here too. Large pork imports for Chinese New Year, coupled with the coronavirus lockdown, led to significant backlogs in Chinese ports and limited demand. Although trade has started to move again more recently, container availability remains a logistical challenge, placing constraints on the volumes that can be sent.

On top of this, US pig prices collapsed following the closure of foodservice and difficulties with slaughter capacity. Low-priced US pork has presented significant competition on the Chinese export market. But of course, this could all change if US slaughter capacity is constrained for too long.

We would still expect to see our pork exports rise this year, but it is possible that the volumes and prices achievable are not quite as high as previously anticipated.

Changing domestic demand

Domestically, demand for pig meat has also changed following the closure of most foodservice outlets during the “lockdown”. Normally, approximately 14% of pork consumption in Britain is out of home.

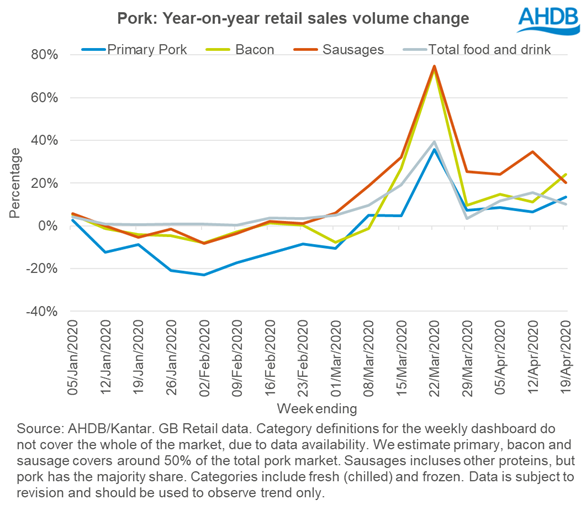

Initial estimates suggest that pork has switched reasonably well into the increased retail demand, though whether higher retail sales will entirely compensate for lost foodservice demand remains to be seen. Kantar data shows bacon and sausage retail sales remained strong even after the initial panic-buying period ended, with volumes up 10-35% compared to 2019 in the first three weeks of April. Primary pork sales volumes are also higher, but the growth has not sustained as well, with roasting joints a challenging area.

It’s also important to remember that the UK is a significant net importer of pig meat products, which account for about 60% of consumption. Anecdotally, the foodservice market disproportionately uses imported product. With this in mind, the British pork market is also perhaps somewhat shielded from lost foodservice demand.

Nonetheless, in some areas the changing face of British demand, coupled with some export challenges, seem to have led to building stock levels, particularly of belly and shoulder cuts. Getting an overall picture on this is tricky due to a lack of national data, and anecdotal reports have been variable. However, if supply chains struggle to move product, prices could come under pressure. Stocks are also reportedly building in some key EU producers, such as Germany, where prices declined. As a net importer of product from the EU, price trends there will affect developments here.

Equally, the cull sow market is heavily exposed to developments on the continent, as Germany is the key destination for sow carcases. You can read more about this here.

Overall outlook

Altogether, continued Chinese demand means the pork market outlook is still positive this year. Exports are still expected to be higher than in 2019, helping compensate for any decline in domestic demand. But, we mustn’t ignore the risk of stock levels building, or slaughter levels being compromised. In such unprecedented times, we should be cautious about being too optimistic.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.